Investing in Home Foreclosures Business with little or no Currency Off

Because the pandemic begins to breeze off, it bears to help you reason why will ultimately the government forbearance programs and you can foreclosure moratorium will come so you can an end. At the end of 2020, from the dos.seven mil financing was in fact on the forbearance program, which means that those people who are experienced buyers was eyeing this new possibility to buy foreclosure households below market price right about today. This isn’t away from arena of reasoning to anticipate an increase out of foreclosed homes soon, and many of them are offered below market value given that finance companies works quickly so you can unload generally ineffective features.

Regardless if you are a primary-big date homeowner or a savvy buyer who would like to breeze right up alot more functions, it is clearly the time to begin with looking property foreclosure property. There’s one thing that ends up many people, although not, the point that they don’t have liquid assets or bucks in order to purchase a house. Although not, the truth is, it is possible to buy land and no currency off. By using benefit of multiple applications and are ready to pay a higher rate interesting, you can get away that have providing household with no money down. In the event your head only snapped support, then it’s for you personally to continue reading to understand exactly how.

Listed below are some FHA Foreclosed Qualities

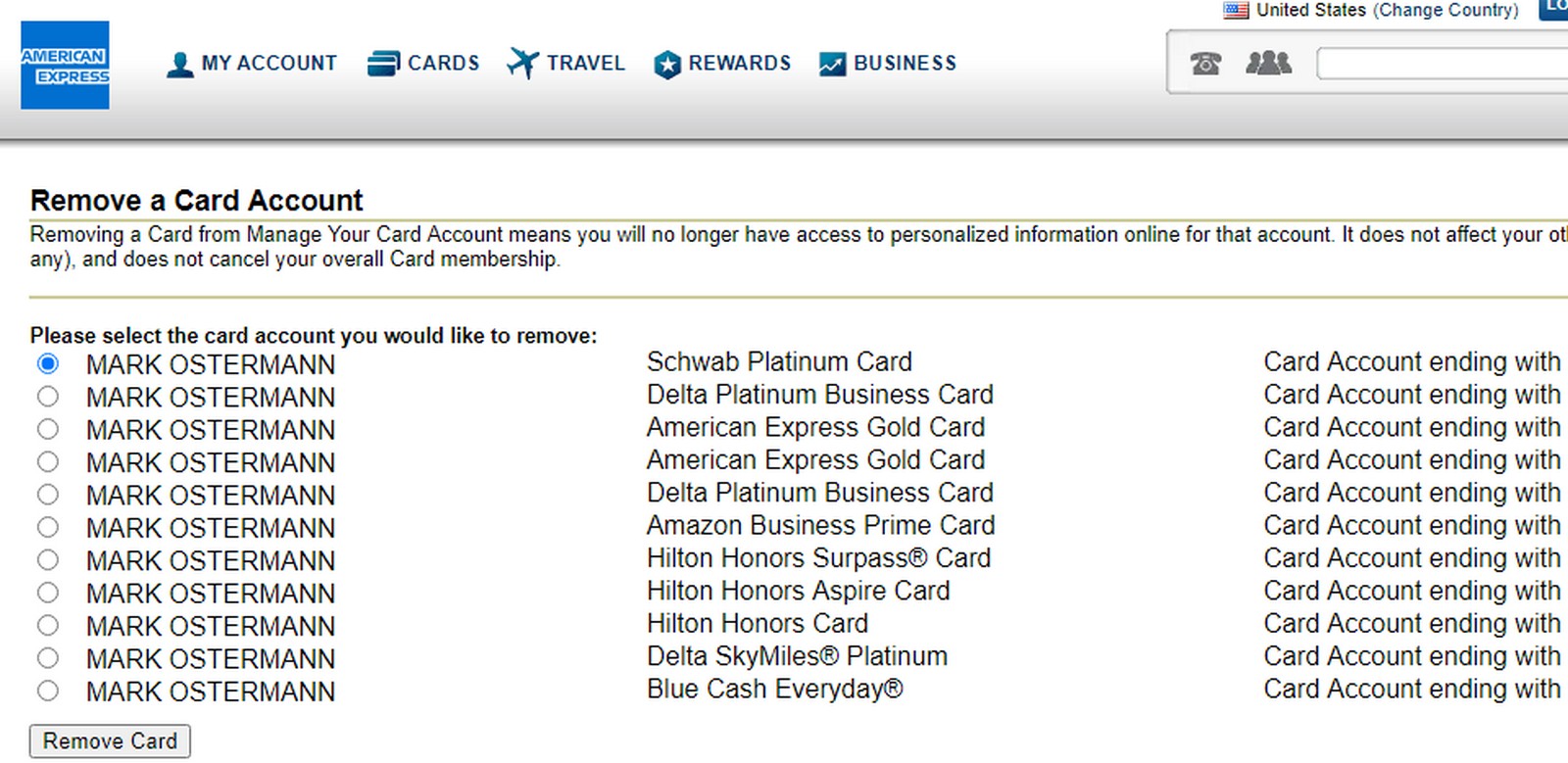

Best place to start is by thinking about FHA foreclosed qualities. An enthusiastic FHA property is the one that are originally purchased through good mortgage that was ensured because of the Government Property Government. The first home loan owner been able to secure its loan given that it was supported by new FHA. It unique program was available to first-time home buyers that’s built to assist them to manage to get thier footing about housing industry. Thus, individuals that can was denied a traditional financing are able to utilize it discover a home and no money off or really low downpayment.

Yet not, also FHA financial residents can be default. The real difference would be the fact their monthly premiums are a good PIM, which is yet another insurance rates agreement set contrary to the mortgage. Ergo, when they standard new FHA will pay the financial institution hardly any money one to was destroyed into the loan. This will be ideal for the financial institution as they are capable recover their losses, referring to just the thing for you because a purchaser as financial are prepared to market or sell the house or property to own as very much like sixty% lower than the value. Many land are offered lower than market price that was former FHA funds, and because the newest FHA keeps rigorous terms and conditions when it comes to domestic sales, some are for the rather good shape.

