9 Strategies for Getting a home loan When Thinking-Operating

Modified From the

Self-a position around australia has been continuously increasing across the past fifteen years as more and more individuals move away from the standard four-big date times, employed by a large team otherwise bodies organisation. A self-functioning body is essentially defined as someone who will not discovered an everyday salary away from an organization. This may is somebody powering her team, ranch or elite group behavior. In the 2021, 2.2 billion Australians recognized as thinking-functioning, an effective eight.2% increase as the 2010, and this amount has actually absolutely improved blog post-pandemic.

Yet ,, despite this upsurge in amounts, of many mind-working some body believe it is difficult to rating a home loan as the they feel one to loan providers faith they are a top risk owed so you can a lack of money stability. It doesn’t mean you to definitely, since a self-functioning person, you are precluded of providing a home loan in your conditions. It really means it is possible to usually be asked to give a whole lot more records to prove which you meet the lender’s a great deal more strict financial criteria.

1. Test your possibilities

Due to the fact a personal-functioning person and you may a primary-go out house client, your own financial so you’re able to-do record might possibly be prolonged since there are a few more points to consider. Rather than just providing a number of payslips like an excellent salaried personnel, you’ll want to tell you income for around 1 year, but usually couple of years, to get qualified.

Yourself-employed earnings is additionally accessible to interpretation, according to the bank. Probab to see tax statements for around 2 yrs, so they are able score the average that correctly shows your revenue. Its not all lender uses a comparable approaches for computation. Particular includes things like depreciation and you may any extra superannuation you have reduced to make the journey to whatever they consider an excellent reasonable shape. They’ll along with generally check your internet winnings in advance of taxation.

You can find exceptions. Such as for instance, assume you have been a good salaried electrician or accountant for 5 ages, and you simply began yourself 1 year ago. If so, the financial institution look at your regular earnings more a lengthier several months, your own deals while the sized your put. If you’ve been care about-used in less than one year, you may also struggle to see home financing after all. not, you may need to envision sometimes prepared or going down the low-doc loan route if you fail to hold off to invest in a house.

2. Carry out an intensive finances observe what you could pay for

It’s best to map out a spending plan to see what you are able actually afford, rather than just what a financial usually give your, despite your circumstances. This is especially valid if you’re worry about-employed as you will is not able so you can trust a beneficial normal income to make your own monthly payments, especially if it is seasonal in the wild. This means taking into account all of the expenses of a mortgage including with sufficient offers the slim times will be it eventuate.

One method to assist with your financial budget is to apply a great self-working income calculator. These tools get such things as internet finances in advance of taxation and you may depreciation into account. Once you’ve a sharper thought of your earnings, you might funds accordingly, preferably that have an economy buffer in the event of an urgent situation.

