Are you ready to help you crisis certain amounts?

- Get in touch with financing Administrator

- The Procedure

- 100 % free Financial Calculator

- Funding Conditions

Bringing home financing can seem daunting regarding the outside lookin in the. That’s why Payment House Lending aims to go apart from making your own financial processes easy, smooth, and you can stress-free.

That have action-by-action recommendations off Settlement’s educated mortgage advisors, you are able to always know what’s going on together with your financing. Also, you could nearly initiate and you will song your own purchase for the our free LoanFly app. Out-of uploading records and you can seeing next methods so you can checking the borrowing from the bank get and you will keeping track of your loan standing, you should have an entirely transparent look at their home loan processes on people internet sites-connected tool.

Get in touch with a mortgage officers right now to start. You might be along with welcome to lookup Settlement’s Faq’s web page to locate answers so you’re able to common a mortgage concerns. The audience is right here to make the loan processes an amazing you to also to make sure that your mortgage shuts timely.

- Contact that loan Administrator

- The Procedure

- Totally free Mortgage Calculator

- Money Words

Prequalify

Basic, complete their prequalification setting with Payment House Financing. This is the way we start new verification processes and ask for extra factors to undertake your residence loan acceptance.

Get your Documentation In a position

Your loan officer have a tendency to email address your a listing of factors needed to suit your software, which you yourself can send via safe e-facsimile or publish so you’re able to LoanFly Debtor Portal from the pc or favorite unit.

Complete The Official App

Work at the loan manager doing the called for records. To help you rates anything up, you can agree to signal and discovered documents digitally. You can agenda a consultation with us to go more any questions in order to comment and you will sign data individually.

Handling

The processor instructions the new assessment, term union, or any other verifications. You’re asked to transmit more details centered on just what the newest processor knows are required for your certain financing program to help keep the process on course.

Underwriting and you will Cleaning Standards

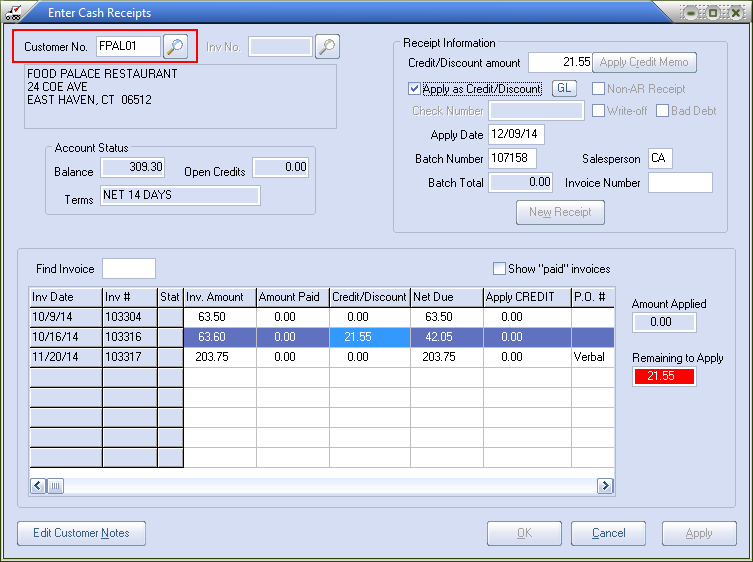

All of our underwriter studies your paperwork to decide when the all the mortgage program recommendations was in fact met. Either, a loan is Acknowledged with Conditions, which means that your underwriter may need much more information ahead of it technically approve the loan. This can include your explaining a jobs pit or taking evidence that earnest money fee has cleared.

Ready yourself to close off

This will be fun your loan is just a few methods regarding closing! The better provides the closure figures toward title company’s better, which up coming adds men and women numbers on the label charge as well as the ones within the a home price.

Last Numbers

The loan officer covers latest number to you in advance of their closing conference. While you are required to give one loans to help you closing, make them in the way of good cashier’s take a look at made off to brand new title team. You may want to prefer to cord money for the name company.

The top Day!

Take a last walking-due to of gorgeous custom-generated house! Afterwards, you are able to sit in new closure meeting so you can sign documents. Then, tap oneself on the rear and you may commemorate you might be a homeowner!

From the decorating people and you can/or all the papers, an applicant is actually no chance obligated to take on the fresh new terms and conditions and you may requirements of your financial offered, nor does the brand new debtor must promote these types of data files for financing Guess.

Check out a extremely-put mortgage calculators, our very loans Lyons own Percentage Calculator, evaluate additional price circumstances and determine and therefore fee option matches your money.

Such calculators are perfect creating things to guess their homebuying can cost you. For much more specific number centered on your individual need, render Payment Household Lending a trip. Our company is happy to create a home loan bundle to help you reach your quick-term desires and you will much time-title goals!

Financing Conditions

The total annual price of a home loan conveyed as the a share. It provides focus or any other loans charge instance situations, origination charge and you may home loan insurance policies.

The fresh new proportion in order to meet the requirements you to own a mortgagepares your own full month-to-month homes expenses or other personal debt (the amount you have to pay aside) together with your full month-to-month revenues (the total amount you get).

The difference between the sales cost of the home additionally the mortgage matter. Buyer will pay having bucks and will not financing having home financing. Serious Currency: a deposit given to the seller to demonstrate that a potential customer are intent on purchasing the domestic.

The entire process of pre-deciding what kind of cash a prospective visitors might be entitled to use. Prequalifying for a loan does not guarantee acceptance.

Your loan count, excluding desire; the amount borrowed otherwise remaining outstanding. And additionally, the fresh new area of the payment you to definitely reduces the an excellent balance out of a home loan.

Written research one proves you’re owner of your home. Underwriting: the study of your own overall credit and you may property value as well as the dedication away from home financing rates and title.

The total yearly price of a mortgage conveyed due to the fact a percentage. It provides appeal and other fund charges such facts, origination charges and you will home loan insurance rates.

Brand new ratio so you’re able to be considered you to have a great mortgagepares your own full monthly homes expense or other obligations (extent you pay away) with your total monthly revenues (the amount you get).

The essential difference between product sales price of the house in addition to mortgage number. Consumer will pay having cash and will not financing that have a home loan. Serious Money: a deposit provided to the vendor to show that a prospective consumer try intent on purchasing the family.

The entire process of pre-deciding how much money a potential visitors could well be eligible to use. Prequalifying for a loan does not be sure recognition.

Your loan matter, excluding notice; the quantity lent otherwise left delinquent. Plus, this new the main payment you to decreases the outstanding balance from a home loan.

Written evidence that proves you’re manager in your home. Underwriting: the research of your own complete credit and you will worth of therefore the commitment regarding a home loan rate and term.

Laisser un commentaire