Should you decide Move Closing costs Into your Mortgage When Refinancing?

Spoiler aware: all mortgages enjoys settlement costs. But what concerning so-called “zero closure cost” finance? It too has settlement costs it’s simply an issue of whom pays for all of them and exactly how. Closing costs have to be paid down by anyone. In various places, it could be customary into seller to spend term insurance coverage or the attorneys https://paydayloanalabama.com/faunsdale/ fee. There aren’t any federal guidelines away from exactly who covers just what.

It’s your loan officer that can give you a loan Costs guess that can checklist personal range product costs you will likely encounter at the finally payment. When selecting a house, it could be area of the deals between the suppliers and the consumers. This new sellers keeps its will set you back together with people their own, however, customers can invariably inquire the new providers to cover certain otherwise all the customer’s charges. Suppliers aren’t compelled to, but the consumers can merely inquire.

All the closing costs is going to be divided into both the brand new customer’s responsibility and/or vendors. When heading into the brand new closure desk when buying a house, the fresh new customers tend to generally must offer enough money the downpayment, closing costs and cash supplies in the way of an excellent cashier’s see otherwise by the cables the mandatory count right to brand new payment broker. Today, wiring the funds is the well-known method. When selecting, the fresh new buyers don’t possess much of an option even if to blow the income. Both physically or perhaps to ask the financial institution to have a loan provider borrowing from the bank by the changing the fresh new chose interest rate right up a little. It rise in rates lets loan providers having extra loans readily available into the customers so you can counterbalance these fees.

When refinancing, consumers also provide the option of adjusting the rate and having a credit throughout the financial. Handling that loan manager, the borrowers is capable of doing a fast rates-benefit study to choose in the event that improving the rates is sufficient to significantly counterbalance the borrower’s fees. As previously mentioned in the first section of this particular article, all loans possess settlement costs it is simply a matter of which pays for just what as well as how. In the event the sellers refuse to pay one part of the buyer’s charge, men and women charges all are the duty of one’s customers.

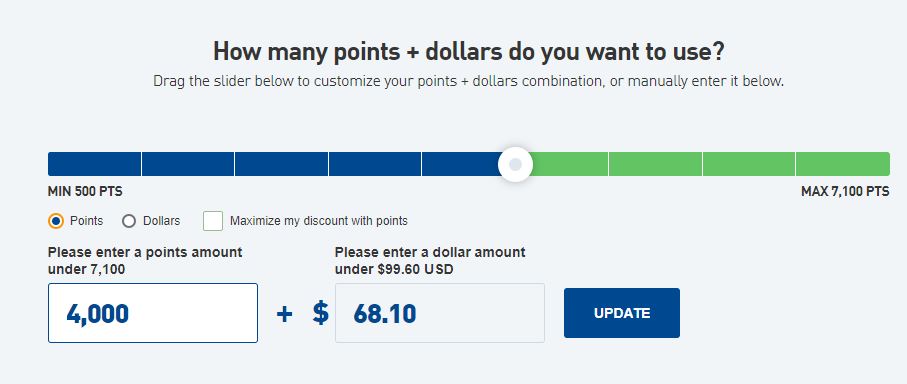

The consumers are able to afford them up front or query the loan financial to regulate the rate with the loan upward. Performing this lets the financial institution to incorporate some degree from a great bank borrowing on payment dining table. Just how much out-of a cards? You to definitely is based on the borrowed funds matter, variety of loan and you will mortgage term. Such as for instance, with a beneficial $eight hundred,000 amount borrowed, and you may an increase of 4.00 percent is available no products, cuatro.25% is available with a 1% credit towards the settlement costs. Into an excellent $400,000 financial, which is $4,000 for the credit which is a so good guess of costs for the majority of places.

At exactly the same time, for less mortgage numbers, raising the rate may not be much let

Having an effective $100,000 mortgage and you can a 1% credit, that is $step one,000 which are placed on closing costs during the settlement. It is certainly better than zero credit at all keep in mind the latest larger the mortgage the larger the credit.

In the long run, borrowers is also decide to move specific or all of the closing will set you back whenever refinancing. Plus in really days, consumers manage exactly that. Several things here-yes, one to adds to the loan amount and you may yes one to escalates the payment per month. However, merely quite thus. Playing with an elementary 29 12 months repaired rate of cuatro% for example, the difference within the payment is only $19 a month.

On the a good $400,000 financing, this new mortgage might be $404,000

Examine that with striking a bank account to cover closure will cost you when refinancing, cutting a bank checking account equilibrium of the $4,000. Anybody can certainly realise why very borrowers please roll about closing costs as the difference in payment per month try negligible than the economic hit taken whenever investing in will cost you that have a bank checking account.

Ultimately, all ways talked about may appear meanwhile. Borrowers will pay up front, buy them with a lender borrowing from the bank, to alter the pace highest, otherwise roll all of them toward finally loan amount. And you may people mix of such. You’ll find settlement costs for each loan. You can not circumvent one. Some one need be the cause of all of them and if refinancing it’s completely up with the people.

Laisser un commentaire