Where to find An educated Mortgage Prices When you look at the Fresno

We provide reduced Fresno, Ca financial pricing for pick and you can re-finance transactions. If you’re looking purchasing a property on the Fresno area or if you need to refinance your household loan interest rate, please definitely contact me personally really having a no-cost/no-responsibility quote.

Fresno, Ca Mortgage brokers

Virtual assistant mortgage brokers try to have military members you to definitely currently serve our country, just who in past times served, and their families. Good program!

While you are to invest in a home into the Fresno or you is refinancing your current home loan interest rate you can easily naturally wanted in order to secure an informed home loan rate readily available.

Four Procedures So you’re able to Obtaining the Better Home loan Price:

- See an established mortgage company which provides lower-rates mortgages into the Fresno.

- Work at a talented Loan Administrator (no less than 5-10 years of experience).

- Inquire, many concerns are great!

- End as well-good-to-be-genuine quotes.

- Make sure to find out what the full charges are (for everything).

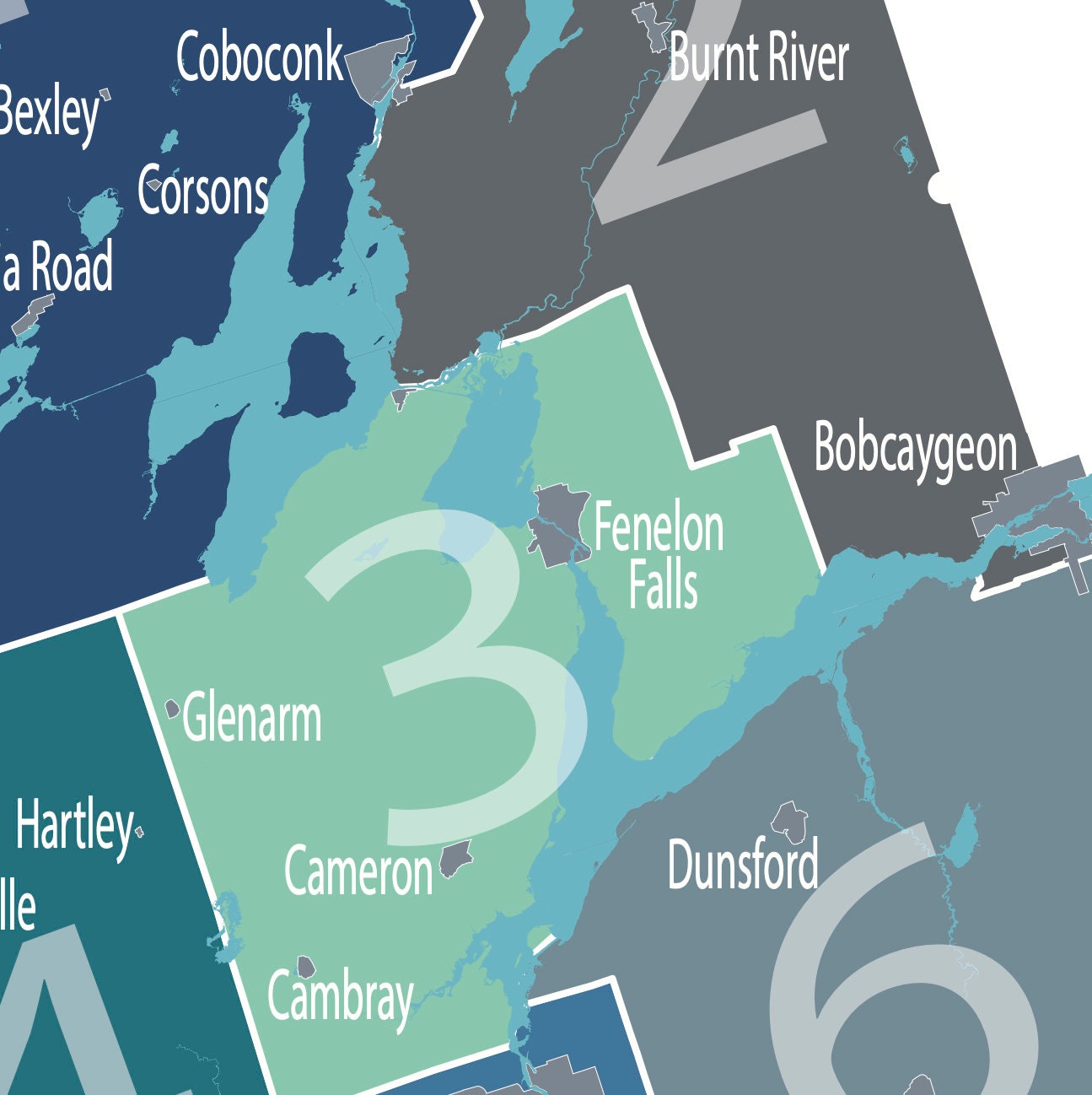

Fresno Compliant Mortgage Constraints

The brand new 2024 Fresno compliant financing limitation are $766,550. Below are your house loan limits for you to five-unit functions in Fresno.

Fresno Mortgage broker

An established Fresno mortgage broker is actually somebody who can buy the brand new top current mortgage prices from inside the Fresno and offer exceptional customer services. A dependable large financial company will receive several years of experience, accessibility a multitude of mortgage software, and you will a leading score on Bbb, Zillow, and.

Taking important and you will helpful tips on their members are a button characteristic too. Listed here are four academic posts In my opinion every financial candidate is always to understand.

If you find yourself preparing to purchase a home you really must have to read through this article. It will make you more information about the records you desire to find a property.

Files Needed seriously to Re-finance

If you are refinancing your existing financial interest rate after that this information is to you. It does promote a listing of files you will need to refinance your home loan.

Family Inspection

When you purchase a home you ought to complete a home Examination. On this page, you are getting all of the particulars of property Examination.

Home Assessment

When you are to buy a property or refinancing your mortgage rate of interest next be sure to realize my personal Household Appraisal post.

Financial Pre-Recognition

Here you will find the very first direction to have obtaining good pre-recognition having a mortgage bank. To find a mortgage pre-acceptance you will need to done a software setting, complete the fresh expected files, and allow the mortgage Officer to locate a copy of credit history.

Four First Guidance

- Debt-To-Income ratio fifty% or less than

- Down payment of 3% or even more (Virtual assistant financial 0% down)

- Credit history out of 620 or more

- 1-cuatro unit land

Every lending company varies it is therefore crucial that you keep in head this is not a hope might receive good home loan pre-acceptance out-of a lending company for people who meet this type of five earliest assistance. Some mortgage loan providers require a diminished obligations-to-money proportion, a high advance payment, and/or a top credit history.

When you move on towards pre-acceptance processes it is necessary you promote real details about the loan software therefore the direct data files your loan Administrator are requesting. The newest pre-recognition techniques will be just take 24-48 hours accomplish after you have the loan application finished and all your own papers recorded.

Because pre-acceptance is complete the mortgage Administrator will situation you a great pre-recognition letter when you find yourself buying property. To have people which might be refinancing the current mortgage, the loan Officer have a tendency to prepare brand new file for underwriting.

Laisser un commentaire