Past month myself and you may my wife gone towards the the brand new home

My wife performed show question over re-mortgaging her business apartment even as we got educated affairs selecting an excellent the latest bank in earlier times considering the rectangular footage of a floor town

I don’t know is it is the best source for information to get this article so moderators please move it if necessary.

In any event, the associate failed to appear alarmed and you can told you they had a complete panel of specialist loan providers to utilize and are confident to find a loan provider

Outline is king I am aware, however, nowadays I am able to describe while you will find millage in my own dispute, I could specialized.

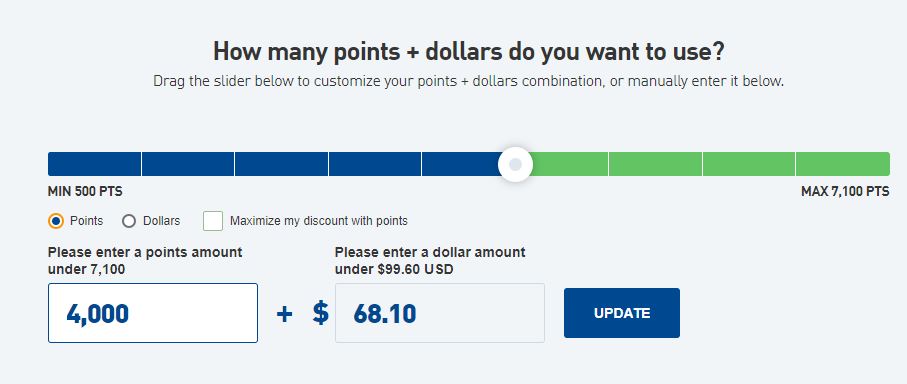

The combined mortgage is actually setup which have Nationwide Home loan Attributes and we chosen Santander. The home we went out-of is in my term merely and has now already been maintained that will be being rented away – the lender might have been notified and its now into the a purchase – assist. To raise the newest put for the the new, combined assets i necessary to lso are-mortgage yet another property (within my lovers identity) and you can pull out to 25K equity.

We were selecting the house for over 1 year and you can my earliest visit to Nationwide are as much as Could possibly get last year for a consultation on my own. Then we had property see including my spouse and you can i experience the programs when you look at the greater detail. During this period we had been had not found the best property but try enthusiastic to understand exactly what we can use. I acquired plans within the dominating on the newest buy (Santander) plus the lso are-home loan (The borrowed funds Works).

Fast pass and in addition we discover the house along with a deal recognized. Promote acknowledged on such basis as a fast deals as we was not for the a string and you may neither are the vendor. I get in touch with Nationwide online payday loan New Mexico therefore the representative went to our house once again to help you improve the newest programs. I next fulfill within Nationwide office a short time later on later in the day to review the mortgage now offers accessible to all of us and therefore turned out to be with similar loan providers. All the we’d to-do is make a commitment to your duration off label & fixed several months in addition to formal app would be manufactured the very next day, which was a saturday. My partner is a nervous person and i vividly think about her asking regarding measurements of their particular flat just in case it was something and you may once again i are informed it would be okay.

Very early you to next week i acquired fortunately that the Santander mortgage was approved together with Home loan Really works had a need to publication a call/valuation to my couples apartment. Timing was damaging to me personally while i was a student in Paris getting organization and we also had to work it head to around the tenant from the flat. The brand new valuation occurred towards Thursday that week and that i came back back for the Tuesday. We called brand new associate several times with the Tuesday just like the we’d our earliest ending up in the fresh solicitor on day and that i required specific suggestions. I happened to be advised the guy had not read right back regarding the valuation, it could just take up to five days towards the are accountable to already been thanks to.

The next Tuesday We contacted the Countrywide representative having an improvement however, he was of unwell and i also is actually advised he could be expected to enter tomorrow from the Abbotts person, as this is where he was based. We named into Tuesday and you can once more the fresh consultant try regarding sick thus i requested the individual into the Abbotts who I will speak to on the all of our circumstances. This is how i discovered Countrywide haven’t any procedures in place to possess Consultants at hand more than constant financial software with other consultants which is effortlessly the things i is informed as i entitled its headquarters. Your face place of work told you they’d obtain the local director to give me a call that go out who was based in another type of department, that he don’t, therefore i decided to get in touch with the loan really works myself to own an revise. Perhaps not convinced during the time, the application are exclusively in my partners term very she got to make the call. In any event, she try informed very quickly your report was emailed so you can the latest countrywide representative into the mid-day during the day the fresh new valuation is actually achieved, and also as myself and you may my spouse dreaded it is actually not able to lend by size of the home. At this stage i happened to be livid which have Countrywide and you will called their head office to find out as to the reasons We had not already been called by the a nearby director and you can required the contact information. I happened to be advised this is not allowed but we were able to learn hence part he had been situated in. At long last bought your local movie director and explained what you, as well as that i spoke so you can their agent the day after the valuation and you can try told its would not be a response away from the loan work through to the after the month, today knowing the declaration was a student in his email email. Your local manager told you he couldn’t imagine to as to the reasons We was not advised of your choice not to ever lend to your Tuesday we talked, but perhaps it had been because the the guy desired to deliver bad following good news immediately following he’d located another lender! I think you just need to place your cards down up for grabs and be honest along with your clients!

Laisser un commentaire