Just how Maried people Will enjoy Public service Financing Forgiveness for their Student Personal debt

Editorial Ethics within Education loan Planner

It’s no wonders that great thoughts think the same. Which is probably a primary reason its common for all of us to decide a spouse predicated on their own career.

Particularly, in one single study considering U.S. Census investigation, 16% of married couples throughout the knowledge and you will medical care marketplace was in fact partnered to a different studies or doctor. 9 % of people working in personal services were elizabeth industry, and 8% off cops and you can firefighters and additionally chosen spouses with the exact same professions.

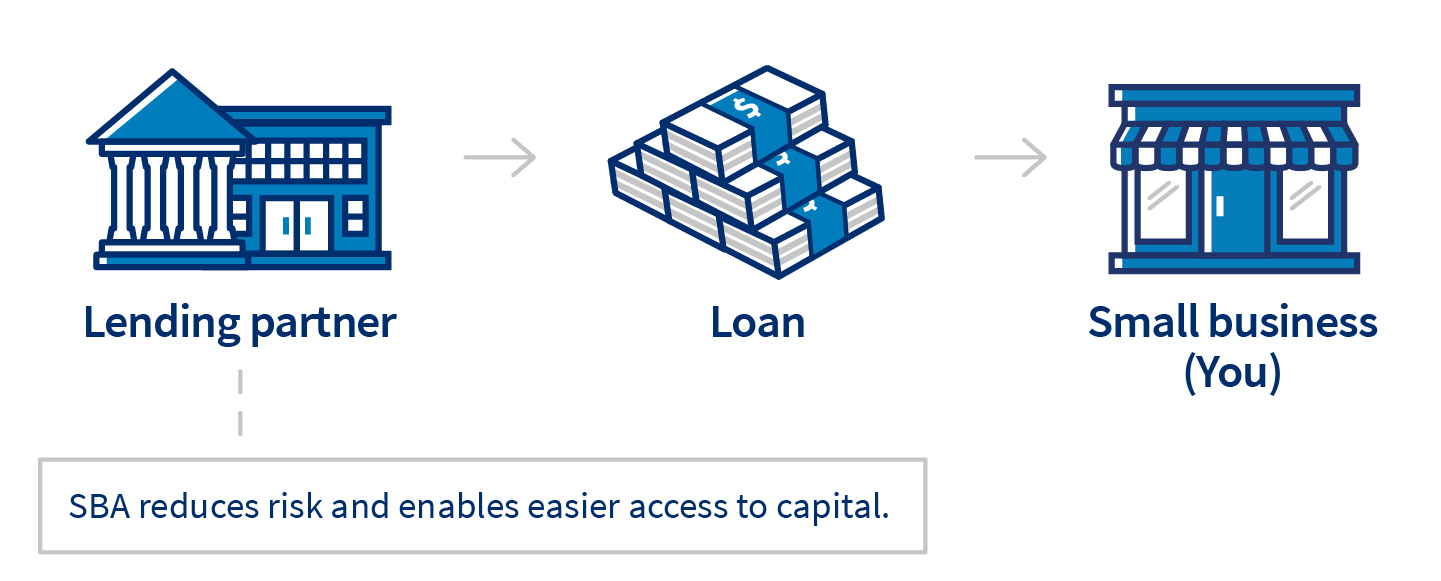

Even in the event your lady isn’t really within the a similar public service jobs, understanding how PSLF work – and how it has an effect on all your family members money – makes it possible to create the best decision. This is how partnered spouses can enjoy Public service Mortgage Forgiveness.

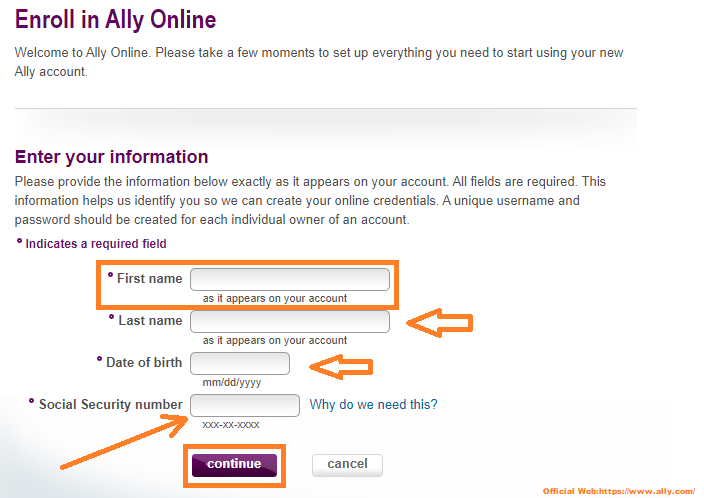

College loans and you will marriage

In the terms of your great Peter Create about Princess Bride, Mawage. (suite…)

Continue Reading