Sr Mortgage Officer NMLS 457837 MortgageLiz House Financing Powered by UMortgage

?? Publication your home To invest in Means Telephone call: CONNECT:?? Call/Text message Lead (760) 214-3647?? Upload Myself an email: ????? See My personal Site: mortgageliz————————-Pursue Myself On Personal:?? Instagram: Facebook: TikTok: VIDEOS:?? Watch YouTube Shorts! See movies regarding the First time Homebuyers right here: ————————-Have you been A realtor? Systems So you’re able to!?? Sign up all of our private VIP Twitter Group, « Providing Upwards Education, » in which i discover more about social media, real estate, & find out more about mortgages: Create Coming Groups: Would you like to find out more about Social networking + tips create your providers? Contact you! We may desire find out if the audience is a great fit! Our team is always trying expand together with other incredible agents, & if you are considering the newest financial loans to suit your subscribers so you’re able to grow your organization in 2023 & beyond, Why don’t we Cam! Plan a period of time right here to my diary: ME:I am Liz LeFore that loan Officer that have MortgageLiz Group Domestic Credit Running on UMortgage | NMLS 457837 I shall help you produce wise choices along with your house. With 19+ yrs of experience throughout areas of financial investment, focusing on Very first time Homebuyers, Bodies, & Old-fashioned Financing. We cam Foreign-language fluently & concentrate my personal time in helping you plan for the long term whenever you are strengthening wealth which have A house you to definitely family at once.

The brand new opinions here is actually of the journalist & not always UMortgage otherwise it’s subsidiaries. mortgageliz UMortgage Organization NMLS# 1457759 | UMortgage is actually an equal Housing Financial. »>

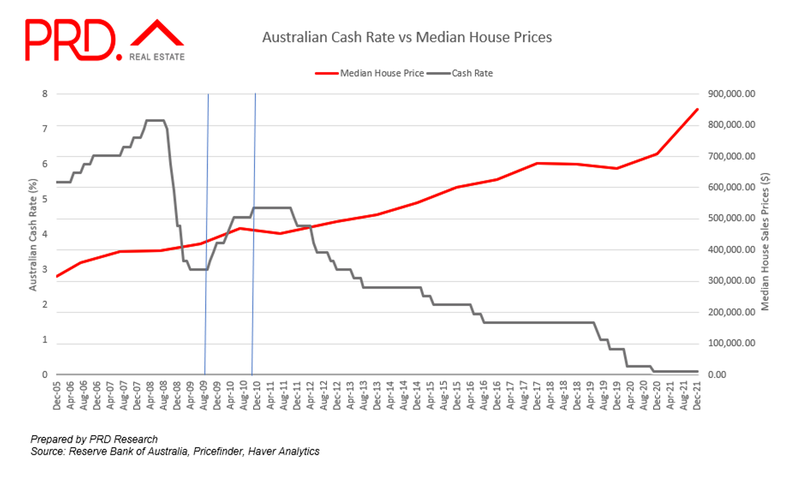

? Documented Money: Once you show off your complete money documented to the tax returns, loan providers faith new precision and you can visibility. You will get the means to access down rates, and work out your ideal household inexpensive in the end. ????

?? Non-QM Investment: You want an adaptable solution in the place of complete tax statements? Non-QM loans are there for your requirements! While they render possibilities, they arrive having large interest rates. Its crucial to assess your specific situations before you choose that it roadway. ??????

?? The option are Your: Based on your debts, you could choose for reported earnings or non-QM resource. Consider your much time-term goals and you may consult a home loan elite group having individualized advice. ????

The #step 1 goal is actually for our customers to enjoy their property And you can Like their residence financing!

?? Get it done Today: Prepared to build your flow? Apply at home financing specialist who’ll make it easier to browse these types of selection and you may hold the best solution to suit your fantasy house. ????

Think about, advised choices may be the the answer to unlocking the homeownership goals! ???? ————————- ?? Join my YouTube route right here: ————————- This is My personal Route! I am Liz LeFore, & on this route i speak about every A house, Financial, & Real life Event to better prepare that get your 2nd household. You are helped by us build money you to house at once, & whenever you are teaching your regarding home buying process that would be very first & complex quicken loans Meeker location every at the same time.

Agenda an occasion right here to my calendar: ————————- In the Me personally: I’m Liz LeFore financing Administrator with MortgageLiz Cluster Family Credit Run on UMortgage | NMLS 457837 I will help you create wise conclusion along with your domestic

?? Guide your home To shop for Strategy Phone call: ————————- Why don’t we Hook up: ?? Call/Text message Direct (760) 214-3647 ?? Post Me an email: ????? Check out My personal Site: mortgageliz ————————- Realize Me personally With the Personal: ?? Instagram: ?? Facebook: ?? TikTok: ————————- Related Films: ?? Observe YouTube Shorts! ?? Observe films from the First time Home buyers right here: ————————- Could you be A representative? Units So you can! ?? Sign up all of our individual VIP Myspace Category, « Providing Upwards Studies, » in which i learn more about social networking, real estate, & find out about mortgages: ?? Create Upcoming Classes: ?? Do you need to discover more about Social network + how to construct your business? Contact you! We possibly may always see if we have been a good fit! All of us is obviously looking to expand with other incredible agencies, & if you are considering new financial loans for your readers so you’re able to grow your providers in the 2023 & past, Let’s Talk! With 19+ yrs of experience throughout aspects of home loan financial support, dedicated to Very first time Home buyers, Authorities, & Conventional Resource. We speak Language fluently & concentrate my personal time in helping you arrange for the long term when you’re strengthening money with A home one to family at once.

Laisser un commentaire