Everything you need to Understand DHFL New house Financing

In this article, why don’t we check New home Financing product out-of DHFL (Dewan Construction Money Restricted). At the outset, I want to concede there is nothing special about it device. Its a plain vanilla extract financial device. As simple as it will become. There isn’t any really love feature contained in this product which requires an effective higher look. You will find assessed of a lot such as for example love situations off banking companies inside our prior to postings. Although not, if you are planning to try to get a home loan, it will always be far better enjoys options. Let us discover more about DHFL New home Financing device.

Who’ll Implement?

- You should be about 21 years old in the duration of putting some loan application.

- Limitation age in the loan maturity: 65 years (discover particular conflicting information on their website)

- Possess an income source (either salaried or thinking-employed)

Just how much Loan Can i Get?

Getting funds to Rs 30 lacs, you can get a home loan as much as ninety% of your own cost of the house. To own financing over Rs 31 lacs, loan-to-well worth was felt like according to DHFL norms and you may assistance. I can maybe not come across one thing from the LTV to the DHFL websites. However, it may be ranging from 75 so you can 80% of your own overall cost.

Cost of the house is one region. The loan repayment element might influence the loan eligibility. The loan eligibility relies on your income and you will existing loan loans. An earning co-applicant increases the loan qualification.

What’s the Mortgage Tenure?

Maximum loan tenure are thirty years. At the same time, the borrowed funds tenure wouldn’t expand away from retirement otherwise sixty age, any is before. This might be to have a good salaried loan applicant. For a home-operating people, maximum many years at financing maturity is actually 70 many years.

What’s the Interest rate to possess DHFL Brand new home Mortgage? Which are the Almost every other Charge?

The mortgage rates keeps fluctuating. The rate relies on the kind of the field (salaried or care about-employed) as well as the loan amount. DHFL calculates EMIs for the month-to-month cutting harmony foundation. Other charge become operating commission, valuation costs, tech charge etcetera. You can check out the newest selection of costs and you can fees to your DHFL site.

Will be Tax Benefits Any Some other?

DHFL are a casing finance company (HFC). Regarding angle cash taxation laws and regulations, a home loan regarding a keen HFC have a tendency to bring you the same tax experts because the home financing from a bank. You can aquire benefit of as much as Rs step one.5 lacs to have dominating cost significantly less than Area 80C or over so you can Rs 2 lacs to have interest payment on the a homes loan.

What’s going to Function as Protection on the Mortgage?

The house is bought about financing proceeds would-be mortgaged for the bank. Occasionally, DHFL will get inquire about more security such as life insurance policies, FD receipts etc. You don’t have for a loan Guarantor (or more DHFL says on their site).

The length of time Does it Get getting Mortgage Disbursement?

I would personally predict HFCs are operationally nimble compared to the banking institutions into the disbursing loans. While the financing is actually a product tool, this may let an enthusiastic HFC to face out of the competiton. DHFL webpages mentions step three-15 days once they have obtained the brand new expected documents.

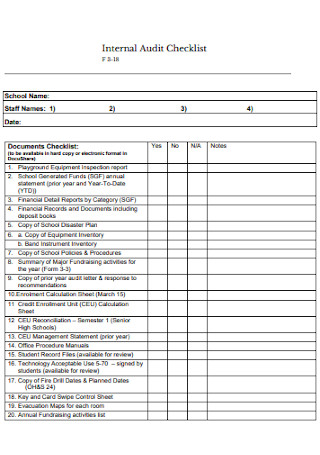

Which are the Documents Had a need to Submit an application for DHFL New home Financing?

Under Money associated documents, an excellent salaried candidate offer paycheck slips and content of financial membership declaration over the past ninety days. A personal-employed people will have to offer duplicates of cash tax returns, GST output, balance sheet and you can duplicates of checking account comments.

Please keep in mind that I’m presenting all the details from their website. The exact number of data needed to expose earnings could be some other, especially for mind-working.

A couple of things to protect Against

There’s nothing wrong contained in this mortgage device or having DHFL. But not, if you are planning to try to get that loan away from DHFL, do examine against the pricing that you might get from other banks otherwise HFCs. While doing so, you need to protect well from people deals out-of third-class items. At the time of loan sanction, you will be questioned to acquire insurance policies of one online payday loan Pennsylvania sorts of otherwise others (Financial shelter facts). Whenever i was not saying that you should not purchase insurance coverage, you need to together with appreciate the price as well as the viability of your own product. In addition to that including insurance plans can be extremely expensive but such as for example agreements may not give you suitable form of publicity. I discussed a real-life example in this post. Genuinely, any of these insurance goods are outright non-feel. Grab necessary methods to quit becoming target regarding mis-offering. Manage observe that this is simply not you have to become a lot more cautious if you find yourself choosing finance regarding construction finance companies. Mis-promoting of such situations happens during the finance companies as well.

Laisser un commentaire