Odds of Taking Denied Shortly after Pre-Recognition And you will What to do

Preciselywhat are your chances of bringing refused immediately after pre-recognition? Even although you may have been through the process of getting […]

Just what are your odds of delivering refused immediately following pre-acceptance? Even if you could have experienced the whole process of becoming qualified and acknowledged, there’s absolutely no ensure out-of latest recognition. It is possible to become pre-recognized and unsuccessfully have the financial support order your brand new home.

The absolute most difficult going back to that it that occurs is good ahead of closing. Assertion ahead of closure brings plenty of heartbreak and negative thinking.

To end any heartbreak, the audience is wearing down the causes an excellent pre-approval was refused of the underwriting and ways to give yourself the newest most readily useful options during the effectively acquiring funding.

Every thing begins with knowing the design underwriters and you can loan providers jobs in this. Once we accomplish that, this article dives toward particular tactical explanations a home loan is actually denied after pre-approval.

An Underwriters Perspective

For those who comprehend numerous stuff on this website, so as to the latest Dolinski Group centers on delivering effortless architecture and you may ideas prior to dive toward tactical information. The Lansing real estate professionals believe in arming you into the better pointers you’ll be able to in order to generate experienced choices which can be good for your situation.

This post is no different… Before you go on most of the causes your own mortgage are rejected immediately after pre acceptance, why don’t we look at a high-height construction during the borrowing risk study.

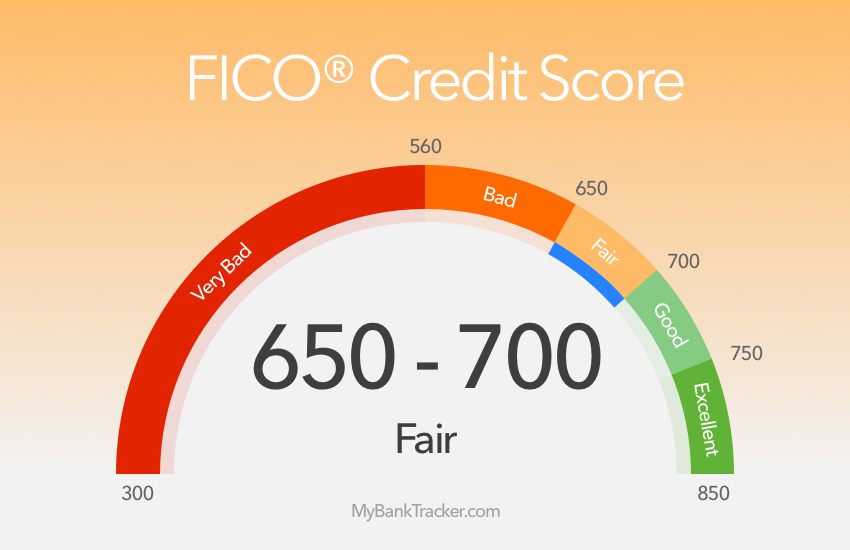

If you’re trying to a home loan, there can be an enthusiastic underwriter that looks at the financial picture – credit history, income, profession, personal debt account, debt-to-money proportion, down-payment, financing method of, and a lot more.

Brand new underwriters tasks are in order to approve or deny mortgages according to chance calculated out-of a proprietary chance-research design and a great lender’s administration plan for risk.

Put another way, a keen underwriter is wanting at your condition and are calculating a threat rating to you personally. Like, a loan provider can get estimate all potential homebuyers ranging from 0 and you can 100, in which 100 is the greatest exposure and you may zero is not any risk after all.

Offered current market requirements, the lender establishes they wish to agree most of the applicants online payday loans Massachusetts having a chance score below 40. One house visitors significantly more than 40 becomes denied.

As a home customer, all of this ensures that you should do that which you possible to reduce your thought chance rating. This provides the ideal opportunity at providing recognized and you will getting accepted.

It’s impossible to understand every component that gets into calculating just one exposure get, however, i can say for certain of numerous prominent points.

Keep this effortless believe in mind: grab strategies one to decrease your overall exposure situations and avoid people steps one to boost your chance things.

Enhanced Debt Levels

Good sixty-year-old woman try moving to a lake household in the Haslett, Michigan. She worked hard for many years to save right up this currency and you can try fundamentally to acquire their own dream family.

Preparing for brand new disperse and you can amidst her excitement, she discover by herself from the a dealer purchasing a fresh pontoon ship…

Their unique financial obligation membership improved while the financial obligation-to-earnings ratio are pressed excessive. This means that, she was rejected the mortgage one week prior to closure.

Although of us cannot relate solely to purchasing a pond home and you will the latest pontoon watercraft, their disease is quite prominent.

The debt-to-earnings ratio are a portion of income that goes on personal debt. When taking for the the newest obligations instead of a rise in the income, you improve your personal debt-to-income proportion.

Particularly, what if you get $cuatro,000 a month. Between playing cards, a car loan, otherwise school fund, you end up purchasing $step 1,000 monthly. You’ve got a 25 percent financial obligation-to-income (DTI).

Laisser un commentaire