step three. Look at the credit score

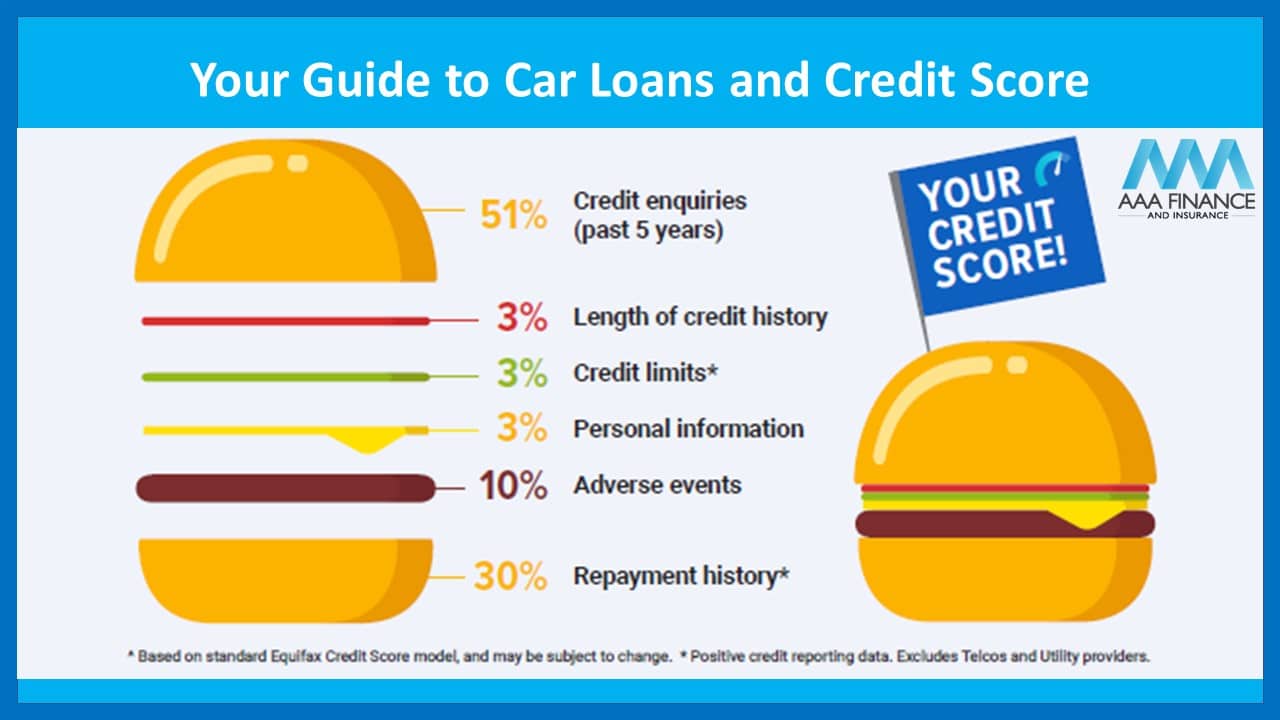

Which have a beneficial credit rating is not a necessity getting getting a home loan. Nevertheless, it is a considerable ways towards obtaining one you are comfortable that have, particularly if you are worry about-employed. Definitely spend the costs punctually, especially your credit cards, so your get was high after you incorporate.

In the event the credit isn’t good for any kind of need, you can always slow down the financial application up to it enhances. This will make the entire processes work with way more smoothly.

4. Get a better deposit together

The greater your own put, the latest faster you’ll need to obtain to suit your mortgage. The minimum deposit necessary was 10% of your property’s value. Although not, for folks who put less than 20% of property’s worth, you might have to shell out lenders’ home loan insurance policies. Likewise, particular lenders need an even higher percentage to your notice-employed.

You might see home financing which have less than that in moved here the event that you enjoys a great guarantor. Yet, proving as you are able to conserve to have a deposit is one thing loan providers browse up on favorably as it explains try seriously interested in and also make a long-name financial commitment.

5. Talk with a mortgage broker

Speaking with a large financial company is definitely a good idea. They could help and you may give you support when you fill out the app and, we hope, pick your a competitive price. Home loans is free to chat to (their percentage originates from the financial institution) and so are experts in the profession, so it might be a win-profit. Concurrently, it is extremely likely that somebody you know can recommend home financing representative they’ve put prior to.

six. Talk about your own income tax return along with your accountant

Which have a creative accountant was a double-edged sword whenever obtaining a home loan due to the fact a self-working individual. They are able to in order to minimise your goverment tax bill plus websites funds, however you will need certainly to reveal an excellent money to track down a home loan. You have an actual dialogue together with them, especially doing tax date. This way, you could potentially acknowledge the best advice that will not jeopardise your odds of bringing a mortgage.

seven. Continue an effective monetary details

Self-functioning home loan apps is actually without a doubt complicated, so something that is also expedite the process is the best thing. Therefore, it is best to keeps within able any help paperwork off their accountant you might say which is possible for your financial in order to cross-site. These include your very own tax returns backed by the fresh Australian Taxation Office’s notice off tests. you need one partnership suggestions, balance sheets or other suggestions that the accountant deems expected.

8. Rating income insurance

Unfortunately, anything not work right in life. Section of your cost management techniques is cover starting a worst-case situation where you clean out your primary revenue stream. Income insurance is perhaps not excessively high priced and may end up being vitally important if you have a major accident otherwise scientific emergency later on one to influences your capability and then make your instalments across the second 20 otherwise 3 decades.

9. Look around

Fundamentally, getting worry about-employed doesn’t mean you simply cannot rating a maximum financial that have a extremely aggressive interest and other good fine print. Contemplate, there clearly was a number of competition on the market, and that means you won’t need to end up being desperate. In addition, you don’t have to take a loan towards financial you have been which have because you had been an excellent kid – especially if they aren’t versatile. Again, it is better to speak with a large financial company exactly who will be able to provide you with several selection.

Laisser un commentaire