Look at the Credit score And you will Credit history

2nd, see in which your credit score really stands. You can find out that have a straightforward check. Remember, you can opinion your credit report a-year, free-of-charge. If you don’t such as for example that which you look for, look closer at your credit rating. One mistakes on your credit history is easy to remove, that may keeps an optimistic effect on your credit score.

Before you could progress with your software, be honest concerning your credit rating. When you yourself have a less than perfect credit rating, you might struggle to get a hold of a lender ready to manage your. With regards to the disease, it might be a smart idea to work with strengthening your credit before dive into your family equity loan application.

Compare Home Equity Loan companies

As with any significant financial conclusion, you really need to research rates before you apply to work with a certain house collateral financing financial. If not shop around, you could potentially with ease overpay.

Since you research rates, see a lender which provides competitive rates of interest and charges. As well, you ought to prefer a lender with a decent character.

Get A house Collateral Loan

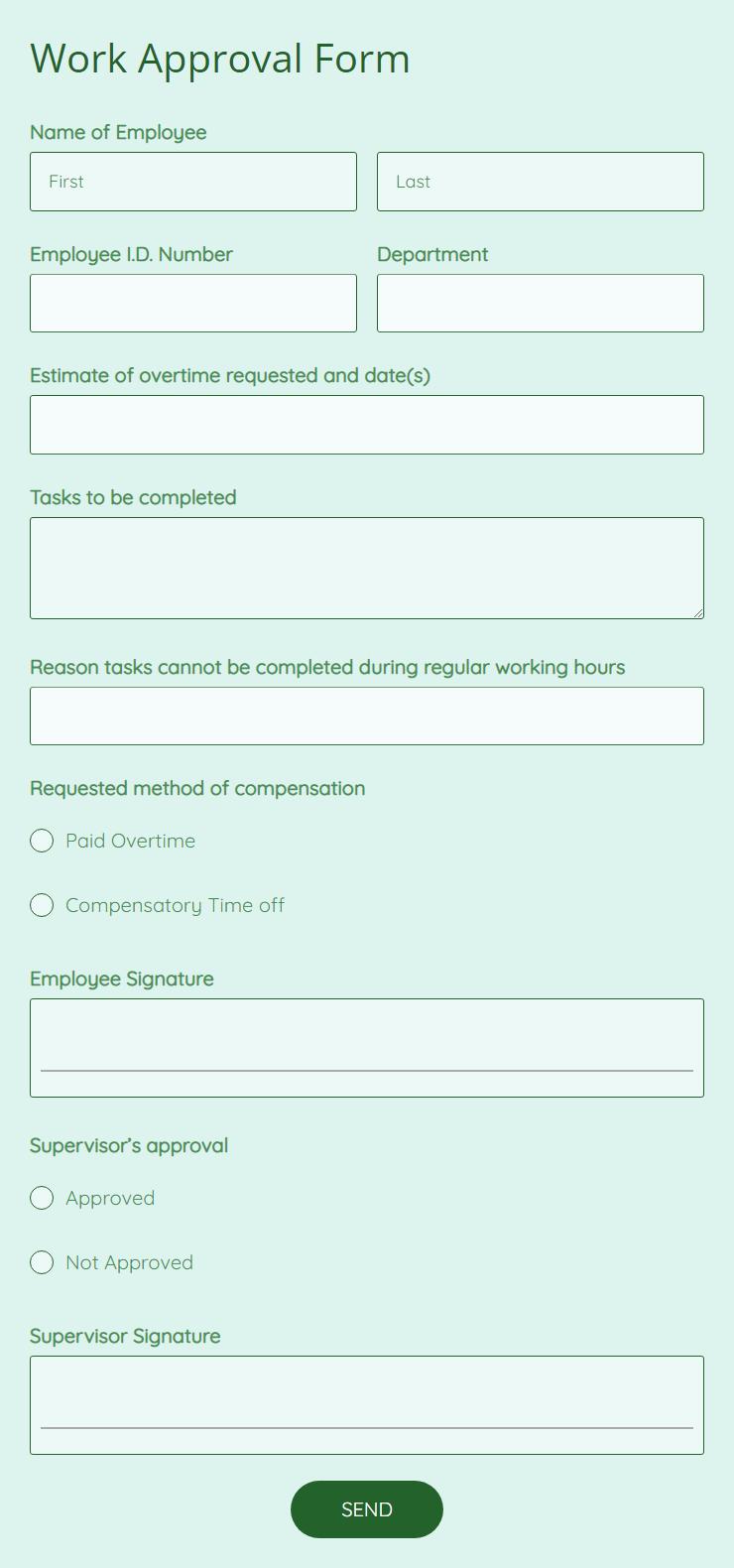

When you select a loan provider you happen to be comfortable with, it’s time to sign up for the loan. The original application often query a wide range of questions about your financial situation, employment situation and you will family value.

Immediately after searching the application, the lender might perform certain homework. Such as, you happen to be expected to offer documentation to suit your income because of shell out stubs or lender comments. Some lenders might want to name your boss to verify you keeps a stable job. At exactly the same time, of several lenders will loans in Ola conduct an assessment of your house to verify its well worth.

- Previous shell out stubs

- W-dos forms, the past 2 years

- Tax statements, going back 2 yrs

- Files away from extra money sources

- Current bank statements

- Down-payment source

- Title documents, eg driver’s license

- Public Safeguards matter

- Previous family appraisal

Property security loan is a type of second financial when the you already have home financing in your domestic. Thereupon, the latest files your make available to the financial institution you are going to getting the same as this new data files your given into the brand new financial process.

Mediocre Family Equity Interest rates

House equity mortgage pricing is below the attention costs tied to personal loans, including handmade cards. But not, home security financing cost become some greater than top financial cost.

When you look at the 2023, this new Government Reserve constantly increased rates of interest. Thereupon, home guarantee financing rates are more than they certainly were a good year in the past. Yet not, you can’t really understand whether family equity loan rates will rise otherwise belong the long term.

Alternatives So you’re able to A house Guarantee Loan

A property security loan is not the best possible way to acquire supply towards the financing you desire. There are many more alternatives well worth examining.

Personal bank loan

An unsecured loan does not feeling your home security whatsoever. As an alternative, these mortgage is unsecured. Thereupon, possible deal with an alternate payment that will not use your house due to the fact security.

Typically, personal loans include highest interest levels than family guarantee funds as a result of the not enough equity. If you’re increased interest isn’t top, personal loans might provide significantly more assurance since your house isn’t at stake.

Cash-Aside Re-finance

A cash-away re-finance involves replacing your existing mortgage having the one that has a higher mortgage balance. You will get the cash as a lump sum payment to utilize given that the truth is complement. But you will only have you to definitely mortgage payment to keep up with.

If, instance, you borrowed $150,000 on your mortgage, you could potentially re-finance that loan on the a unique you to with good balance regarding $180,000. Might upcoming receive the more $31,000 since the just one percentage.

Laisser un commentaire