Are you aware that this new Virtual assistant now offers a-one-Date Close structure mortgage much like the FHA You to definitely-Day Personal financing?

The new Department from Experts Circumstances modified and offered a component of new Va Lenders’ Guide to include more pointers getting Va structure money.

The latest Virtual assistant types of usually the one Time Close financing allows certified borrowers to finance both the structure while the long lasting loan to own our home in itself (the mortgage) at the same time.

With a Virtual assistant One to-Big date Intimate framework loan, the brand new debtor does not have to care about being qualified for a couple of lenders, a few closing times, etc. Brand new Va financing program comes with including a couple of intimate framework funds, however the That-Big date Close sorts of this financing enjoys specified experts.

The fresh element of Va financing regulations addressing You to definitely-Day Close laws and regulations explains, New permanent funding is generated prior to design, additionally the latest terms is actually modified to the long lasting terms and conditions at the end regarding build. Two-date romantic loans essentially involve an initial mortgage closing in advance of the beginning out of structure, and a second closing where long lasting capital can be used when deciding to take out, otherwise change the first financing.

Individuals should know you to definitely when you’re Virtual assistant loan guidelines technically permit the debtor to act because her very own creator, lender requirements usually use.

Va You to definitely-Go out Intimate loans, like any almost every other Va mortgage issues, require the borrower so you can consume our home after finished

Particular lenders may not allow debtor to get results as the good company into the project, while others might require comprehensive records (receipts, functions requests, composed plans, an such like.) regarding the borrower to help you be the cause of exactly how mortgage funds is spent inside design stage. Try to discuss what’s you can with that loan officer.

Your house can be used while the borrower’s no. 1 quarters, regardless if conditions are made for those called to help you energetic responsibility solution, deployments, and other sorts of military obligations.

I have over extensive lookup with the FHA (Federal Housing Administration) as well as the Virtual assistant (Institution away from Veterans Activities) One-Go out Romantic Design mortgage applications. I have verbal right to authorized loan providers that originate this type of residential financing products for the majority states and every providers provides supplied you the principles because of their affairs. We could hook your which have mortgage loan officers who work for loan providers that know the device well while having constantly provided quality services. The information is managed confidentially.

FHA will bring recommendations and you can connects consumers to help you accredited One to-Time Intimate lenders to increase awareness about this financing unit and you will to assist people receive higher quality service. We’re not purchased endorsing otherwise indicating lenders or mortgage originators and do not if not take advantage of this. People is to shop for financial properties and evaluate its choices prior to agreeing in order to proceed.

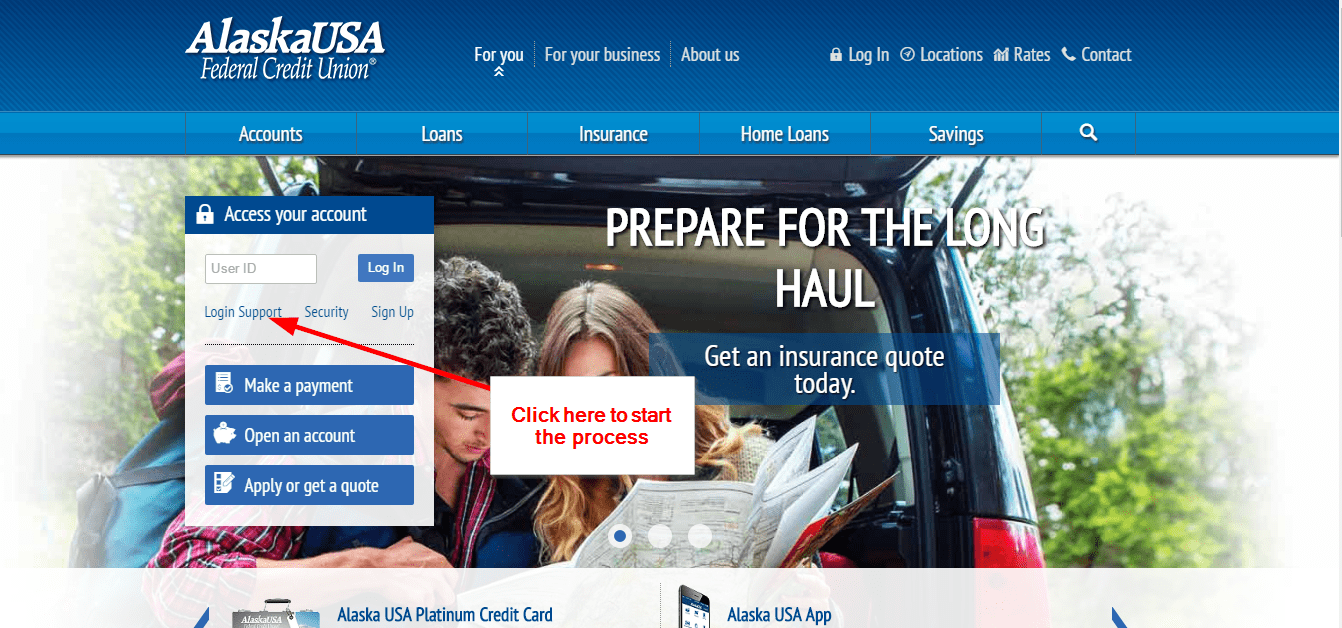

When you’re selecting getting contacted by the a licensed financial in your area, delight post answers on the questions less than

Please be aware you to investor guidance with the FHA and you will Va One-Go out Personal Design System just enables single members of the family homes (step 1 equipment) and never to own multiple-members of the family devices (no duplexes, installment loans Washington triplexes or fourplexes). As well, next home/strengthening appearance commonly anticipate below these applications, also but not limited by: Package Homes, Barndominiums, Vacation cabin Property, Shipments Container Land, Stilt Residential property, Solar (only) or Wind Driven (only) Belongings, Dome Residential property, Bermed World Protected Home, Lightweight Property, Accessory Dwelling Tools, or A-Presented Residential property.

Please send your email request to [email protected] which authorizes FHA to share your personal information with one mortgage lender licensed in your area to contact you.

3. Let us know the and you will/and/or Co-borrower’s credit profile: Higher level (680+), A good – (640-679), Fair (620-639) or Poor- (Less than 620). 620 ‘s the minimum qualifying credit rating for this tool.

4. Have you been otherwise your wife (Co-borrower) qualified pros? In the event the possibly of you meet the criteria veterans, off payments only $ount the debt-to-income ratio for every single Va allows there aren’t any maximum mortgage amounts as per Va advice. Very lenders is certainly going to $step 1,000,000 and you may remark highest loan number towards the a situation-by-instance basis. Or even, the latest FHA deposit is 3.5% as much as the utmost FHA financing limit for your county.

Laisser un commentaire