What is actually Finest for My personal Business, Security otherwise Obligations Investment?

Small enterprises commonly you desire money. This is particularly true having companies to start with grade of innovation. There are two main very first types of money open to small businesses-personal debt financial support and equity funding. Just like the a small business manager, that is effectively for you?

Secret Takeaways

- Start-up small enterprises can use collateral money otherwise financial obligation resource to help you see currency when they’re dollars-bad.

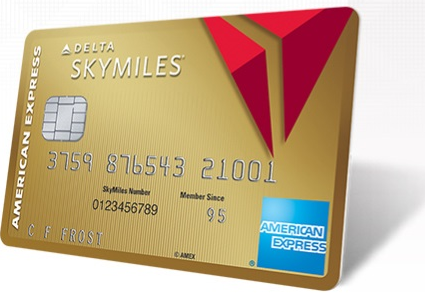

- A bank loan is a variety of financial obligation money employed by small enterprises.

- Guarantee financing mode making it possible for stakeholders getting the main team.

- Providing a small business installed and operating usually need providing aside some kind of personal debt. (suite…)