#4. Work changes or inconsistent occupations history

When taking away financing, the lender should remember that this will be paid down. So it hinges on you which have a steady stream cash from your work.

If you decide to changes work between your lifetime of pre-approval and duration of buy, your own employment records and income weight dont indicate as much. While switching a position does not usually trigger a problem there are points that can without a doubt cause problems. Changing efforts during the exact same community is ok incase you are a beneficial salaried staff member. Modifying jobs can lead to issues when all following https://paydayloanalabama.com/margaret/ the try involved: fee money, incentive money, offer otherwise short term work, 1099 a job otherwise notice-employment. With all these circumstances, a reputation income is needed to guarantee future money requirement and you will meet with the government’s Capability to Pay advice.

#5. Obligations so you’re able to money ratio is not low enough

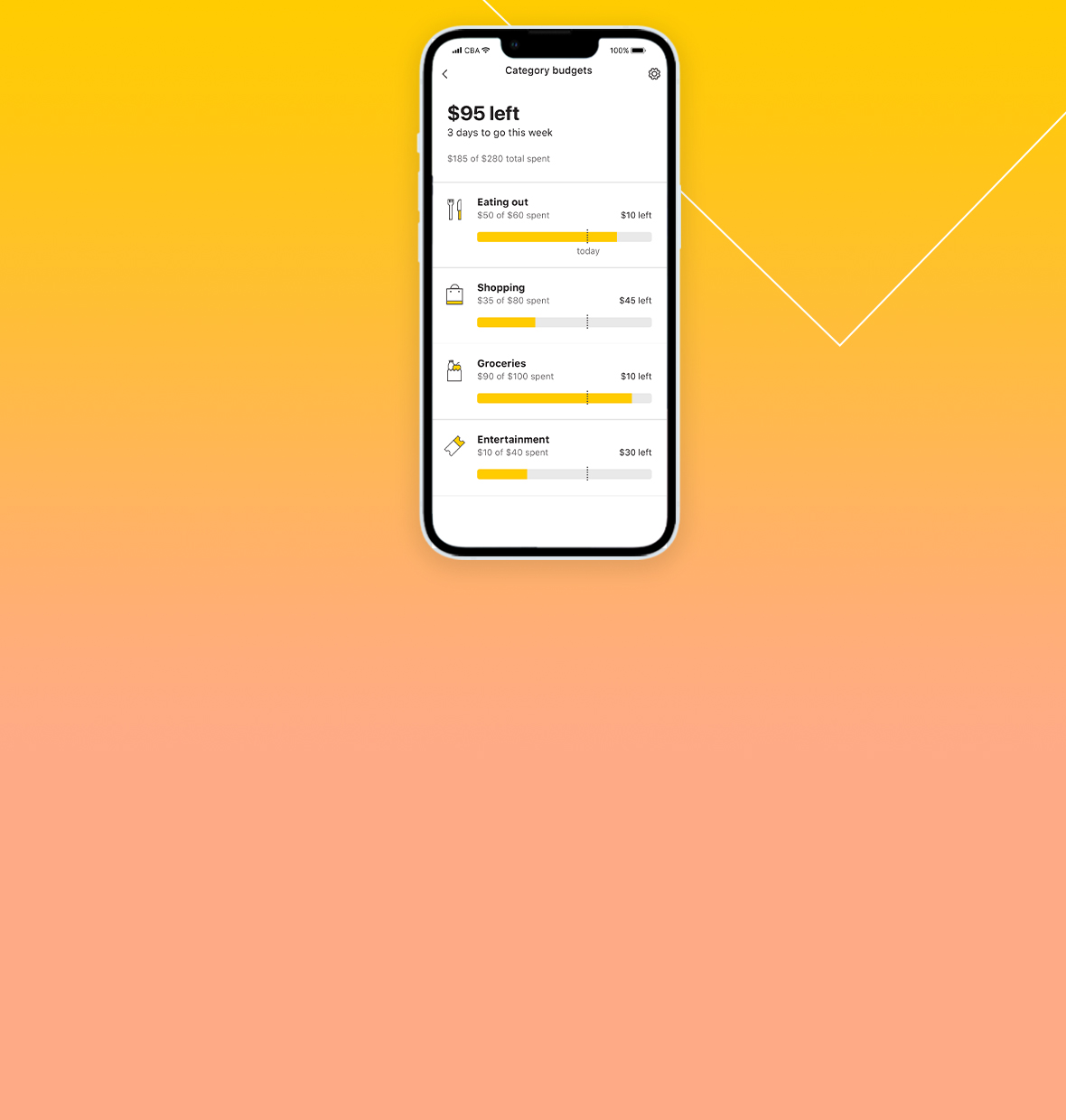

![]()

Together with the matter you really have secured to have a down payment, financing processors may also go through the amount of loans you possess as compared to your income inside the Washington county. This really is entitled the debt in order to money ratio (DTI). Already into conventional, FHA and you may Va mortgage programs, you could tend to get approved that have rates all the way to fifty% that have compensating situations; yet not, with the jumbo and you can non-compliant finance we provide the utmost approved financial obligation so you’re able to earnings ratio are 43%. Whether your DTI is higher than which might most likely become refused mortgage capital.

To change your own DTI, reduce any financial obligation you have got into the figuratively speaking, automobile repayments, otherwise personal credit card debt, etcetera. before you apply to own home financing. So you’re able to calculate the debt so you can income proportion, make sense all your monthly personal debt costs, for example education loan otherwise automobile payments and you may separate that count by the gross monthly money. Prior to paying off personal debt so you’re able to meet the requirements it’s very important your accentuate having a skilled Financing Manager who’ll feedback your situation and you will suggest on which steps to take so you’re able to qualify.

#six. Not existence high tech in your fees

Be certain that you’re up-to-date with your income taxes. Financial lenders generally find one to-2 yrs of individual tax statements, business tax returns for many who individual your own business, otherwise W-2s otherwise 1099s. Your income fees can assist decide how much you really can afford now and from the life of the mortgage so perhaps not existence up-to-date with your earnings taxation shall be detrimental within the the loan edibility. For many who haven’t recorded tax statements this may bring about big activities within the income recognition procedure even although you is actually first pre-approved for a loan. For many who haven’t filed be sure to display it early in the fresh pre-acceptance techniques therefore activities try not to occur after you’ve a property around package with serious currency deposited.

#seven. The latest Assessment is lower than the newest cost

Both taking refuted a home loan is beyond their manage. If your house that you will be wanting to order try appraised at a cost which is lower than the new price otherwise extent your asking in order to acquire, the financial institution cannot understand the domestic really worth while the adequate to support the amount that is getting borrowed and can probably deny the job. Alternatives in cases like this are to negotiate into seller in order to reduce steadily the price or set extra money as a result of compensate on lowest worth. Mortgage brokers will foot the latest advance payment percentage into the all the way down of your own conversion process speed otherwise appraised well worth.

Home loan Denials are Challenging

It is difficult for your obtain that loan rejected. Fortunately, understanding these popular factors helps you avoid which deflating sense or discover things you can do just after becoming rejected a good mortgage. Remember a few of these possible problems once you make an application for home financing. And have confidence in the expertise of the respected home loan advantages from the Sammamish Home loan.

Laisser un commentaire