The best strategies for household security to fund old-age, considering positives

Over the past long time, house guarantee account have increased significantly all over the country. Actually, since the initial one-fourth regarding 2024, the common resident had seen its equity boost from the $twenty-eight,000 season-over-year, in respect study regarding CoreLogic. You to uptick in home equity began into the 2020 and you can is actually motivated, in the high region, of the a variety of reduced cost, lower having-selling family catalog and you may popular by people. Ever since then, the average cost of property has grown over 50% – hiking of normally $317,000 from the next quarter from 2020 in order to $480,000 in the 1st quarter of 2024.

Who has leftover the typical resident with about $300,000 in home security . And, that equity shall be borrowed facing, typically from the a low price, getting an array of spends – including debt consolidation reduction and you may home home improvements or solutions. Individuals likewise have a number of various other house collateral lending options to choose from, in addition to house equity loans and you will family guarantee credit lines (HELOCs) .

If you are household renovations or consolidating debt will be wise a way to use your security, thus can deploying it to help loans retirement. Particularly, you can tap into your own guarantee to greatly help security senior years expenditures, instance unexpected medical expenses. Exactly what is the greatest answer to play with family collateral in order to funds your retirement – and you will exactly what are a number of the pros and cons each and every option? Some tips about what to understand.

An educated strategies for domestic guarantee to fund old age

Below are a few of the greatest possibilities you’ve got for many who want to make use of your residence guarantee to pay for old-age.

