660 Credit rating Mortgage Options and you may Loan providers

660 Credit score Mortgage Possibilities

When you are seeking to get a house if you don’t re-finance, you may have found that many loan providers need people getting close perfect borrowing from the bank. For this reason, of numerous homebuyers having a 660 credit history don’t believe there are mortgage available options on it. You can find financial applications and you may lenders that can assist and also you can always buy your fantasy household even after a credit history regarding 660.

Even if Federal national mortgage association recommendations enable credit ratings paydayloanalabama.com/slocomb as little as 660, specific loan providers features highest standards and want higher results. This will be particularly the instance if you are looking getting a good jumbo financing or even a conventional loan oftentimes.

There are many 660 credit rating financial options available to you personally regardless of whether you are purchasing or refinancing your house, if not an investment property.

*If the financial is not able to help you with any one of the borrowed funds programs referenced significantly more than, you might getting speaking with a bad lender.

FHA Mortgage that have an excellent 660 Credit score

FHA loans make up no less than 25% of all the mortgage loans in the us today. They assist whoever has straight down credit ratings, a tiny advance payment, otherwise a top personal debt to help you earnings proportion . FHA direction also support credit scores only five hundred. Although not, lenders possess the brand new self-reliance setting its criteria highest.

When you yourself have a credit score out-of 660, we could help you to get recognized having an FHA loan. Here are the very first requirements:

- Credit score with a minimum of five hundred

- Deposit off 3.5% 10%

- Two-year performs record

- Completely file earnings with spend stubs, W2s and you will tax returns

- No bankruptcies within the past two years

- The home need to be your primary quarters

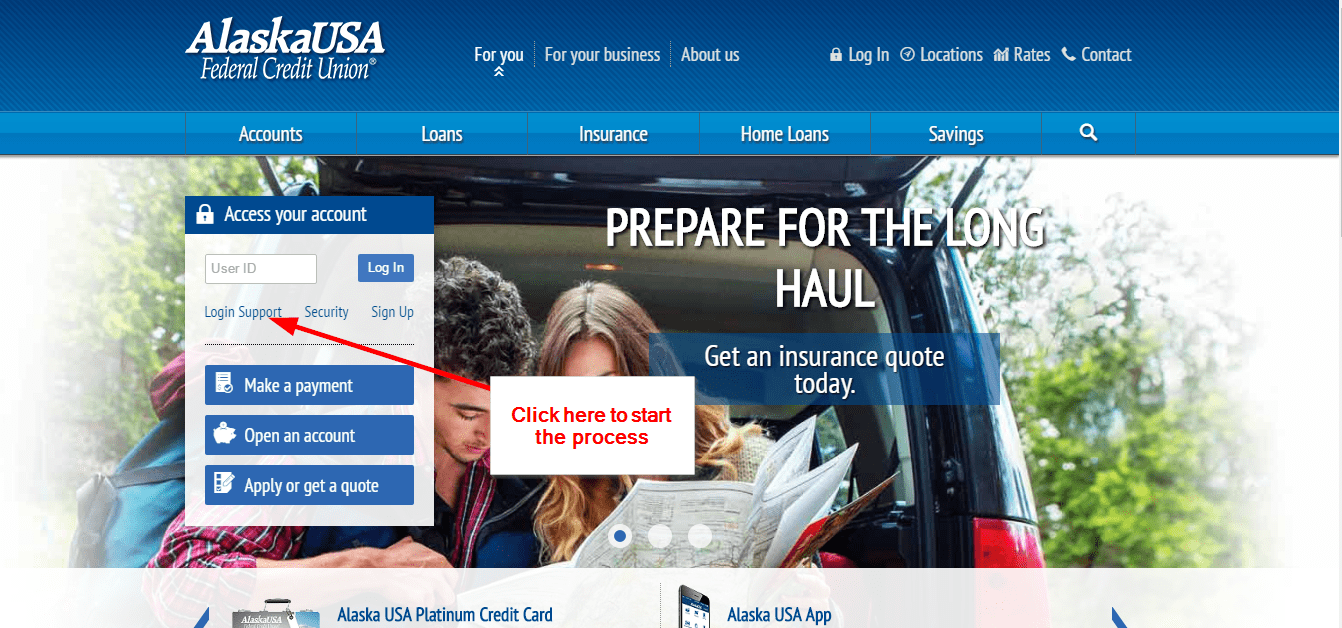

If you like discover pre recognized getting a keen FHA mortgage, done so it consult quotation form and you may a talented mortgage officer will get in touch with you. Comprehend [ FHA Loan Direction ]

There are even lenders whom give down payment advice for individuals with credit scores over 620 that are probably pick its domestic playing with an FHA mortgage.

Virtual assistant Financing having a great 660 Credit history

Whenever you are a veteran, productive army, and/or lover away from a veteran then you can qualify to own an Virtual assistant loan. Va fund according to the financing guidance don’t have any minimum credit rating requisite. Therefore if youre qualified, you can aquire a Virtual assistant mortgage which have an effective 660 credit history although most other lenders let you know that you prefer a top get.

- Zero downpayment

- No limitation loan amount

- Zero credit score requirements

If you see the key benefits of a good Va mortgage, it seems an amazing home loan program. When you find yourself having problems providing approved to own a great Virtual assistant mortgage that have an effective 660 credit score, upcoming why don’t we help you. Discover [ Virtual assistant financing requirements ]

USDA Financing which have a 660 Credit score

USDA fund was for people who plan to pick a house inside a rural town with little advance payment. The house will need to be based in a qualified town. You can search to own possessions qualifications by using the USDA eligibility device.

You need to be able to find good USDA loan with good 660 credit rating as USDA direction do not have a beneficial minimum credit history requisite.

Exactly what lenders will look to have are a track record of expenses bills on time. Very, you can get a diminished credit rating however the lender’s underwriter can make a judgement name reliant whatever they look for to your your credit report.

Laisser un commentaire