Just to decorate a better photo, banking companies find 3-5% of one’s credit limit as a month-to-month expenses

Around speaking, the minimum repayments monthly with the a good $10,000 credit card restrict is around $300 of cash. $ of money 30 days you’ll security to $45,000 out-of financial. Regarding bank’s sight, thus, a charge card limit comes to an end you from borrowing and you can effortlessly upkeep one to sum of money. Thus, if you have a great $20,000 charge card restriction, which could lower your credit by simply below $100,000, even although you avoid they.

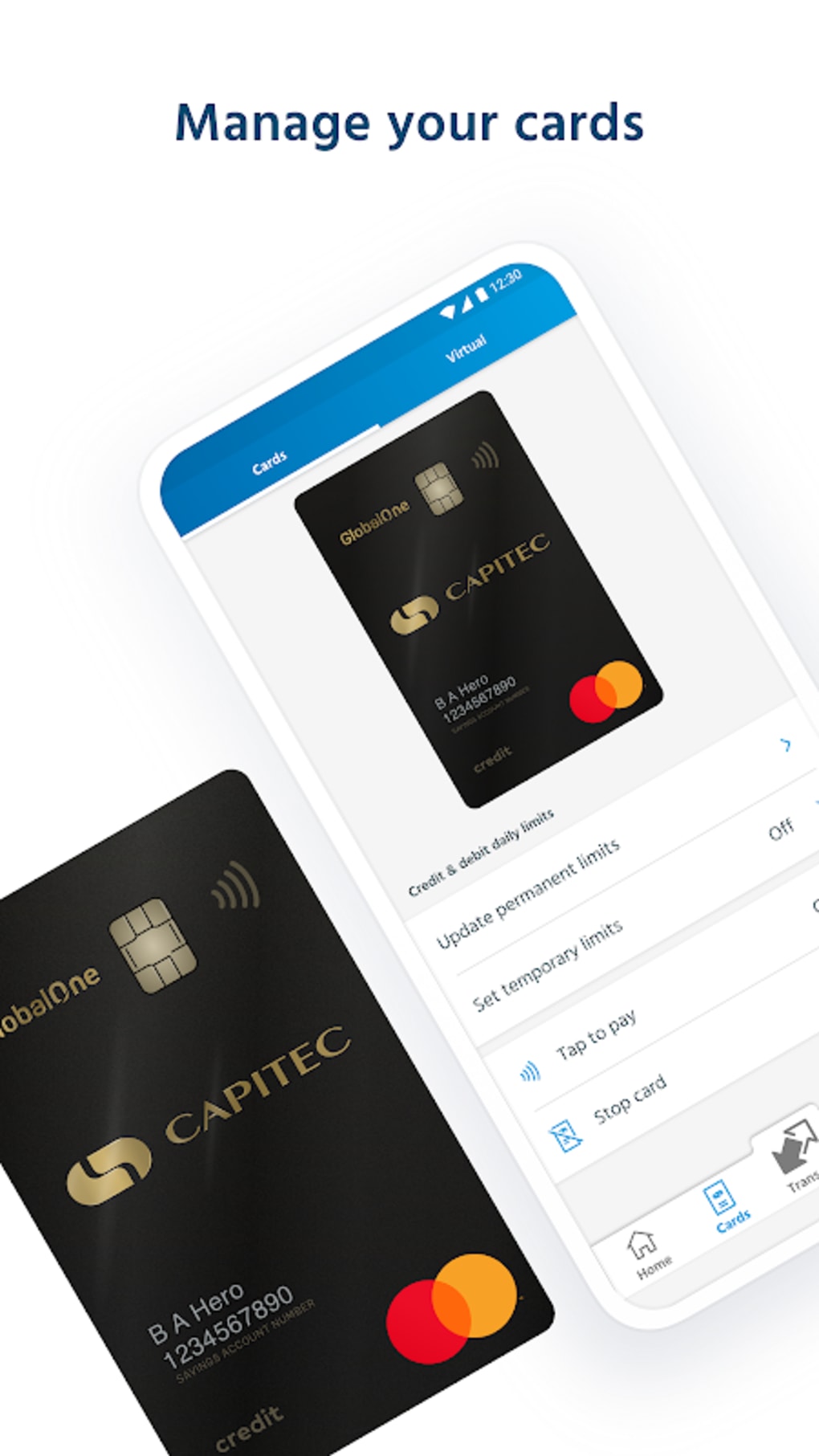

What to do about charge card constraints?

When you’re facing an income difficulty and are also incapable of get the financial you prefer because of your income, next cutting your credit card restriction or cancelling they completely is really help. Just telephone call their credit card provider and get these to lower their credit constraints or personal the fresh new account. You to definitely credit card you can expect to lower your financial borrowing potential enormously.

What to do about credit ratings?

There are many different determinants regarding a credit history, and some provides a healthier determine than others. For every influence on your own rating decrease after a while, and thus financing more excess body fat so you can newer events.

It is vital to take control of your borrowing responsibly and you will shell out your own debts promptly. Late, overlooked or low-repayments, also courtroom fines, enjoys an effective negative perception.

Paying off credit debt immediately will help maintain your credit score who is fit. That choice is to get a debt settlement mortgage which have a diminished interest rate than simply their charge card. You can spend less on notice and possibly pay off the complete obligations faster.

It’s always a good idea to keep an eye on the quantity from credit checks you have over. Checks regarding loan requests otherwise car financial support, such as for example, can adversely effect your credit rating. Yet not, not absolutely all credit monitors are identical. The brand new Zealand provides two types of borrowing checks: hard and you can delicate. Difficult borrowing from the bank inspections be a little more total consequently they are generally performed when you sign up for credit. Delicate borrowing monitors, while doing so, try shorter complete and are generally for things like charge card offers otherwise done-by landlords and you can assets administration people as part of this new occupant examination processes. Despite the fact that do not have as much of an impact on your credit rating, he or she is nonetheless submitted in your credit file. When you have loads of smooth borrowing from the bank monitors when you look at the a great little while, this may nevertheless be considered a red flag to a few lenders.

Any defaults full of an organization on your credit check can also be be the determining basis towards the banks to help you so zero to help you the fresh lending you look for when you are properly instant same day payday loans online Utah conference all the the other financing criteria’s.

Trying to get a mortgage

For those who have a dismal credit score, you may need to work on improving it before you often effectively score a home loan of a main-stream lender. Once the licensed economic advisers, all of us during the Global Money is guide you to increase your chances of a be mortgage and we can be introduce and dispute their situation for you. Talk to you and you will know what to do and just what are working to your advantage.

What and you will content composed on this website is actually real and you may direct towards good the global Loans Characteristics Ltd studies. All the information given in the blogs on this site really should not be substituted for economic guidance. Financial advice needs to be wanted. No one or people just who rely really otherwise indirectly through to recommendations within post get keep In the world Economic Qualities Ltd otherwise their employees responsible.

A survey of numerous finance companies of the mortgage brokers and reported from inside the the Zealand Herald discovered that two generating $130,000 a year and with an excellent $100,000 deposit can find the quantity they may borrow quicker by $47,000 simply because they had a $10,000 credit limit to their playing cards. A beneficial $15,000 limitation you can expect to lose how much cash they can borrow by $80,000 while a good $20,000 restriction you will suggest $100,000 reduced.

Laisser un commentaire