Tips Pay a golden step 1 Borrowing Partnership Consumer loan?

On line Financing Commission Cardiovascular system. Visit the Wonderful step one Borrowing from the bank Commitment On the internet Financing Percentage Heart, accessible because of their website. Get on your online Bank account to help you begin the brand new percentage techniques.

Go to a department. You may make consumer loan repayments when you go to a region Wonderful step one Borrowing Partnership department. The employees during the part will assist you during the processing your percentage.

Member Service Get in touch with Heart. Contact this new Golden 1 Member Solution Get in touch with Center by contacting 1-877-Fantastic step 1 (1-877-465-3361). Its customer service agencies is also guide you from the fee processes over the telephone.

Payroll Deduction. Put up payroll deduction which have Golden 1 Borrowing Commitment. That one lets your loan money getting automatically deducted out of your income, streamlining the latest fee processes.

On line Statement Pay from A unique Organization. If you want to deal with your finances as a consequence of a different financial institution, you could potentially establish on the internet statement shell out and work out loan repayments in order to Golden 1 Borrowing from the bank Connection. This process provides independence and convenience.

You could reference Fantastic step one Borrowing Union’s Financing Upkeep page for much more more information and you can strategies for while making mortgage money. It resource will give extra understanding to your fee procedure and options available for your requirements.

Things to consider

- Qualification Conditions. Always meet the creditworthiness and you can subscription requirements, because the Fantastic step one bases borrowing decisions for the FICO Ratings and you can particular qualification standards.

- Application Process. Get acquainted with the application process, that requires become a cards relationship user and you can taking needed personal and you may financial guidance.

- Loan Terms and you can Amounts. Understand the mortgage terms and conditions offered, plus payment symptoms and you can mortgage quantity ranging from $step one,000 upwards.

- Rates of interest. Look into the competitive creating APRs and ensure they line-up together with your funds and you can financial opportunities.

- Payment Options. Speak about the many procedures accessible to pay back the loan, as well as on the web repayments, department visits, cellular phone recommendations, payroll deduction, an internet-based expenses spend regarding an alternative establishment.

- Later Payment Fee. Know the later payment fee, and this number in order to $15 for many who miss a fees due date.

- Co-Applicants. If the desired, believe including an excellent co-applicant to the application. Fantastic step 1 allows applicants to incorporate a good co-applicant for the app processes.

- Starter Fund. If you’re strengthening borrowing from the bank, pay attention to the « starter financing » solution, which gives brief repayment money. Getting funds to $step 1,five hundred, no co-signer will become necessary. To own quantity to $2,five-hundred, a great co-signer or guarantor is required.

- Borrowing from the bank Mission. Envision whether or not the mortgage meets your own created mission, be it combining bills, making a critical get, otherwise improving your credit profile.

- Registration Requirements. Make certain you meet with the registration criteria, especially if you live external Ca but qualify using nearest and dearest, residential commitment, otherwise a career.

Alternatives

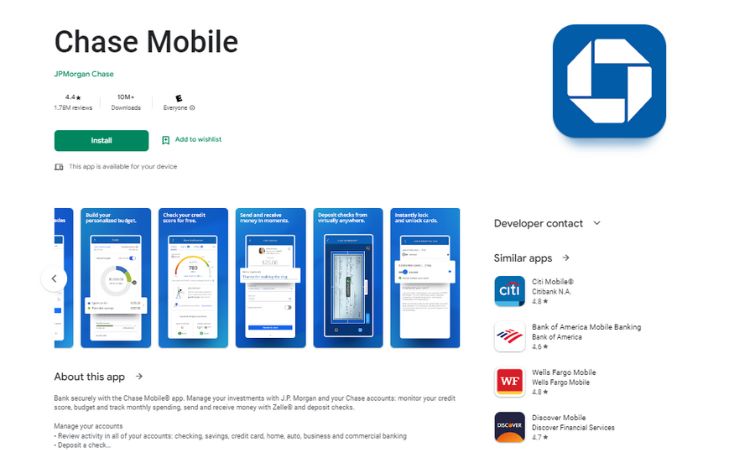

Credit cards. It allows you to buy things and borrow money doing the credit limit. You could potentially like to repay the bill completely for every month otherwise bring an equilibrium to make lowest repayments. Types of organizations giving playing cards are Chase, American Show, to see.

House Equity Funds/HELOCs. For individuals who very own property, you can use their security just like the security for a financial loan. Family security financing offer a lump sum, if you’re domestic security personal lines of credit (HELOCs) render an excellent rotating personal line of credit. Wells Fargo and Bank away from The united states try loan providers offering domestic security points.

Fellow-to-Peer (P2P). P2P stop platforms hook up consumers individually which have individual loan providers otherwise investors. Borrowers discovered loans financed because of the numerous investors. Prosper and you may LendingClub try preferred P2P financing platforms.

Store Capital. Certain stores give money having highest commands, such as for instance furniture otherwise electronic devices. These funds have promotional periods which have deferred interest. Top Pick and you may Fruit is actually types of people offering retailer resource.

Laisser un commentaire