Obama Tries to go out of Trailing Good Affordable Homes Programs

Share:

President Obama was overall his final name with an ambitious FY-2017 finances proposal towards financial approaching year. New finances functions as a statement of administration’s plan and funding priorities. The newest finances solidifies the Administration’s dedication to growing possibilities having private developers to construct property inventory that’s reasonable to prospects and you can family members after all money membership and you may help the quality of present federally-aided housing. They tries to strengthen the low-Earnings Houses Taxation Borrowing from the bank (LIHTC) and you may The newest s. Moreover it proposes higher investment levels for some trick U.S. Department out-of Casing and Metropolitan Creativity (HUD) programs.

Income tax Borrowing Applications

This new Obama Administrations sought for equivalent LIHTC system alterations in the latest FY-2016 advised budget. The fresh budget do expand states’ LIHTC authority by allowing these to move doing 18% of the personal activity bond frequency cover for the nine% LIHTC allocations. The new finances would remove the limit towards the number of qualified census tracts you to definitely HUD is also employ.

Another type of variety of proposed changes carry out apply at states’ Certified Allocation Arrangements. Claims could be needed to tend to be one another affirmatively promoting reasonable casing as a specific allotment taste additionally the maintenance regarding federally-helped affordable construction just like the a selection traditional. Again, the new finances shows using an income-averaging code to decide an effective project’s conformity that have earnings eligibility recommendations to help you encourage earnings-combo for the services.

New proposed FY-2017 funds aims a permanent expansion of your system and you may $5 mil in the allocating authority yearly. It could including ensure it is NMTC to help you offset Alternative Minimum Taxation responsibility. This offer mirrors the only presented about President’s FY-2016 recommended funds.

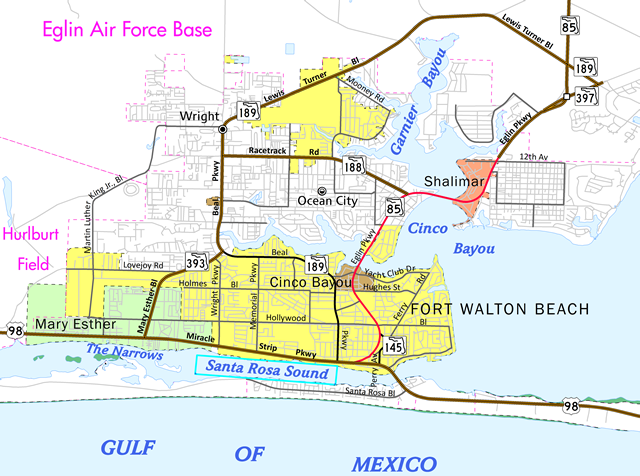

The fresh new finances indicates the fresh income tax credit, that is directed at teams that do not fundamentally qualify since low-income teams, but that have sustained or anticipate to suffer a financial disruption right down to a major employment loss skills, for example an army feet closure otherwise factory closure. New National government and lead it tax borrowing from inside the past year’s recommended funds. Applicants on borrowing is necessary to speak with relevant Condition or regional Financial Creativity Agencies (otherwise similar organizations) in choosing men and women opportunities one to qualify for the credit. The financing would-be organized utilising the process of your own Brand new Areas Tax Borrowing or while the an allocated funding borrowing from the bank exactly like the fresh new income tax credit to possess financial investments from inside the licensed possessions utilized in a good being qualified state-of-the-art times manufacturing project. Brand new proposal would offer on the $dos billion inside credit to have qualified investments accepted in the each of the three age, 2017 because of 2019.

Build The united states Ties try a lower life expectancy-pricing credit product for State and you will regional governing bodies which were enacted included in the Western Recovery and you can Reinvestment Operate out of 2009. The united states Quick Send Bonds create build through to this new effective example of brand new Make The united states Bond program by giving a different sort of bond system with wide uses that may notice the brand new sources of financial support getting system financial support. Including together with resource for area 501(c)(3) nonprofit entities, qualified spends include funding with the form of systems and applications which are financed that have licensed personal interest bonds, at the mercy of the fresh new appropriate County bond frequency caps for the certified private craft bond class. The latest suggestion will be energetic to possess securities given immediately after .

U.S Agencies out-of Property and you will Metropolitan Creativity Software

Predicated on Secretary Castro, the greatest the main HUD funds try seriously interested in supporting the latest household just who already reside in federally-aided casing. Consequently, President’s FY-2017 HUD budget implies enhanced capital for a few trick applications.

The fresh finances shows hefty money contained Ohio personal loans in this program which have a 60% rise in financing profile out of this past year. This most funding carry out assistance implementation has half a dozen the Choices Neighborhoods, and up to 15 this new Hope Communities, and numerous most other considered offers having communities.

Laisser un commentaire