Explore a housing Loan to construct Your ideal Home

So how perform I start? you may well ask. Building a bespoke home can be quite complicated and you can expensive. For this reason it’s also possible to explore a houses mortgage (a legitimate monetary unit) to turn your ideal into the truth.

Construction financing are utilized for various intentions: first homes or trips land. They’re able to also be employed to have local split-down/rebuild systems that will be common these days also. Most of us have viewed larger property otherwise houses with an increase of amenities oriented to restore more mature formations inside the highly desired-once metropolises and you may superior areas.

How will you rating a property mortgage? To locate a houses mortgage, an ambitious home builder always starts off having architectural preparations since the the basis for estimating brand new projected value of the brand new complete dream household. As soon as your agreements are approved and accepted of the most of the curious people, build financial institutions essentially present that loan centered on good percentage of the fresh new accomplished, estimated property value our home. Generally away from flash, the construction financial institutions requires your (the fresh borrower) and work out a great 20% down-payment, making a left financing value of as much as 80% of the estimated worth to own financing had a need to make the new family.

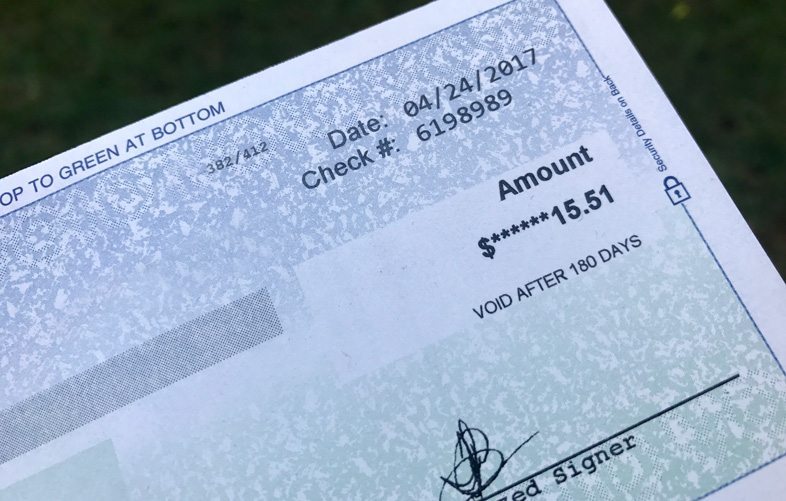

What’s the second step? This is actually the part where the homestead trip could possibly get an effective bit tricky. Structure loan providers do not just give a lump sum payment in order to your. Rather, it circulate the borrowed funds funds during the installments (named draws) as needed while in the some stages of the construction endeavor.

Actually, a property mortgage could be the simply mortgage you’ll previously apply to possess into the an asset that does not can be found – not even anyhow!

As an example, a real contractor will most likely demand commission immediately following fundamentals was poured and put. Just like the framework moves on, other strengthening trading designers – such as for example stone layers, carpenters, roofers, plumbing technicians, electricians and musicians – will require fee towards the features it provided. Probably you’ll find even more prices for other items instance property titling, checks, appraisals, land and you will indoor doing millwork.

A routine customized-founded house can Louisiane personal loans take six-18 months to construct – maybe lengthened during the a savings littered with likewise have affairs and you may labor shortages. You will see of many evaluate items to browse payment dispersals, as they are specifically designed to make sure zero stand otherwise delays exists in improvements of one’s residence’s framework.

What goes on if the structure is gone? If the strengthening stage is accomplished, the construction mortgage is paid off quickly whenever a more traditional long-name home loan is positioned in place. Offered you had free of charge overruns and your household appraises from the the first estimated really worth, acquiring the mortgage financial support is not nearly since rigorous a good process.

Specific financial institutions bring a loans bundle that includes both the design and mortgage loan. Particular lenders may offer to protect the interest rate having the enough time-name financial resource in advance while the house is becoming founded. With this function, when the interest rates go up via your structure stage, you’ll know already that your particular mortgage financial support remains secure.

The design lender will be your own ally in the basic strengthening plans with the finally walk-by way of of one’s accomplished home

We could assist. Strengthening a custom home pertains to of numerous members to guide you with each other just how – especially if you have to take aside a primary-name mortgage for construction another, longer-label mortgage so you’re able to forever money your new home because enterprise is complete. It’s advisable that you has actually a skilled coach assist navigate the newest economic crossroads on the road to and also make your dream household a real possibility. For those seeking discussing a construction loan given that a choice, get in touch with Commerce Faith today .

Earlier in the day overall performance is not any make certain from future show. The fresh views and other information from the opinions are given as the out of . It summation is intended to give general advice simply, that will be useful with the reader and listeners. This point isnt an advice of any brand of financing otherwise insurance method, is not predicated on people style of financial situation or you desire, that is not designed to alter the recommendations off a professional taxation advisor otherwise capital elite group. While Trade may provide information otherwise share viewpoints regarding time and energy to go out, such as pointers or viewpoints was subject to transform, aren’t considering because the professional tax, insurance coverage or legal advice, and may not be relied on as the suchmerce will not render tax information or legal services in order to consumers. Request an income tax expert of taxation implications linked to one product and specific financial predicament.Investigation consisted of here out-of third-party business is actually obtained from exactly what are noticed reliable present. However, the precision, completeness or accuracy can’t be protected.

Laisser un commentaire