You’ll encounter a hard query of the credit rating during the application form procedure

Are unable to pre-meet the requirements

LightStream does not provide pre-degree so you can prospective consumers. A challenging query may ding your credit score – and there’s zero be certain that you’ll be acknowledged.

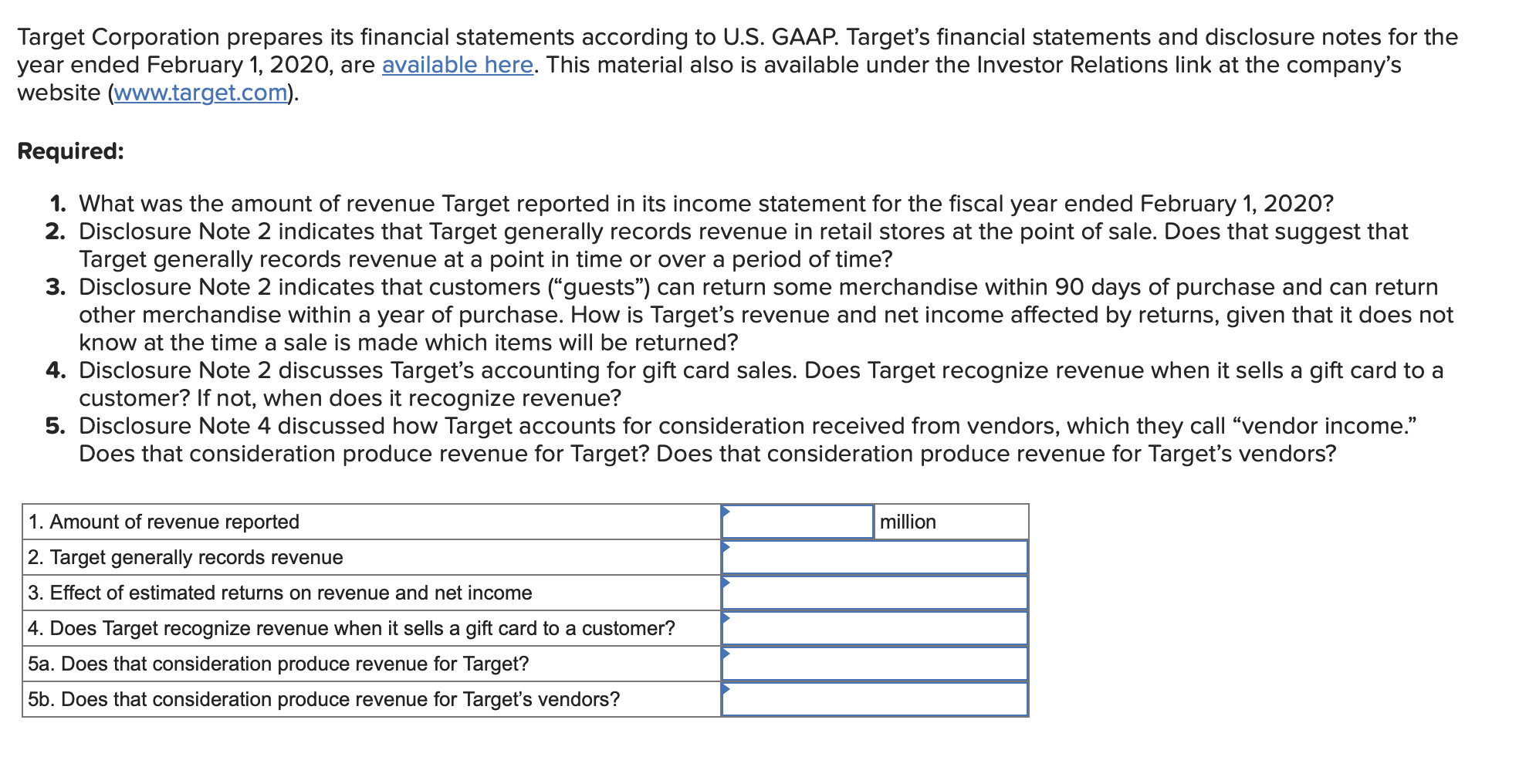

LightStream signature loans: arrangements and you may choices

LightStream offers a broader list of loan terms and conditions and numbers than simply a number of other consumer loan loan providers. Listed here is a simple review of money requirements, how much cash you might be able to acquire, new terms and conditions offered and you may exactly what your financing will set you back.

Financing quantity

LightStream fixed-price loans begin on $5,000, and you will be able to borrow around $100,000 depending on how you need to use the loans. (Refinancing is not allowed.)

Loan words

Financing terminology vary of the financing types of. Home improvement, solar, swimming pool, Camper and motorboat financing has a term duration of a couple to help you twelve ages because these financing sizes possess higher borrowing limitations. Virtually any loan sizes provides terms of two to help you eight years. Extended mortgage terminology generally feature increased Annual percentage rate, while the payment is down.

- Origination charge

- Late charges

- Prepayment punishment fees

Coupons

LightStream has also a great Rate Beat program who defeat one similar financing promote out of a competition because of the 0.10% Apr.

Income criteria

LightStream will not reveal money standards to the its website. However, it considers the debt-to-earnings proportion as well as how much you have inside the put and you will advancing years levels to decide if or not you have sufficient earnings to meet your own current debt burden and you can a different financing.

LightStream personal loans: pricing

LightStream will bring fee-free financing, so credit can cost you just the interest you’ll be able to spend throughout the life of the mortgage. LightStream personal loan cost are below some other lenders, dependent on their creditworthiness. Further, specific LightStream money has better APRs as opposed to others. Including, a property upgrade financing might have a lower life expectancy Apr than a good debt consolidation loan.

Going for a shorter mortgage payment identity also may help you earn a lower Annual percentage rate. Create automatic money, and you will score a keen will even render a performance discount in the event that you are recognized for a financial loan having a lower rate of interest regarding a contending bank offering the same mortgage conditions with similar borrowing character criteria.

LightStream signature loans: financial stability

LightStream is a part of Truist, designed whenever BB&T and you will SunTrust banking institutions matched. With regards to the Federal Set-aside, Truist Lender is among the ten biggest commercial finance companies into the the latest U.S., also it brings individual and commercial financial activities, bonds broker, asset management, mortgages and you can insurance coverage services and products.

According to the studies firm Weiss Studies, Truist Lender keeps a b- score, falling trailing the average towards cash advance Ariton reviews the profitability, resource quality and capitalization. However, the bank acquired a perfect score for metrics pertaining to balance as well as harmony layer.

LightStream unsecured loans: the means to access

LightStream financing credit criteria is actually more strict than other consumer loan loan providers. The second use of evaluation can help you see whether you could potentially qualify for a beneficial LightStream personal loan, where you are able to implement and things to find out about the applying techniques.

Access

Unlike of a lot personal bank loan loan providers, LightStream is available in all fifty claims, together with Arizona, D.C. LightStream’s minimum credit score standards aren’t revealed on the internet site. It simply claims which « merely approves an excellent-to-excellent credit users. »

- An established credit rating that presents a combination of significant loan versions, such as a home loan, car finance, major handmade cards and you may payment funds

- A variety of put and you may funding levels that show a capability to keep

- An excellent loans-to-money ratio one helps what you can do to repay the debt debt

Laisser un commentaire