Which are the qualification standards on the program?

Action 5: Range of Work

A rehab advisor is actually assigned and you may schedules the initial examination. Brand new rehabilitation advisor ratings head risk assessments and construct range of work with citizen.

Faq’s

Applicants need certainly to manager take the home, homestead because the prominent quarters in the financing name, and you may earn in the or below 80% City Average Earnings (AMI) that have a secured item limit of $twenty five,000. Assets should be five (4) equipment otherwise reduced.

How do brand new Heredity Finance layers benefit the application form?

Into the Heredity Money, you will find good Rondo Descendancy Confirmation application which can you desire becoming complete. Having people one to be considered of all the system layers (Normal and you will Genetics Financing), around $80,000 in help is available.

Exactly what are the necessary files add to your software?

The applying needs three (3) months out-of paystubs and you will bank/investment makes up the friends, along with the newest one or two (2) years of government taxation statements/W2/1099s. Other stuff are requested inside the underwriting techniques.

What is the rehabilitation advisor’s part throughout the program?

The latest treatment coach is the individual that advocates towards the homeowner’s account to make sure most of the work is done predicated on agency off homes and also the passage through of most of the codes and you may monitors of the City of Saint Paul.

What kind of treatment efforts are protected by the program?

The applying focuses primarily on https://www.paydayloancolorado.net/frisco/ certain protection/habitability products which should be accomplished basic. Only particular repairs are permitted for every the application guidance. We are not capable promote deluxe reputation/home improvements past builder basic important options. The application form can not protection any appliances. The fresh Rehabilitation Advisor work with you to construct the new scope away from work to getting completed. Builders should provide a few (2) many years of visibility on every functions finished.

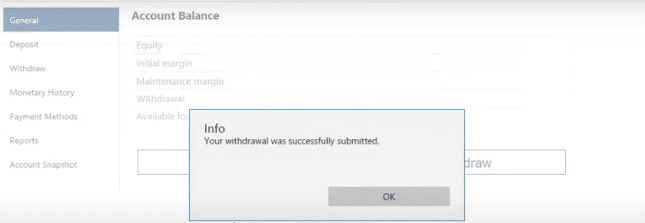

When i am preapproved into rehab program, how does the fresh disbursement of your own finance performs?

The metropolis often disburse the cash on the builder on the newest completion of your own treatment opportunity and also the passing of the inspections. Really works will most likely not initiate up until the financing closes and the notice to the office acquisition is issued because of the rehab mentor.

How does the latest bidding techniques really works?

The city out of Saint Paul has actually a list of designers just who are registered typically contracting really works that can be agreed to residents, otherwise homeowners is also look for their contractors additionally the Town will feedback their permits and other back ground, such minimum insurance coverage and degree during the head safer contracting techniques.The brand new rehab coach will be sending the fresh range away from work to new contractors chose by homeowner, additionally the low in control bid is typically picked.

Whether your estimates is more than what you’re preapproved to have, this new treatment advisor tend to beat functions that is not a protective/habitability requisite, and/or homeowner will get spend the money for huge difference to keep they. Homeowners may pay the variation to work alongside a builder who’s got increased quote, in case your reduced quote is not preferred. The city cannot highly recommend certain designers consequently they are perhaps not in control on show out of contractors.

What’s the lead-paint exposure assessment of course could it possibly be expected?

When your family was depending just before 1978, the home have to go through a lead chance investigations once you are preapproved to your system. Or no dangers are found, money might also want to be employed to mitigate them basic and the others will go towards other advancements, fitness, and cover need. Head remediation performs should be accomplished in a single (1) 12 months by a lead-certified contractor in the Minnesota Agencies from Fitness. This is simply not needed if you find yourself obtaining an urgent situation rehabilitation loan.

Other Home improvement Apps

From inside the pause of Town of Saint Paul’s Citizen Rehab program, excite read the pursuing the lover communities that also provide home update software:

Laisser un commentaire