I found myself in addition to considering a charge card with an excellent ?12K restriction

Hi there, I absolutely wished to get off an update for it to give hope to individuals into the an effective simmilar disease. We got their suggestions and called a broker who had been brilliant and you will set my partner, who has got the superb credit rating just like the applicant first and you can myself given that applicant # 2, that it gave a more substantial weighting so you can him in the place of me personally and you may we’ve got only had an entire home loan bring out of a top roadway lender having a beneficial ninety% mortgage 🙂 A broker is the channel proper that have a complex credit rating very thanks for the advice!

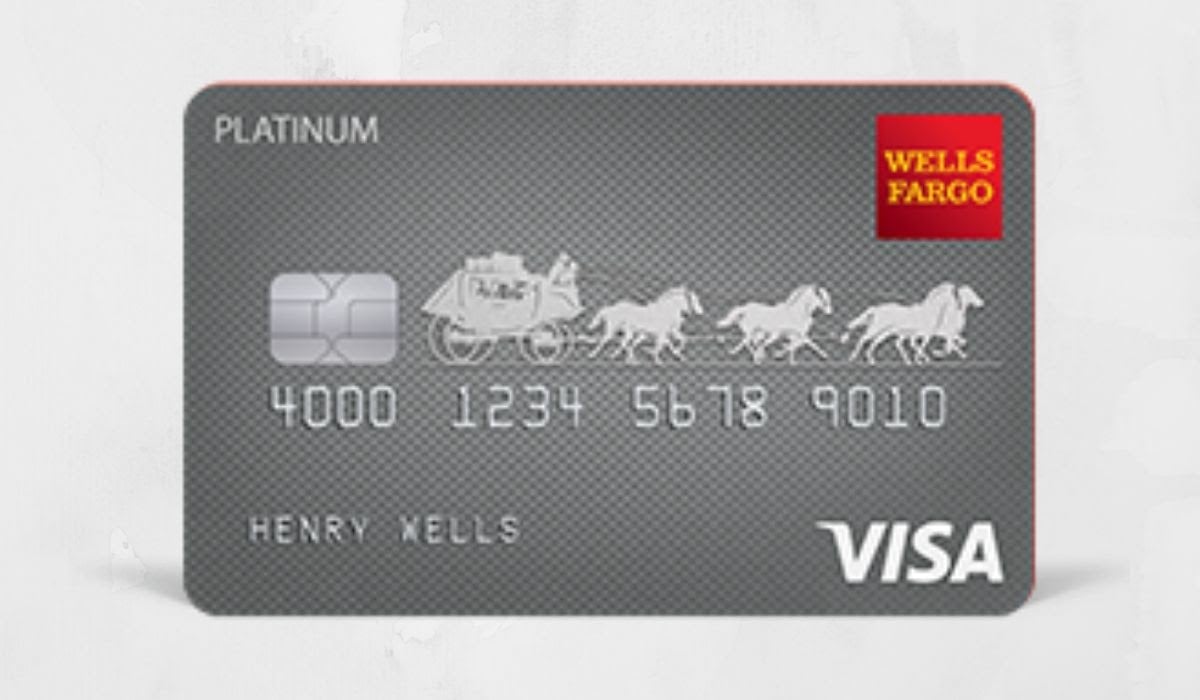

Loan providers are mindful now. I had a vintage standard off nearly six years ago you to are because of drop-off within the a couple of weeks, that have an or perfect record, and you can earlier this times an optional agent informed me they wouldn’t rating me a home loan. Given that standard had fell out-of my personal file, my credit score ran quickly off Crappy so you’re able to Excellent and that i may now score a beneficial ?700K real estate loan off some one. Its absurd one two weeks tends to make such as for example a difference. NB proper from inside the the same disease, watch out for trying to get a charge card off a family owned from the a financial with which you had a satisfied default. Age.grams.

Hello Checking to possess just a bit of recommendations myself and you may my personal lover are looking to get a home loan maybe end from next year. Could emergency online rent loan for eviction notice it be value make payment on non-payments? My area has actually a great thin credit file together with so it could just be me personally trying to get the loan. We have a very well paid safer work as the an effective midwife. One suggestions was most greatly enjoyed thank you

M&S Bank are belonging to HSBC so if you features a good now undetectable came across standard which have HSBC then no matter if a delicate lookup which have M&S teaches you might possibly be approved you continue to feel denied on the a painful lookup

You may have a far greater danger of a mortgage on an okay price in case your non-payments try paid, in full or with partial agreements.

Default step 1 (Hook Financial Outsourcing Limited): First registered into initially (initially Equifax and you will Experian then month-to-month to all the step three companies) Overall really worth try ?303 The initial loans are an enthusiastic overdraft on the Co-Op Financial most recent account The debt was in arrears long before very first , or earlier. I can not identify yes while the my Co-Op account has now been signed.

Predicated on the thing i provides read on your discussion board, do you really believe I might be capable of getting the brand new standard removed completeIy got rid of while i never received a Observe away from Standard page? As an alternative, can i make an effort to obtain it registered so you’re able to an earlier time as i strongly accept that I became during the arrears for longer than 6 months earlier was first entered on the first ? Whom do i need to produce to, the debt collector, Co-Op Financial or Economic Ombudsman?

An alerts 0f Standard letter doesn’t have anything to do with their credit record

Default dos (Thames Liquid): This is certainly a default that i obtained of a water services bill in the a message that i got vacated more than a year previous to help you several months under consideration regarding the statement It is demonstrably wrongly delivered to me Earliest entered in order to Equifax on the (once 3 months when you look at the arrears) Ought i build directly to Thames H2o earliest and/or Monetary Ombudsman?

you think I may be capable of getting new standard eliminated totally removed whenever i never acquired an excellent Observe away from Default page? Zero. You didn’t understand that from me! A loan provider does not have to posting you to definitely befor including a beneficial standard on the credit score.

Laisser un commentaire