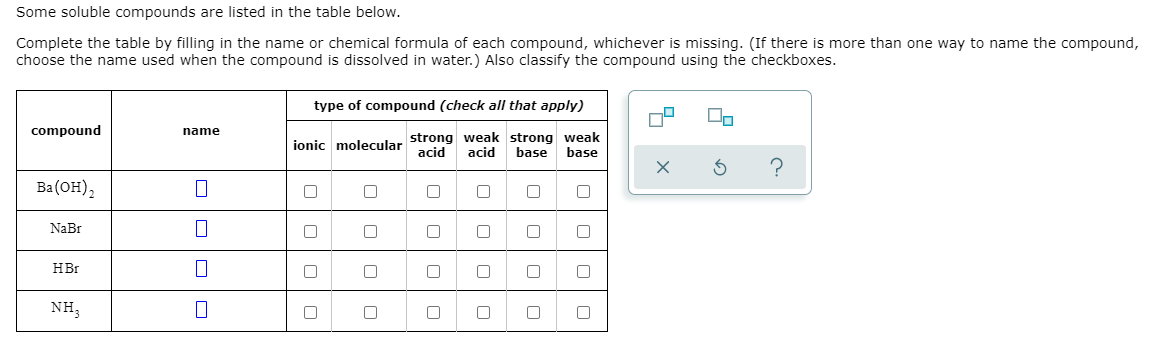

Can you use Homes Because the Security To possess An unsecured loan?

Folks who are ready to increase or create a property to the the rural land web sites are able to use property once the guarantee to possess a keen improvement/build loan and you will…. the brand new collateral on land can lessen or eliminate the down payment to own an update/structure financing, Brandon Simpson, financing administrator to have Earliest Southern area Ranch Borrowing, told you.

Build funds are often used to pay money for material, labor and belongings, and generally require that you pay only attention for the finance which can be made use of given that design progresses. To track down a construction financing, your bank requires their strengthening preparations plus monetary ideas, including an estimated budget and you will timeline.

Using residential property as collateral having a personal bank loan differ mainly based towards financial you employ. Whether your function of the borrowed funds is actually for debt consolidation exterior out of a current farming procedure or debt perhaps not associated with the purchase or improvement of your outlying belongings, next a farm Credit financial may possibly not be capable complement the brand new applicant’s loan consult. Therefore, it is advisable getting a candidate to talk about all the information which have that loan manager so you’re able to most useful determine if financing are provided or perhaps not.

The application of the funds regulation the borrowed funds goal. Farm Borrowing from the bank try associated with rural agricultural credit to have full and you can part-big date farmers as well as rural land residents. The most preferred cause of an unsecured loan is actually to possess debt consolidating, incase one debt consolidation is not tied to an agriculture procedure otherwise rural land, odds are we simply cannot build a loan. Simpson said.

Do you require Land As Equity For selecting Alot more Residential property?

If not want to use dollars having a downpayment, you could pledge the latest homes you possess to reduce otherwise remove their down-payment. In terms of when to or ought not to do that, it is considering every person’s financial predicament and purpose he could be looking to to complete, Simpson told you.

The advantages And you can Cons House Security Loans

As a whole, the advantage of belongings guarantee finance is the fact that the value of land often permits the lender and debtor so you can construction a package which is advantageous for functions. House provide sufficient equity to support a downpayment, and thus releasing up bucks on debtor.

Having fun with property since equity for a financial loan makes you bring out financing rather than risking property just like your home, automobile, offers or stocks.

In certain situations, the brand new guarantee (land) can be used in place of an advance payment allowing new borrower to hold onto their funds, Athletics said.

The disadvantage is that having fun with house due to the fact security ties within the resource towards the length of the borrowed funds and also the financial is simply take hands of your equity if you do not meet up with the terms of the borrowed funds contract.

Issues To inquire of Lenders One to Take on Land Just like the Equity

Lenders One Deal with Residential property Since the Collateral, completely understanding the standards and you can hopes of using your property as the security getting a land loan is essential ahead of proceeded the process and you may Recreation says you’ll find couples standard questions you will want to query the loan administrator.

- Must i play with my residential property since the guarantee to loans in Guilford Center have a specific method of out-of financing (and you will be aware that the goal of the borrowed funds usually determine the new lender’s response)?

- What’s a part of with my residential property once the equity to own a good financing?

- Manage I wanted an appraisal?

- Are there fees in it?

- Why does using residential property as security feeling my money and you will financing terms?

Are Security House Finance Right for you?

Deciding though a land equity loan excellent to possess you is definitely your own decision, but normally, in the event that having fun with residential property since the collateral towards that loan can aid in reducing the repayments and supply most other beneficial financing words, it is a good idea to consider. Yet not, the debtor has to grasp the chance and you can implications out of with regards to established belongings because security having a supplementary loan, Sport told you.

Laisser un commentaire