10 Situations That Meet the requirements Your To own An excellent USDA Home loan in Michigan

A few of the requirements one meet the requirements your to own a great USDA mortgage loan inside Michigan is – money, downpayment, fico scores, and. Getting a USDA loan isnt far different than getting good conventional home loan. Listed here are ten situations that can impression the loan recognition.

1munity Lender Approval having USDA

USDA are a government institution you to definitely sponsors the applying, however your area financial commonly deal with 100 percent of your exchange. It means your people banker really does from getting the application so you’re able to providing the very last recognition. USDA puts a last stamp of acceptance to the financing, plus that is treated of the financial. Suppliers can contribute to six percent of your own sales speed on the closing costs.

2. No Down-payment

New down-payment specifications – or decreased you to is the reason a lot of buyers buy the USDA home mortgage system. No downpayment will become necessary, so it is mostly of the 100 % resource lenders in the current field.

You have got a downpayment virtue who does just take age having most group to store 5 % off or higher. During those times, home prices can go up, and also make rescuing a down payment also more complicated. With USDA mortgages, home Selmont West Selmont loans buyers can find instantly and take advantage of increasing house beliefs. Minimal credit history to possess USDA recognition try 640. The debtor need a reasonably good credit background that have limited 30 day late payments during the last 12 months.

4. First-Big date Homebuyers

USDA protected mortgage loans commonly suitable for the customer. However,, people first-day or recite customer searching for belongings beyond significant towns and cities is always to consider their qualifications with the system. The applying is available to buy purchase only, no capital characteristics otherwise 2nd property. A purchaser never individual a different domestic during the duration of buy.

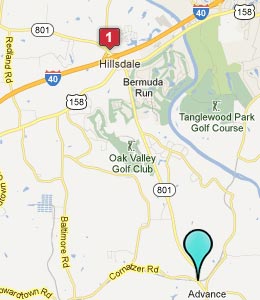

5. Geographical Limits

Geographic parts getting USDA mortgages are getting land that has to be located contained in this a beneficial USDA-eligible area. Become eligible, a home have to be into the a rural area. Generally, metropolitan areas and you may towns having a population below 20,000 be considered.

six. Assessment and you can Possessions Requirments

An assessment into the assets to choose the really worth is necessary. The brand new assessment statement also confirms the house is livable, safer, and you will suits USDA’s minimal possessions conditions. One protection otherwise livability circumstances must be fixed before mortgage closure.

seven. Land Restrictions

USDA mortgage loans are not designed to finance farms or higher acreage features. Alternatively, they are aimed toward the high quality unmarried-house. It’s also possible to loans certain condos and you can townhomes to the program.

8. First Household Standards

House becoming purchased should be much of your household, meaning you want to reside around on near future. Leasing qualities, financing features, and you can next family orders are not eligible for the latest USDA financial financing system.

nine. Mortgage Proportions by Income

There aren’t any stated financial constraints having USDA mortgages. Alternatively, an applicant’s money identifies the maximum mortgage dimensions. Brand new USDA income limitations, then, make certain realistic financing brands towards the program. Earnings of all of the family relations 18 yrs old and you can earlier don’t go beyond USDA guidance right here.

10. Cost Feasibility

You normally you want a 24-times reputation of trustworthy work to qualify, including sufficient money regarding said a job. not, education from inside the an associated industry is also replace particular otherwise all of you to definitely sense criteria. Your bank should determine repayment feasibility.

USDA’s mandate should be to promote homeownership in non-urban areas. As such, it makes its mortgage reasonable to help you a larger spectral range of domestic customers by continuing to keep prices and you may costs reasonable.

Find out more about the key benefits of a good USDA mortgage and you may working with your neighborhood area bank. Keep in touch with one of our home mortgage pros on Chelsea State Financial. Contact all of our work environment because of the mobile: 734-475-4210 otherwise online.

Laisser un commentaire