One safeguards otherwise livability things must be remedied just before financing closure

Including, property qualification maps haven’t been somewhat current much more than simply 15 years. Many believe it or not populated parts across the You.S. be considered. That was just after considered a rural city might today end up being an excellent significant populace cardio.

Possessions requirements: The bank usually order an appraisal to your possessions that can create value what you are purchasing. The fresh appraisal statement including confirms your house is actually livable, secure, and you may match USDA’s minimum property requirements.

Property models: Contrary to popular belief, USDA funds are not supposed to funds facilities otherwise high acreage properties. Alternatively, he is geared toward the quality solitary-home. You’ll be able to money particular condominiums and you may townhomes towards system.

Occupancy: Your house you are buying have to be most of your quarters, meaning you want to live on here into foreseeable future. Leasing qualities, resource characteristics, and you can second house orders are not eligible for the fresh new USDA mortgage system.

USDA mortgage debt-to-money proportion (DTI): Latest DTI restrictions are set during the

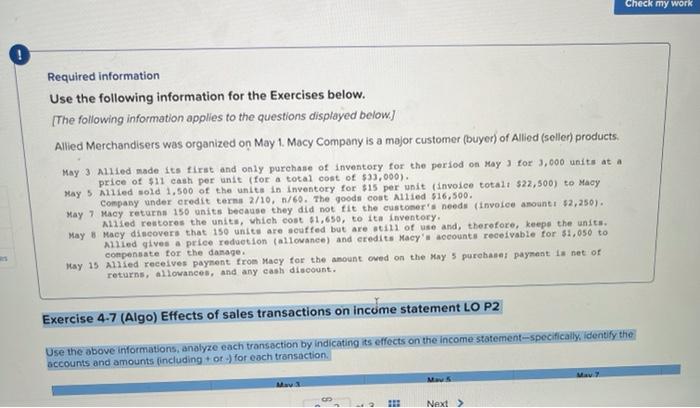

USDA mortgage map: USDA mortgage brokers are available in of many suburban areas around the country, usually simply exterior biggest places. Here are screenshots indicating USDA eligible metropolitan areas (what you but the fresh tan portion).

Keep in mind that the fresh new USDA lender have a tendency to matter any household money towards constraints

The financial institution tend to be certain that USDA rural development financing qualifications on same way as for various other financial program. (suite…)

Continue Reading