Decide for a house equity loan otherwise HELOC

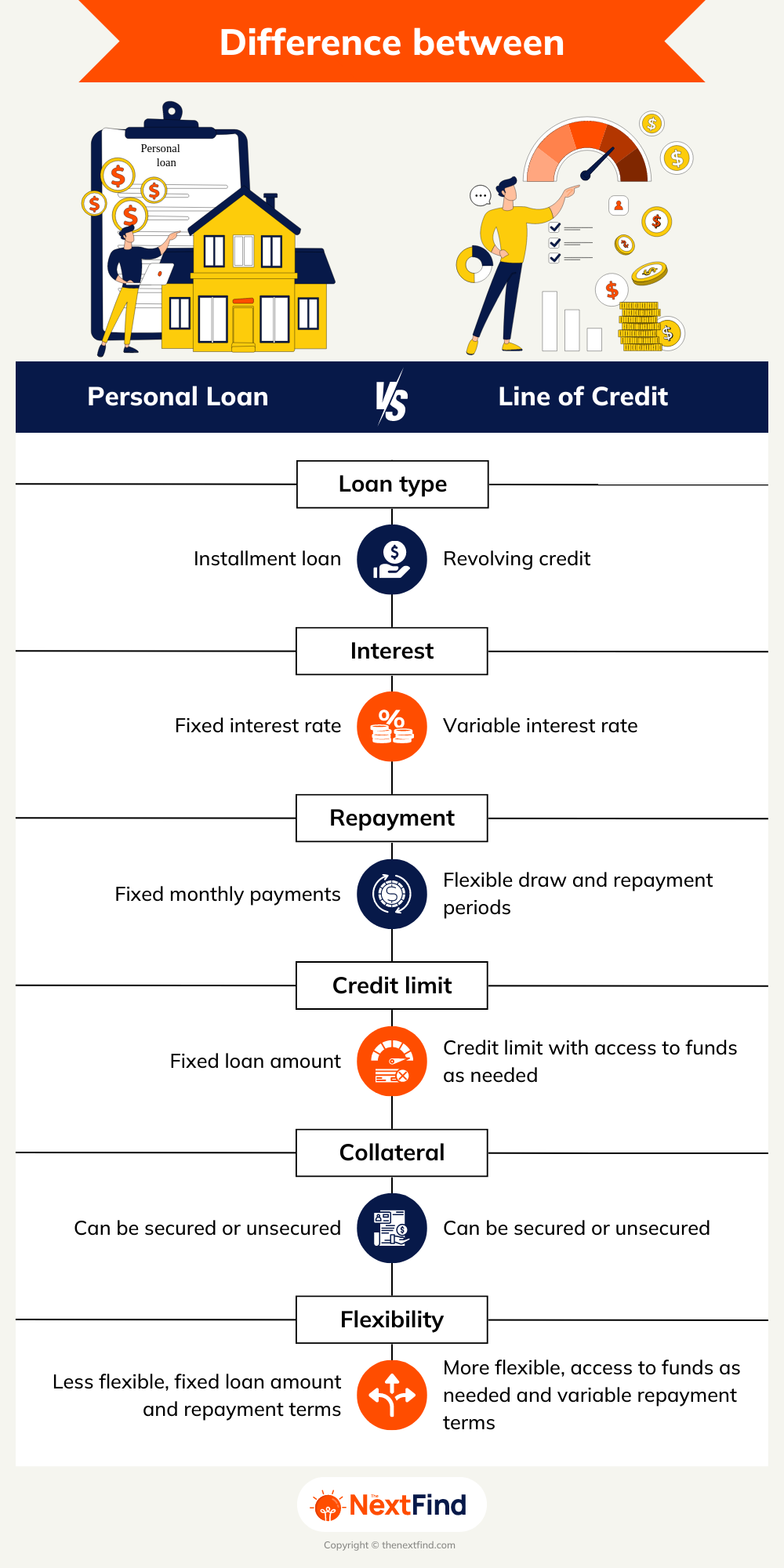

A property collateral mortgage you can expect to bring a lump sum payment of money which you can use to pay for old-age costs. Otherwise, you might tap the residence’s guarantee via an excellent HELOC , which performs just like the a personal line of credit that you can obtain out of given that expected in the draw several months .

Although not, it is very important take into account the potential downsides of any option. For example, even if house collateral fund and you will HELOCs will often have down rates than many other facts, such as for example playing cards and personal financing, it will be tough to repay the loan, along with attract, particularly if you are on a predetermined income.

« Playing with a house guarantee mortgage or personal line of credit to pay for pension is not sustainable more than a long period, » claims Stephen Kates, CFP and you may dominating economic specialist at the .

Kates says that while it is prominent to use this type of borrowing from the bank choice to possess family home improvements and you will repairs otherwise unexpected costs, brand new downside is they dont write a continuing and you will alternative income source like other domestic security activities.

Thought an opposing financial to improve money

An other mortgage may be the best bet in case the goal is always to enhance your earnings. As opposed to a house security mortgage or HELOC, an opposing financial has no need for you to definitely pay the loan with monthly premiums. Rather, you repay the mortgage having focus when you promote your house or die.

Therefore, this 1 is sometimes perfect for individuals who do not have youngsters or heirs they want to log off their house so you can, says Gloria Cisneros, a certified economic planner in the riches management organization LourdMurray. Or, it may sound right to make use of an opposite home loan for folks who keeps almost every other possessions arranged for the heirs, predicated on Cisneros.

Although not, in the event your dependence on financing is actually brief and you expect even more dollars ahead within the in the near future, taking out fully an other home loan to pay for senior years might not build sense, Cisneros claims. Inside situation, taking out an excellent HELOC or family collateral mortgage will be a great most useful services.

Your residence should also be distributed out-of otherwise have a lower equilibrium so you’re able to be eligible for a reverse financial , Cisneros contributes. Additionally, you usually have to be at the very least 62 years of age, though some lenders enjoys all the way down minimal many years conditions to own low-government-insured opposite mortgages.

Select whether you can afford brand new maintenance off your family while attending fool around with an other financial loan. Anyway, one of many standards of a face-to-face mortgage is the fact that property owners continue to pay assets taxes and you will insurance policies and continue maintaining brand new possessions when you look at the good shape.

Downsize to show your collateral toward cash versus borrowing from the bank

Because of the risks of taking out fully financing to cover retirement , Michael Collins, CFA and you can creator of riches administration business WinCap Monetary, recommends downsizing as an alternative solution.

« In case your current house is bigger than you want into the senior years, offering they and you may downsizing could offer you more money in order to funds advancing years costs without taking out fully that loan, » claims Collins.

This is often your best option to fund senior years, advantages say, particularly if you can find an inferior household inside the cash.

Whatsoever, inside circumstance, you could prevent paying rates of interest during the the present high pricing, claims Donald LaGrange, CFP and you will wide range coach within Murphy & Sylvest Money Administration.

Another option getting downsizing is actually attempting to sell your residence and you may moving to a retirement neighborhood. LaGrange claims these types of teams are all the-inclusive, therefore it is you’ll be able to in many cases to save cash by firmly taking benefit of all the facilities offeredmon amenities is activities, cleaning and private dinner and you will laundry services.

Almost every other choices for financing senior years

Prior to taking aside a loan to pay for advancing years, make sure to think all your choice – plus the individuals away from credit from your own home. Particularly, you can envision back once again to area- or complete-date work, says Kates. Providing work is enhance online payday loans Hawleyville Connecticut your income and relieve the will to have funds or distributions from the offers, Collins claims.

Simultaneously, you s such as for example Personal Safety and Medicare, Collins says, because they can render certain kinds of capital during the retirement.

The bottom line

Taking out fully property collateral financing or HELOC to fund old age might possibly be helpful given that a short-term solution. However, pros warn it just is practical whenever you easily manage to pay back the loan, since defaulting have bad consequences for example a loan provider foreclosing on your own family. Fundamentally, even in the event, the way to use household guarantee to fund retirement is based on the financial predicament and you can requirements. Benefits say providing certain advice might be difficult since the per problem may be some other. Thus, it is generally far better get in touch with a financial advisor so they can opinion your whole financial image before making a recommendation.

Laisser un commentaire