Dont Let Contingencies Kill Your own A home Transaction

If you find yourself inside the escrow, it is vital to learn the brand new contingencies created towards genuine property bargain. This will be an integral part of the method both for consumers and you will manufacturers. Plus, without a whole understanding is kill the bargain or cost your currency.

A backup was a disorder regarding a contract one governs whenever and you can not as much as what situations a purchaser normally terminate the brand new bargain. It also talks about what happens toward customer’s serious currency or put as long as they cancel.

Generally, a purchaser is terminate the purchase bargain anytime through the their backup period. Whenever they manage, they must discover its complete put straight back. Yet not, immediately after contingencies was removed, the vendor is actually permitted support the buyer’s put should your buyer cancels the fresh new contract. An average put when you look at the Enough time Seashore is around 1%-3% of price. Very misunderstanding your rights when it comes to canceling an agreement are going to be a costly mistake.

1. Assessment Backup

The fresh new inspection contingency lets consumers to complete of many testing. They talks about the fresh new buyers’ physical review and name declaration or homeowner’s organization records. Basically, customers provides 17 months to eradicate the newest check backup. But not, the time period would be altered regarding the arrangement.

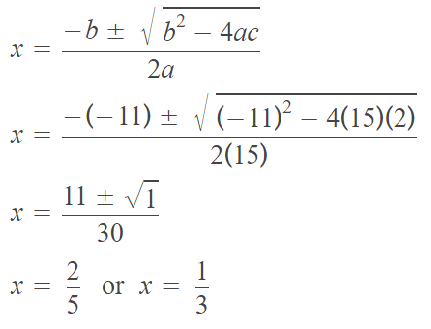

dos. Assessment Contingency

An assessment backup only applies to sales getting made with an effective mortgage loan. The borrowed funds financial will be sending a keen appraiser to consult with the property to determine their market price. By default, new assessment contingency was 17 weeks. Including the inspection contingency, the buyer gets the option to terminate the brand new contract. But as long as this new appraiser will not worthy of the house on give price considering.

step three. Financing Backup

Eg appraisal contingencies, financing contingencies merely apply at requests being fashioned with a home loan mortgage. Automagically, the borrowed funds contingency is actually 17 weeks. It offers the consumer a solution to cancel when they unable to rating an interest rate approval. The duration of which contingency is usually reduced either in the fresh new bargain or after that counteroffers.

Contingency Timelines

17-working-day frames are generally the fresh standard. However, manufacturers or consumers can discuss reduced (or longer) contingency due dates. It is not strange for buyers in addition to their agents within the an excellent competitive field. It’s used as a way to make their bring more appealing so you’re able to suppliers. When you’re a buyer and looking in order to shorten backup episodes, there are two main the thing you need to watch out for:

- Show with your house inspector how fast you should buy an assessment report.

- Talk to your financial concerning time frame needed for an appraisal as well as for loan recognition.

Almost every other Backup Systems

Also the primary contingencies, several others are generally added to a house contracts. Including, if a buyer currently possesses a house that needs to be available in order to acquire this new seller’s property. The customer can add a contingency to that effect. This really is labeled as a contingency available regarding Client’s Assets. It is usually incorporated the acquisition package with yet another function known as a contract addendum. There is certainly an identical mode that gives the vendor the right so you can cancel if they’re struggling to find themselves an alternative assets. (Sure, manufacturers may have contingencies on deal also!)

Deleting Contingencies

When you look at the California, there is certainly something of energetic contingency reduction. It means consumers must remove them written down. To put it differently, a backup is not immediately got rid of. That it can be applied even if the time frame because of their treatment seats. The buyer needs to promote that, or higher, finalized Backup Reduction versions. Each one of these removing, or higher, of the bargain contingencies. As client provides removed them in writing, they could not any longer located a refund of its put. This can be applied even in the event it cancel the newest price, or do not go through with the buy for any reason. Should your buyer cancels after every backup has been got rid of, owner try entitled to keep up with the serious money put just like the liquidated damage. It is given both sides possess initialed which area on the contract.

See to perform

What are the results if contractual due date to your buyer to remove backup tickets in addition to visitors have but really to eradicate the backup in writing? At that point, the vendor can also be point a notification to Client to perform. Which see should be considering on paper that have acknowledgment acquiesced by the consumer. It includes the customer 48 hours to remove its backup otherwise terminate the transaction. If for example the a couple of days ticket plus the client will not remove the backup, then the supplier gets the straight to terminate brand new arrangement unilaterally.

Waiving A backup

Colorado payday loan 255 online

Below particular affairs, you can easily waive new introduction off an elementary backup. For example, if the a purchaser enjoys an incredibly higher advance payment, the financial institution may well not require an appraisal. Therefore, the fresh appraisal contingency are waived. A buyer buying a property which have cash (hence zero home loan), can be waive both assessment and you can loan contingencies, as the neither enforce. The fresh examination contingency while doing so are waived. Just be sure you know the dangers with it and you may talk about them along with your broker.

Laisser un commentaire