MMMWD was a way for the borrower and you will lender to talk about if or not changing the loan is achievable

You are here

- Submitting Conditions & Variations

- Filing Conditions

The newest Chapter 13 Mortgage Amendment Mediation Program on Western Region (MMMWD) is actually a program in the U.S. Personal bankruptcy Legal with the Western Section out of Wisconsin to aid accredited Part 13 debtors continue their houses. MMMWD is made for Part 13 debtors which are unable to afford their most recent homeloan payment, but i have constant income to blow a customized homeloan payment. MMMWD sets up an informal appointment amongst the debtor in addition to financial used from the a basic mediator just who acts as loan places Cos Cob a dialogue facilitator. The latest intermediary never push a loan provider to modify home financing, but may help the borrower together with financial arrive at an agreement.

MMMWD is actually a volunteer program, and you may MMMWD has the support of the Bankruptcy Courtroom. The new Evaluator encourage accredited Chapter 13 debtors and you will loan providers to try the application form. MMMWD has been designed that have defenses for debtors and you will lenders similar.

To start the procedure, new borrower records a movement to participate MMMWD and you may serves a duplicate on bank. The lending company keeps thirty day period to resolve new Activity. The brand new Actions states certain requirements in order to qualify for MMMWD, including:

- Borrower possess normal earnings that is the proprietor tenant of an excellent homes utilized as the debtor’s number 1 house (funding qualities do not qualify).

- Borrower have a home loan balance regarding below $729,750, plus the homeloan payment is not affordable on account of monetaray hardship.

- Debtor could make month-to-month article-petition home loan repayments from 31% off debtor’s terrible monthly earnings or 75% of your own Debtor’s current mortgage repayment, whatever is quicker, performing the following monthly planned due date (and people elegance period) following Stipulation is submitted.

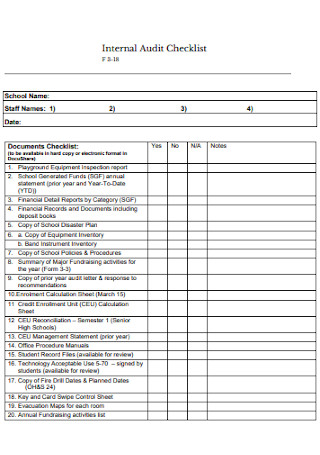

- Debtor need to have submitted done bankruptcy proceeding schedules, and should promote bank having required records and models through the DMM Losses Mitigation Portal, but the lender isn’t needed to use the latest Webpage and can also be request solution document sign. To register on the Site, visit dclmwp.

- Debtor must pay a good mediation percentage out-of $200 into intermediary and you will attend the newest mediation session. Borrower must pay $twenty five to utilize the latest DMM Loss Mitigation Site. These types of costs commonly refundable below one factors. The mediation will be done contained in this 75 days of the conference of intermediary.

- In the event that MMMWD is successful and mortgage try modified, the fresh new debtor agrees not to ever willingly disregard the Section thirteen bankruptcy having nine days, to allow the fresh new borrower to establish a history of using the latest modified mortgage repayments.

- If the MMMWD isnt successful, the fresh borrower believes one to possibly this new automatic remain might be lifted or the debtor will timely recommend an amended Chapter thirteen package to invest the initial mortgage.

Mortgage lenders doing MMMWD might shell out $200 on mediator, and certainly will publish its file requests and you will comment documents and you can variations by using the DMM Losings Mitigation Webpage. Lenders that are happy to participate in the application form, however they are not yet set-up to utilize the brand new Portal will get engage by the special permission of one’s Court. Lenders should use the Portal because it’s the brand new most cost-efficient way into Borrower to offer the necessary data files. Because of the consenting so you can MMMWD, the lender agrees so you’re able to designate a real estate agent having experience with the brand new lender’s loss mitigation apps and you may either settlement expert or access to a keen underwriter which have settlement power. That it associate commonly take part in the brand new mediation courses from the cellphone or video appointment. The financial institution and believes to behave timely and also in good faith to adopt the fresh new Debtor’s mortgage loan for modification. If your MMM is successful, the lending company have a tendency to promptly prepare the required data, and you will, in the event that questioned, brand new Legal tend to approve any modification decideded upon by borrower and you may lender.

By participating in MMM, the lender and you will debtor commit to admission from home financing Modification Mediation Order. The latest advised acquisition pdf document need include the motion to join. Debtors and you can lenders are advised to take a look at the terms of the brand new Motion, Consent and Buy to help you familiarize on their own on the terms of the fresh program.

(A) The fresh new Debtors might be distributing a beneficial Stipulation to sign up the brand new Mortgage Modification Mediation System sanctioned from the You Bankruptcy Legal with the West District away from Wisconsin.

(i) As a result, new Trustee should maybe not pay toward any claims with the Debtors’ home loan personal debt toward homestead a home located at 1234 Fundamental Roadway, Madison, WI

(ii) Abreast of profitable achievement away from home financing amendment, every home loan claims, and additionally one arrearage and/otherwise extra claims, might possibly be managed and paid off beyond your plan.

West Region away from Wisconsin

(iii) Should your mediation try ineffective and there’s no mortgage amendment reached, brand new Debtors often document a viable want to target any and you can most of the home loan arrearage says or throw in the towel the genuine estate in question.

(iv) The timeframe so you can effortlessly complete a mortgage amendment and/or perhaps to document a viable package in case of an enthusiastic ineffective mediation will be subject to the method and you can guidelines off these Financial Modification Mediation System.

Laisser un commentaire