The latest ‘terrifying’ trade-offs an incredible number of Americans face once the student loan costs restart

Tens of many People in the us which have government student loan obligations features got a financial reprieve for over 36 months as a pandemic-day and age payment pause try expanded multiple times since the .

Today many face a special reality into the Week-end, Oct. step 1, when they’re because of restart and make costs, all of the if you find yourself enduring irritating rising cost of living and rising rates.

Over 45 billion individuals to each other owe as much as $step one.six trillion, considering President Joe Biden’s government, hence made an effort to cancel to $20,000 in the college student obligations to own 10s out-of an incredible number of qualified consumers, in order to have the Best Courtroom kill the program inside June.

Supporters have traditionally believed student loans a monetary albatross weigh down the middle classification, preventing upward mobility and you can exacerbating racial disparities, especially for Black consumers.

To locate a far greater comprehension of how borrowers is get yourself ready for the newest resumption out-of payments, NBC Reports asked some one nationwide what sort of trade-offs they have to make and make finishes fulfill. Six anyone common intentions to get-off the position they visited school to possess, undertake a lot more loans, invest down coupons or cut back on recreational items, certainly one of most other sacrifices.

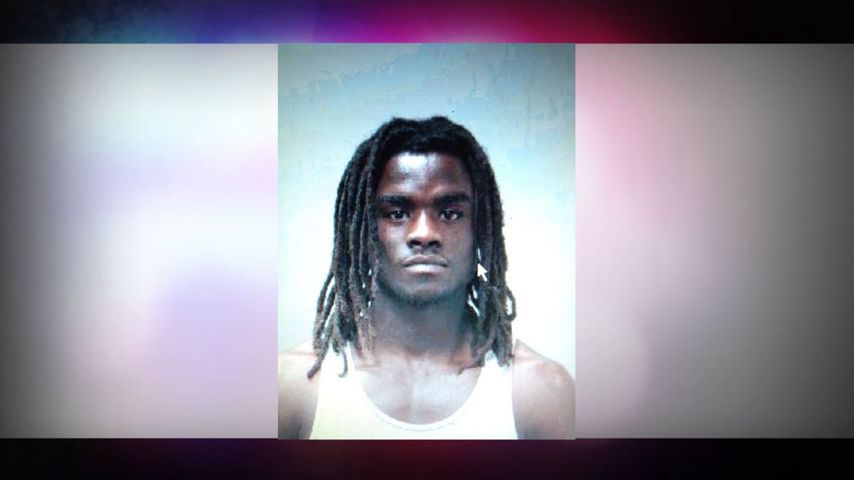

Domonique Byers, 29, Charlotte, Letter.C.

Domonique Byers said the guy owes as much as $sixty,000 in student loan obligations which is anticipated to shell out $800 thirty day period, a cost one to « nearly doesn’t loans Boulder CO appear genuine. »

“Everything day-to-big date seems to currently be daunting. We now have set additional bills towards playing cards and thus my personal borrowing from the bank credit money has ballooned,” said Byers, a human resources consultant which have an excellent bachelor’s knowledge and an enthusiastic MBA. “Using this student loan fee resuming, it appears suffocating.”

Since Byers with his wife prepare to help you anticipate the first youngster in a number of weeks, the guy said he’s going to you will need to get rid of his payment per month compliment of the fresh Biden administration’s Preserving into a valuable Studies (SAVE) bundle, that White Family states you certainly will lower monthly installments for certain 20 mil consumers.

Parvanae Abdi, 34, Ridgecrest, Calif.

Parvanae Abdi claims their $60,000 student loan debt try “an affect that pursue your doing, it affects that which you. » Complete with her industry since an instructor, hence she chose to call it quits in search of work one allows their particular to expend lease, bills and you may student loan payments.

“There are a lot of us, many people whom took away loans was teachers,” said Abdi, which earned a bachelor’s education for the mindset and an excellent master’s into the training within College out-of Southern area Ca. “This is why specific instructors is making. As they can’t afford their figuratively speaking on their professor occupations.”

Abdi is actually living with loved ones and has started part-time and freelance composing operate while looking for complete-date a career that would safeguards all of their particular expense. In the event the she failed to stick with friends, she said « I might more likely houseless. »

« To be real, my monthly income immediately might be $200,” and far of it has to wade their mobile since it is very important getting work, Abdi said.

“I think that’s the terrifying facts of experiencing attended university and achieving sought a diploma during the a lifetime career in which though you reside income-to-income, do you really believe it is steady,” she said.

“The majority of us whom went along to graduate university, i made it happen while the i thought that manage put us for the better status with a position, i envision it would provide us with ideal footing,” she said.

Keith Kruchten, 40, Rockford, Unwell.

Keith Kruchten was actually “incredibly optimistic” one Biden’s forgiveness plan create lightens him from $20,000 away from obligations, making him in just from the $six,500 kept to pay.

Laisser un commentaire