Once you pick a foreclosure home less than market value you’ve got the unique possibility to either lay no cash down or an excellent most minimal number that will help go into the ount of water cash. Such as, when you begin to acquire foreclosure homes you are able to see good domestic that is respected during the $100K, for sale having $40k because it is an enthusiastic FHA property foreclosure. 10% out of 4K is significantly different than 4% out of $100K, and you can with regards to the model of our home you may be eligible for your FHA loan or Va financing that will allow you to pick a property foreclosure domestic below market value and you can maybe even buy a home with no money off.

Generally FHA money require that you place no less than step three.5% down, however, you will find situations where you’re in a position to get property and no money down. Yet not, as previously mentioned earlier, FHA loans have very rigorous advice in addition to family assessment will end up being serious. If the household does not citation new evaluation then you will be unable to complete to shop for property when you look at the foreclosures when you find yourself utilizing the FHA mortgage.

Find Foreclosures Property having Uninsured (UI) Position

One of the better a means to select foreclosures property that you can buy without currency down is by wanting a keen uninsured position foreclosure. It status shows that a house doesn’t satisfy FHA conditions and requires thorough resolve. When you find yourself prepared to place the time and money on the brand new solutions then you can usually purchase the home instead of position hardly any money off. You should https://paydayloanalabama.com/forestdale/ be aware although not you to definitely often UI property is also have unforeseen pressures, specifically if you cannot make repairs on the own.

Look for Foreclosure

Before fretting about how exactly to purchase house without currency down, you will want to get a hold of foreclosures homes to even thought. There are numerous ways in which you can find property foreclosure house inside the their area. Working with an agent who’s experience in the fresh foreclosures market should be a powerful way to select foreclosures in advance of a public auction or get into brief for the a preliminary selling. Listed here is an introduction to how to locate property foreclosure land you to may will let you purchase with no currency off otherwise during the the absolute minimum that will be offered below market value.

- Correspond with a real estate agent

- See on the internet directories

- Review Foreclosureshomefinder

- HUD foreclosure listings

- Fannie mae HomePath

- Freddie Mac HomeSteps

Again, it is important to repeat that there are dangers with the to shop for a foreclosure even though you have the ability to buy which have no money down. It is always better to balance chance towards possibility of funds before acquiring home financing on good foreclosed family.

Laisser un commentaire