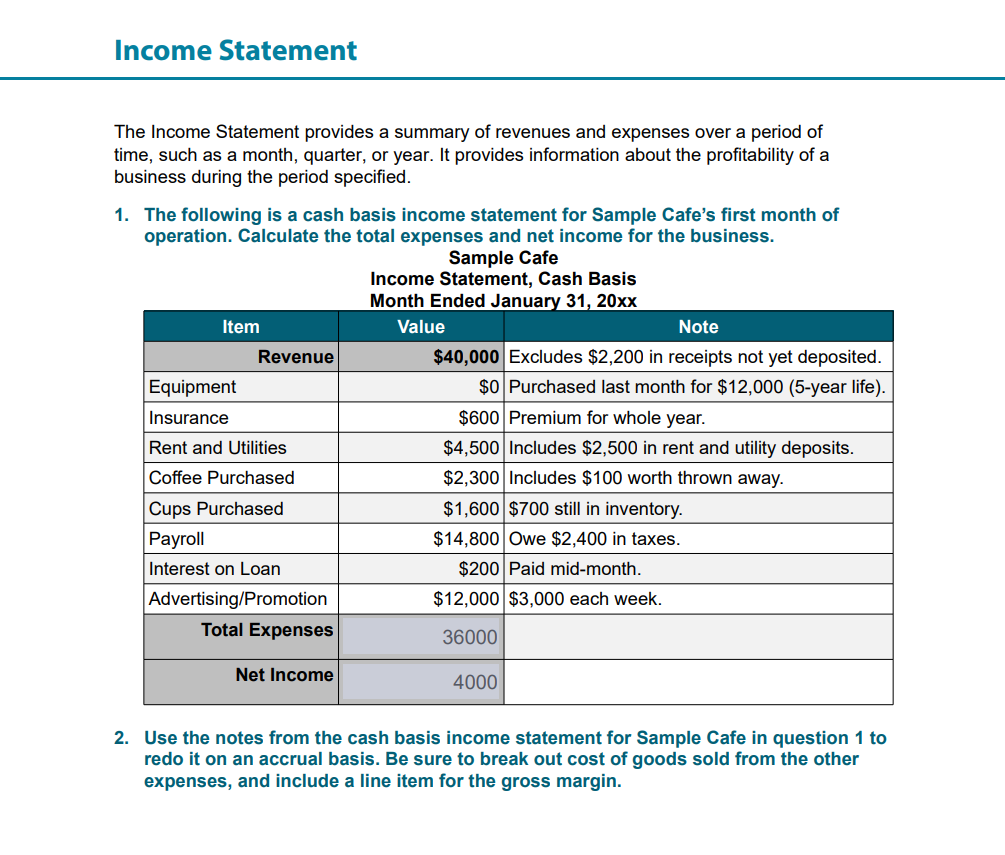

What’s the Difference in Pre-Certified and Pre-Approved Finance?

Highlights:

:max_bytes(150000):strip_icc()/2273200482_39647d9263_h-2404809d75ec4753b4f807a6d114f9e6.jpg)

- One another pre-certified and you may pre-approved indicate that a loan provider keeps reviewed the money you owe and you may figured your satisfy no less than a few of their requirements so you’re able to feel recognized for a financial loan.

- Bringing a beneficial pre-qualification otherwise pre-approval letter is generally perhaps not a make sure might receive financing about financial.

- Are pre-accredited or pre-accepted for a financial loan could help you convince a provider that you are able for resource to suit your get.

Whenever you are looking for a different mortgage or vehicle loan, you have heard of terms pre-qualification and pre-approval using your look. Getting pre-certified or pre-acknowledged will likely be a helpful first step toward protecting the loan.

Are pre-qualifications and pre-approvals the same?

Each other words basically imply that a lender has actually examined debt problem and you can concluded that your meet about a number of the requirements are recognized for a financial loan. The most significant difference between the two is that taking pre-licensed is typically a faster and less in depth processes, if you find yourself pre-approvals be complete or take offered.

Providing a good pre-degree or pre-recognition page are not an ensure that you’ll safe a loan on the lender. But not, it may help your prove to a seller that you’re able to receive financial support for the buy. For both mortgage loans and you will auto loans, delivering pre-qualified helps you determine how much money you could obtain to manage belongings or cars in your funds.

What exactly is good pre-certified provide?

Pre-qualification was an early on step in your house otherwise vehicles to acquire procedure where brand new debtor submits financial study on financial to examine. This might is your income, checking account advice and you can ideal loan and you can fee wide variety, on top of other things.

Your own financial will remark that it submission and you will work with a cards view to choose exactly how probably you are while making your loan money timely. This new pre-qualification credit score assessment is usually what exactly is called an effective mellow inquiry that’ll not harm their credit ratings.

Getting pre-accredited allows you to get an estimate of just how much you is acquire, and also have see the different financial options available. Its generally a fast and simple process that you can certainly do online or higher the telephone along with your financial. Actually, particular banking companies may offer contributes to as little as an hour. Of a lot pre-degree techniques do not require tax returns or other more descriptive financial recommendations you to definitely an effective pre-recognition procedure need.

Although good pre-licensed give is not an ensure that might get the home loan or car finance count you’re seeking to, it could be a great way about how to gauge exactly how much currency debt establishment are willing to give.

What is a beneficial pre-approved provide?

Obtaining a great pre-recognized offer was a lengthier process that need much more comprehensive studies of one’s borrower’s credit history and other monetary pointers. In the example of a home loan, a great pre-approved give can indicate your a great deal more the full time because a homebuyer, that will be such as useful in an aggressive housing marketplace otherwise whenever you are ready to generate a deal toward a house.

Similar to home financing, getting pre-accepted to own a car loan will help you if you find yourself significant throughout the to buy a motor vehicle, because demonstrates you can aquire money and helps you know how much cash you really can afford. Just like pre-qualification, a pre-recognition does not make certain that loan, nonetheless it brings a far more accurate guess out of just how much your standard bank are prepared to give and you may implies that you are more serious on the and also make a buy.

As opposed to pre-certification, pre-approvals generally speaking want a great difficult query, that can briefly reduce your credit scores. The lending company may ask for copies of your pay stubs, W-dos comments and closed taxation statements of earlier age. The procedure takes as much as ten days, but your pre-approval page includes additional information concerning provide, such as a specific amount borrowed in the a specified interest rate.

Create I want to spend the entire pre-recognized matter?

Their pre-approval promote letter generally speaking determine an amount of cash your financial try prepared to mortgage your. You don’t need to to use the full matter from the one form, and it is essentially a good idea to spend less.

After all, this new pre-approval process always doesn’t need most other expenses, such as for example current bills or daily living will set you back, under consideration. Likewise, you might envision planning the near future. For example, when you have an unexpected financial disaster after agreeing towards pre-approval matter, would you be in a position to manage your property or auto? You may review your budget to determine what works best for your financial situation before you decide how much of the mortgage we would like to undertake.

Do not forget to look at your credit file to obtain a notion away from just what lenders and financial institutions can get know about debt habits when you apply for that https://paydayloancolorado.net/vail/ loan. You can discover numerous Equifax credit history which have a totally free myEquifax membership. Sign-up to see Equifax Credit report on the myEquifax dashboard. In addition there are free credit history a-year about three all over the country consumer revealing enterprises-Equifax, TransUnion and you will Experian-in the AnnualCreditReport.

Create a credit overseeing & Id theft safeguards product now!

To have $ a month, you can know where you are having the means to access the step 3-agency credit file. Create Equifax Done TM Largest now!

Laisser un commentaire