That department of one’s lender first started property foreclosure proceedings when you are a new seemed are negotiating the mortgage modification for the good faith

Brand new administration’s eventual system, HAMP, became out from the banking industry’s popular replacement for cramdown, one where business, in place of bankruptcy judges, would control financing reorganizing. Regrettably, the application form has been an endurance getting bankers and you can weak for the majority of difficult-pushed property owners.

In the 2005, Hurricane Wilma blew on the auto repair center one to James Older with his brother got possessed getting 25 years. He previously only refinanced to the another type of financial for the his family inside Western Palm Coastline, Florida, months earlier, compliment of Federal City Lender.

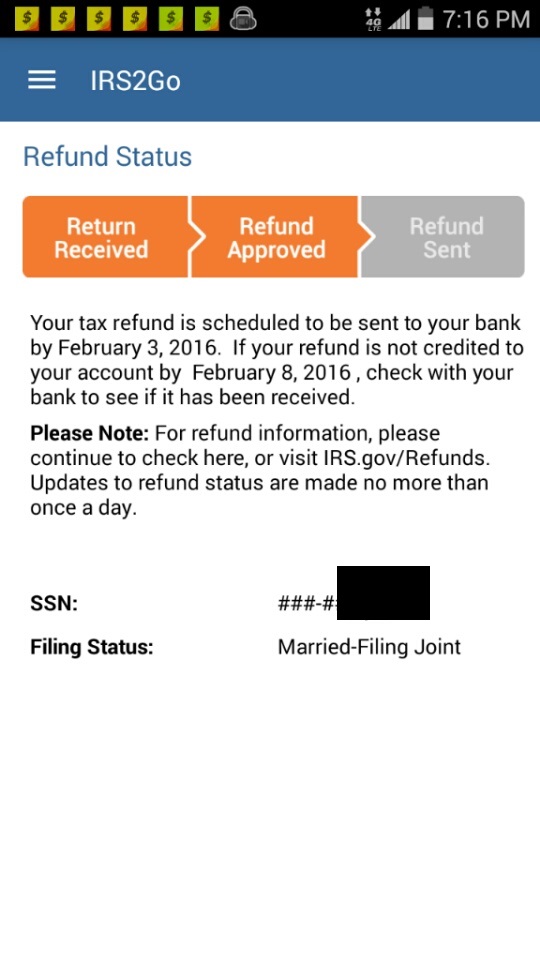

The guy made an effort to get financing modification because of HAMP in the event that program appeared in , however, Federal Area (that would fundamentally be bought by the PNC Lender) dual monitored your. Elder sent in records half a dozen minutes, and on several period had agency plans having an amendment, however, one another arrangements decrease due to. He has almost never spoke so you can an individual being at their home loan servicer in the last 5 years.

Forgiving dominating – more effective types of loan modification – eats into servicer profits, therefore servicers shy out-of principal cures, preferring less efficient interest incisions

PNC willingly withdrew the outcome, after which re-submitted they many years afterwards. A unique hearing is actually pending even as we visited force. I’m not sure what the outcome could well be; the audience is in a position regardless, Senior says. I don’t reject that i owed the cash. All the I wanted are a fair move. Help never emerged towards the home owners.

A following team failed on the aftermath of your Great Credit crunch, and by , Senior was required to standard towards his mortgage loan payments

Servicers, basically glorified accounts-receivable divisions staffed by line-top gurus while making seemingly lowest wages, can also be eke away a return if they will never need to do one customer service. That they had neither the latest possibilities nor the new information to cope with hundreds of thousands out of individual requests, regardless of what far currency the Treasury given them to personalize funds. Discover no way HAMP may have worked tirelessly on the scale which could have had a need to functions, says Max Gardner, a bankruptcy proceeding attorneys and you will a professional toward foreclosures. You happen to be looking to turn servicers toward underwriters. In the very first surf of foreclosure crisis, it actually was obvious that servicers had no power to satisfy it character.

The Treasury Company, and therefore engineered HAMP, compounded the challenge through the program very cutting-edge, tweaking it to your fly which have the fresh regulations and you can recommendations. That it sprung from check the site their sipping dependence on ensuring that just worthy borrowers acquired changes, perhaps spurred into by Rick Santelli’s prototea party rant against undeserving homebuyers. The latest preoccupation having moral possibilities is directed at home owners as opposed to banking companies, carrying out overlapping money and you will investment twice-inspections to help you weed out the latest unworthy and you will position more burdens with the overstretched servicers.

Worse, servicers has actually their particular monetary bonuses that run avoid to your more compact extra repayments into the HAMP. Servicers make currency based on a percentage regarding delinquent dominant equilibrium to the financing. Along with, servicers assemble planned charges – for example later fees – that make it successful to keep a borrower outstanding. Even foreclosures never damage a good servicer, as they build straight back their portion of charge when you look at the a foreclosures sales before investors having which it provider the borrowed funds. The old means of financial credit provided men a share within the keeping property owners within house; today, the fresh incentives all are mismatched.

Safeguarding Loan providers: HUD Secretary Shaun Donovan and Treasury Assistant Tim Geithner, that have dissenter Sheila Bair of one’s FDIC. (AP Photo/Gerald Herbert)

HAMP defenders will cite the huge complexity about construction of mortgage possession because a reason for the program’s incapacity to transmit a lot more rescue so you can homeowners. But bank bailouts was in fact exactly as hard to negotiate, claims Amir Sufi, professor of finance in the University off Chicago’s Booth College or university out-of Providers. The individuals programs got done, Sufi states. Apps to simply help residents never ever did.

Laisser un commentaire