What’s the interest rate for an FHA financing?

The government repays the financial institution into borrower’s incapacity to invest in once they standard towards loan

The option ranging from an FHA or conventional mortgage is principally established on your finances. A traditional mortgage is far more suited to somebody who possess a keen above-average credit score and enough money to have an advance payment off 20%. Traditional finance be more suitable for the acquisition out-of larger home given that steady prices much more efficient to have high-charged mortgages.

Antique money have a couple of variations: compliant and you will non-conforming. Conforming loans go after conditions and terms that are approved by the Fannie Mae and you may Freddie Mac. Those two governmental backed entities (GSEs) get mortgages out-of lenders, package them for the bonds, and sell these to traders. Federal national mortgage association and you will Freddie Mac based criteria a borrower need satisfy in order to qualify for a loan, such as for example revenues, credit score, and deposit number.

Mortgages you to go beyond Fannie mae and you may Freddie Mac’s limit financing count are known as non-compliant or jumbo finance. Jumbo financing are not because the common once the conforming financing, that’s the reason loan providers can be point a high interest.

Such as for example mentioned before, if a borrower is looking to acquire a very pricey domestic, a conventional loan gives more independency than simply an FHA mortgage. For the majority components, FHA fund limit away doing $330,000. In the Mississippi loans event the home you are purchasing was above the FHA restriction, a conventional financing are far more of good use.

FHA fund be a little more suited to someone that cannot lay out 20% or have the typical credit score. They are also easier to obtain as FHA pledges the brand new loan, meaning, lenders do not take on normally economic exposure by loaning the cash in order to borrowers. So it encourages lenders to offer competitive rates of interest and accept way more borrowers.

For the best FHA rate of interest, you will have to search and you may compare loan providers observe who could offer a reduced. Interest rates can also be fluctuate each day and is also crucial that you continue discover interaction together with your mortgage officer to get closed within the within the lowest rates.

FHA interest levels are influenced by a number of personal activities, like your credit score, debt-to-income ratio, and you may deposit count.

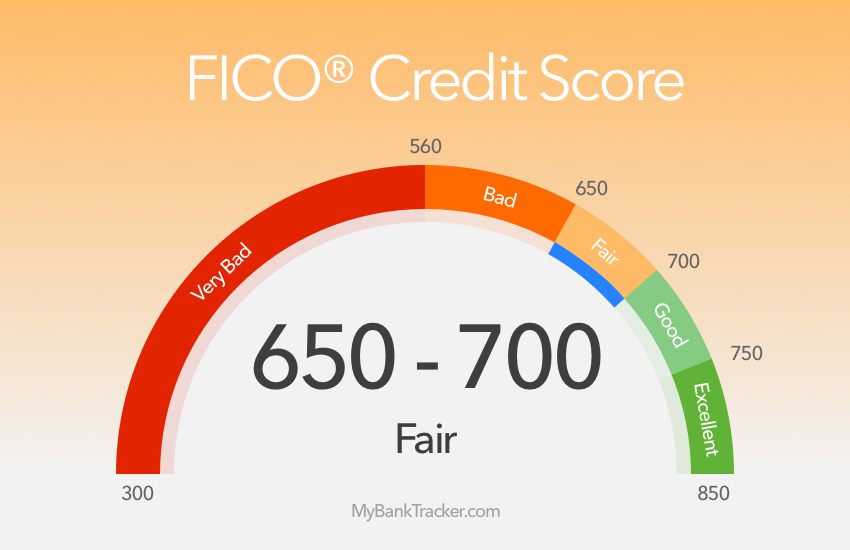

If you have a good credit score, your lender could possibly offer your a much better interest rate. This will help to prevent you from spending several thousand dollars merely into the attention. Additionally, your existing credit rating will determine the minimum count necessary for your own down payment.

The debt-to-earnings ratio is even examined to determine an interest rate to possess your home loan. You can lessen the amount of financial obligation you’ve got if you are paying of up to you might before applying. Having financial obligation would not deny you against acceptance, however you will need establish its well managed and you may not outstanding.

Just what the customers state regarding the you?

Community Funds was great to do business with otherwise taking property mortgage. It party was really quick to answer any questions that emerged, was indeed always finding most useful cost as well as on most readily useful of all of the conditions that emerged. Getting a home loan is significantly out of performs. If you are searching to have a mortgage broker for buying good house, I will suggest Community Financing. They will make process effortless and look away for your desires. – Laurel Yards.

Area Loans try a high-notch team to partner with. Their staff are incredibly educated and you can beneficial in the whole process. I have used Neighborhood Financing for the majority of domestic orders and you will refinances, I’d highly recommend them. The proprietor Reno is the real deal, the guy cares from the his people and you may makes sure Everyone is 100% satisfied. – J. Conone

Laisser un commentaire