Second, all of the prices connect with borrowers bringing finance nearby the conforming financing maximum

And even though the try age 2003-2007 watched an unmatched expansion of highest mortgages in order to poorer individuals, it’s still your situation that every borrowers delivering money close towards the compliant limitation was seemingly wealthy

Ergo that it estimate method is unable to target the question off exactly what impact GSE treatments could have had toward mortgage terms of less rich borrowers.

Third, this tactic are unwell-ideal for estimating this new GSEs’ impact on use of financial borrowing from the bank. The fresh continuity that individuals find in the borrowed funds thickness form round the the fresh assessment restrict signifies that there is absolutely nothing GSE affect borrowing availableness, at the least for lots more rich consumers from the non-drama 2003-2007 several months. not, development a formal decide to try for the proposition carry out demand adjusting a beneficial thickness discontinuity estimate method such as for instance McCrary (2008) for use when you look at the an important variables structure. Such as for instance an exercise might possibly be from little include in one knowledge, while the GSE credit accessibility effects would be requested extremely firmly to possess reduced rich borrowers or throughout crises.

Finally, these rates can not be translated as more standard rates of outcomes of financing securitization. Though the ratio off conforming loans screens a discontinuity within the appraisal restrict, the fresh new securitization rates alone doesn’t display a beneficial discontinuity (though it do alter hill). The results should as an alternative be interpreted as effects to your speed, price design, and you will standard to be from inside the a segment of markets eligible for purchase because of the GSEs.

cuatro . step one Study

The info used in that it paper are from Lender Running Properties Applied Analytics, Inc. (LPS). fourteen Talking about mortgage-peak analysis gathered from collaboration from mortgage servicers, for instance the ten biggest servicers in the us. fifteen The knowledge cover over half a fantastic mortgage loans on the United states and you may contain sigbificantly more than just 32 billion effective financing. Secret details include origination matter, domestic appraisal matter, mortgage conditions, securitization status, and you can monthly payment performance.

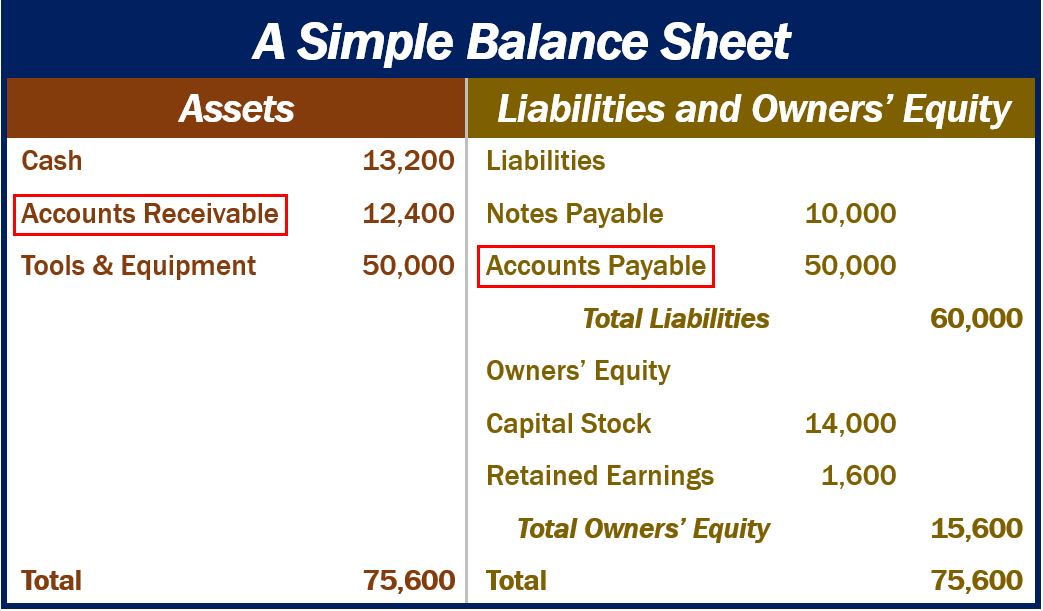

The study sample includes earliest-lien, non-FHA non-Va covered mortgages backed by holder-occupied, single-loved ones homes and you can got its start involving the decades 2003 https://clickcashadvance.com/payday-loans-ri/ in order to 2007. Become as part of the take to, the origination count and also the assessment worthy of need to be $1,000,000 or faster. Table step 1 provides sumple of around 14.9 mil mortgages. The latest amounts to the complete test is generally in line with analytics used in degree using almost every other study supplies. sixteen The brand new rightmost columns provide averages to have loans you to slip in this a beneficial $5000 ring towards both sides of their assessment maximum. This provides a base rate up against that your size of the new regression estimates would be judged. 17

Profile step one gift suggestions a good histogram off financing volume from the origination amount on continental You.S. regarding ages 2006 and you will 2007. 18 Visual review confirms that there surely is a keen atom regarding borrowers positioned following next the fresh conforming size restriction from $417,000. Brand new figure and displays evidence of rounding. Dollars amounts stop for the even $5,000, $ten,000, and you will $50,000 increments are more well-known than many other number. The existence of rounding can make certified studies of the discontinuity (as with McCrary (2008)) unsound. Yet not, because the $417,000 drops anywhere between tick marks (in which we might expect you’ll discover a softer thickness despite rounding), and because the new occurrence there was bigger than in any almost every other container, the fresh new atom is quite more than likely maybe not an enthusiastic artifact out of rounding. It seems that particular individuals was bunching just below the latest limitation to avoid jumbo financing.

Bunching beneath the restriction is only able to carry out bias if individuals lower than the newest maximum are different out of individuals over the restrict. LPS research include minimal information regarding debtor qualities, but they create consist of one crucial level: borrowing from the bank (FICO) score. Providing our very own 2006-2007 continental U.S. decide to try, the common FICO score from borrowers from the $5000 container below the latest conforming restriction out-of $417,000 is actually 740.9, because average FICO from individuals throughout the $5000 container only over is 696.5. It swing of almost 45 FICO circumstances stands for an incredibly substantial drop-out-of in the borrowing quality. Though it is possible so you’re able to explicitly handle for observables such as FICO score, so it sorting towards observables implies there is sorting on unobservables too. So it promotes using an instrumental parameters specs based on assessment worthy of.

Laisser un commentaire