Works done having loan investment need certainly to join making the property Enjoying, Secure otherwise Safer

Do-it-yourself Funds

?Homeowners can apply for a financial loan as much as ?thirty-five,000 to manage repairs, home improvements or updates to their house.

Exactly what performs does this shelter?

There isn’t any requirement that assets have to meet all of such conditions. The mortgage would be directed at one to important element.

- Below average Construction (Pet 1 / Pet dos Potential risks / Welsh Casing Quality Standard)

- Repair, Flames Defense otherwise Shelter

- Blank Property (Repair / Conversion)

- Energy savings (Environmentally better right up)

- Category Resolve Plans / Envelope Plans

- Private Hired Markets (Access Schemes)

- Aids and you may adaptations getting earlier otherwise disabled some body otherwise DFG ideal right up

This is not an enthusiastic exhaustive number whenever new performs contribute to making the property enjoying, secure or safer, then it tend to fall during the regards to the scheme.

The fresh qualified really works would-be influenced by an area Expert Administrator through to assessment of the property. In order to make an inquiry for a loan see, delight e mail us for the 01545 570881.

Exactly who qualifies?

- Owner occupiers

- Landlords

Your local Expert will give consideration so you’re able to property owners and you can landlords. Landlords providing the possessions to allow during the affordable/ advanced book rates, otherwise just who give you the casing for social houses otherwise nomination legal rights will be given priority more than landlords letting toward open-market.

The fresh new applicant should certainly pay the financing repayments or have the means to pay-off the borrowed funds toward deadline https://simplycashadvance.net/payday-loans-wa/. A value look at might be carried out in purchase to ensure candidates can meet financing money.

Exactly how much will i rating?

Loan requests can be produced to own ranging from ?1000 to ?thirty five,000 each habitable product. The borrowed funds number would be calculated according to price of the latest functions which means you will have to submit listed quotations to have the job included in the application.

Your local Authority will be the cause of your own cost together with loan amount ount you could potentially realistically pay off.

The financing is actually appeal free, taking there’s no default toward financing. Whether your loan cost is not met or discover almost every other breach of requirements, the full loan amount can be repayable and you can appeal was due on number kept. Focus will end up due as detailed in the Loan Facility Arrangement. (Already Financial off The united kingdomt feet rate and 5%).

There was a-one from management percentage on the supply of the mortgage. The cost matter is decided out the following:

Susceptible to offered investment, manager occupiers might be able to sign up for a credit card applicatoin Grant doing a total of ?4500, to pay for brand new fees. Given there is absolutely no standard towards mortgage, or infraction off grant standards, brand new grant will never be repayable. In case there are Loan application Commission Offer not-being readily available a total of ?five hundred would-be charged on the candidate.

This type of costs having landlords could well be waived if for example the house is given for rental at Local Casing Allocation price to the duration of the loan period, and property owner rents the home to help you clients about Council’s Reasonable Housing Register otherwise a renter that would qualify to go on which Sign in.

Exactly how am i going to arrange the work?

Neighborhood Authority offer a beneficial supervisory provider to have building functions to be certain consistency into the requirements out-of workmanship and you will prompt delivery from works. This may become computing within the possessions in order to make a program off functions, and drawings where needed, see rates on work, together with to own specialist products, and sort out one affairs while they arise. The candidate get like this particular service once they very desire to within a charge away from 10%, or alternatively they are during the independence to safe their particular contractors toward work.

As with the brand new government fee, there may be a give readily available for proprietor occupiers to cover the cost of the new supervisory provider, subject to funding.

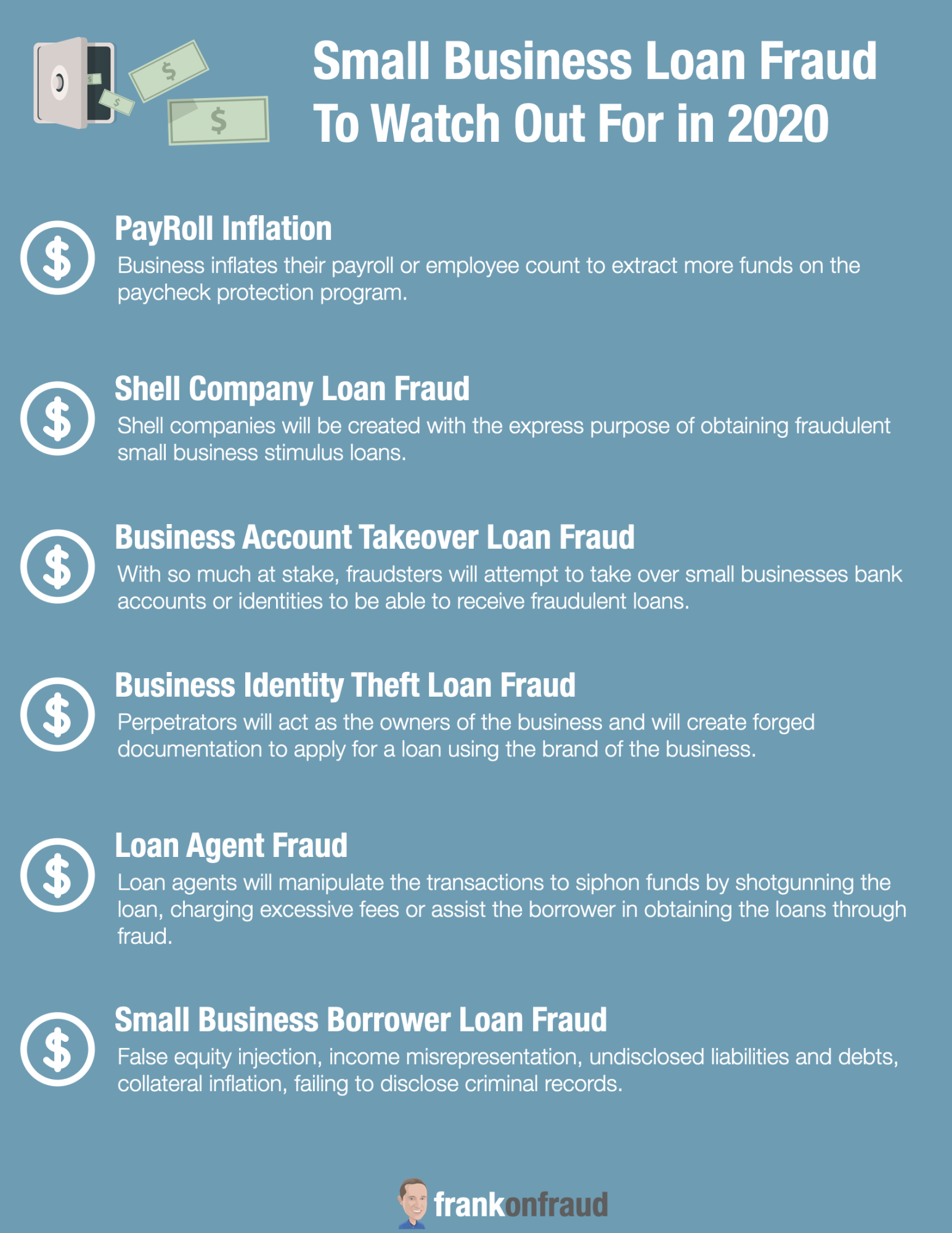

From inside the cases of suspected fraud otherwise deceit – This is the coverage of expert to earnestly pursue, choose and you can read the suspected instances of ripoff and you may deception.

Laisser un commentaire