Options You can test if you fail to Qualify for an individual Loan Whenever you are Unemployed

Lenders cautiously examine individuals areas of debt advice once you make an application for a loan. Such elements are your earnings, the latest proportion of the loans so you can earnings, plus credit rating. This type of activities along promote lenders knowledge into your monetary stability, ability to do personal debt, and you may creditworthiness.

Maintaining a healthy and balanced balance anywhere between such things is crucial in order to securing mortgage acceptance that have advantageous terminology. At the same time, people weaknesses may need proactive tips to evolve debt standing before applying for financing.

Against mortgage getting rejected due to unemployment is going to be unsatisfactory. Still, discover choice you could potentially discuss and improve your possibility of being qualified for a financial loan otherwise explore just like the solutions:

Use Which have a beneficial Cosigner

Consider implementing with good cosigner if for example the jobless position has an effect on your financing eligibility. A cosigner is somebody which have a constant income and you will a good credit score who agrees to expend the loan if you’re unable to. Loan providers gauge the cosigner’s creditworthiness, boosting your likelihood of approval and you will securing way more positive conditions. Choosing a willing and you may able to cosigner is important as their credit and you can money will be in danger.

Score a combined Financing

A joint financing occurs when you submit an application for a loan having someone with a good credit score. This individual should be a close relative or anyone else. Both of you use your earnings when being qualified for a great consumer loan.

You can use fundamental funds for various purposes, including household requests or individual expenditures. Each party have the effect of fees; late payments or non-payments may affect one another credit file.

Make an application for a house Collateral Line of credit (HELOC)

For those who own a home and then have accumulated equity, imagine making an application for a house Guarantee Credit line (HELOC). Good HELOC allows you to borrow on this new guarantee on your home, utilizing it once the collateral. Because your domestic obtains the borrowed funds, lenders tends to be even more easy regarding your a career updates. However, be mindful, just like the incapacity to settle a beneficial HELOC could cause dropping the domestic.

Choices so you can Unemployment Financing

When facing financial difficulties because of jobless, numerous choice provide to possess jobless funds can help you navigate this type of tricky moments:

Contact Established Creditors for Financial assistance

Get hold of your latest creditors, particularly credit card companies, lenders, borrowing unions, or utility company. Describe your position honestly and inquire once they give adversity software, brief commission decrease, or deferred commission options. Of numerous financial institutions will work along with you through the pecuniary hardship to avoid default.

Low-notice Charge card

Credit cards which have a minimal-rate of interest otherwise an effective 0% Apr promote can benefit necessary costs. Be cautious to not collect large personal credit card debt, but this 1 is far more prices-productive than simply high-notice fund.

Acquire Off a retirement/Financial support Membership

Assume you have got a pension account or financial support collection. In this case, these accounts could possibly get allow you to borrow on all of them temporarily rather than punishment. This will bring usage of finance while you are to prevent very early detachment charge or fees. not, it’s imperative to comprehend the terms and conditions and you can prospective much time-name influence on your retirement checking account.

Family & Family members

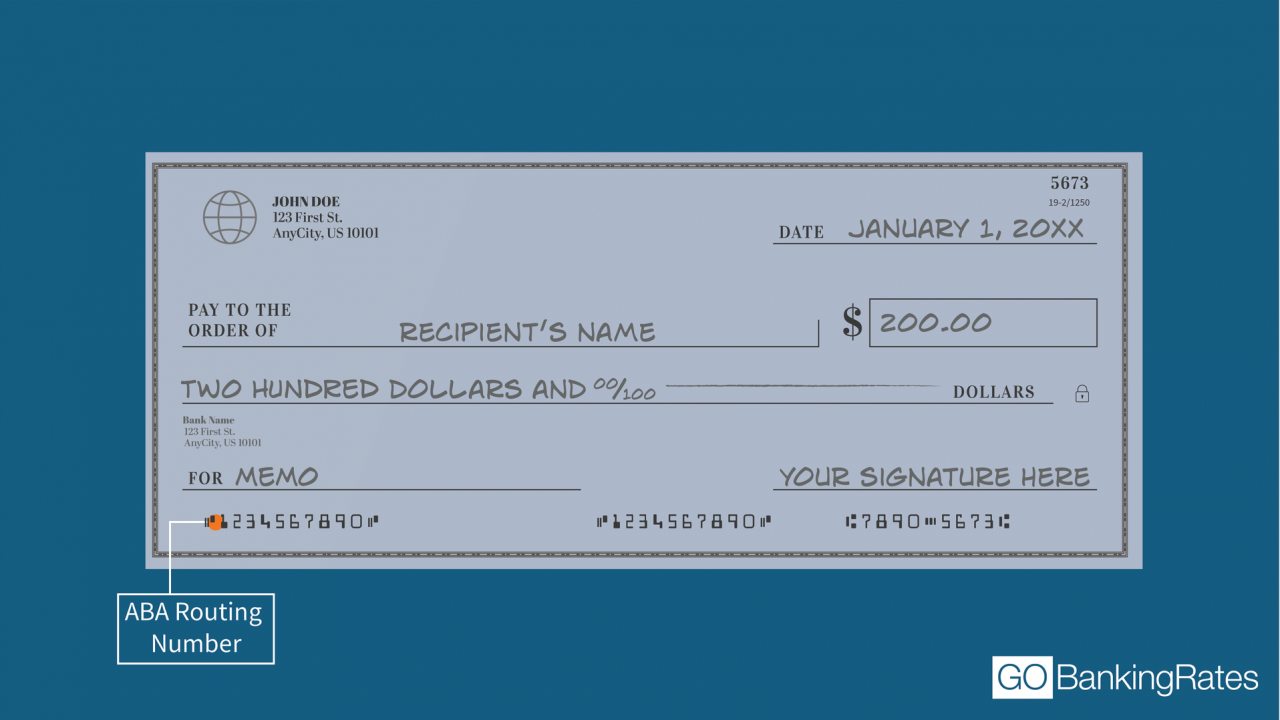

Get in touch with household members otherwise best friends just who is generally ready and ready to give financial help. Borrowing from the bank of members https://paydayloansalaska.net/ of the family might be a practical alternative, tend to versus appeal or tight installment terms. However, it is important to establish clear agreements and cost plans to take care of compliment matchmaking.

Unemployment Insurance coverage

Unemployment insurance is a national-paid monetary back-up made to promote short term financial help to help you individuals who have destroyed their work and you can see specific eligibility standards. It is a very important replacement taking out fully financing when you’re unemployed.

Laisser un commentaire