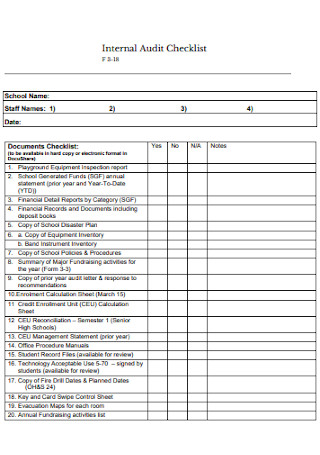

Pick Family Guarantee Finance Positives and negatives

When you’re Pick might be best noted for its handmade cards, the financial institution even offers plenty of borrowing products and you may services, plus domestic guarantee loans.

Domestic equity loans, known as next mortgages, are going to be a useful treatment for protection major expenses particularly family improvements by allowing you borrow against the degree of guarantee inside the your home. Yet not, not all the loan providers provide the exact same cost, charges otherwise loan terms and conditions. This is why researching loan providers and you will deciding on the one into better prices is essential, as it can save you money across the lifetime of your loan.

Zero assessment charge, home loan taxes, or other will set you back due within closure

Of numerous loan providers charges a minumum of one fees ahead of financing disbursal in the form of closing costs, which can diversity approximately dos% and you can 5% of one’s amount borrowed.

Home guarantee personal line of credit (HELOC) isnt available

Household collateral lines of credit (HELOCs) mode similarly to house collateral finance in this both loans was backed by your own residence’s collateral. not, the two financing types disagree in the way they mode. A home guarantee financing is a phrase mortgage. Term loans bring just one upfront payment you following pay back over an appartment time.

By comparison, HELOCs are revolving personal lines of credit, and that allow you to use to a borrowing limit you need certainly to upcoming pay-off when you look at the a certain time frame. But not, Look for cannot already provide that one.

More resources for this type of loan, view the guide to the pros and you may disadvantages regarding property guarantee personal line of credit.

Household equity financing

Traditional family guarantee funds offer you a lump sum payment that’s covered by the collateral of your property. With Discover, you could potentially use as much as 90% of your home worth that have the absolute minimum amount borrowed away from $35,000 and you can an optimum quantity of $three hundred,000. Find offers repaired payment schedules to own ten-, 15-, 20- and you may 31-seasons periods. Evaluate Discover’s webpages to get more details.

Knowing how far collateral you may have in your home might help you determine the borrowed funds count you might incorporate formon purposes for domestic collateral money are domestic renovations, solutions, disaster expenditures and you may debt consolidation reduction.

Refinancing mortgage

A home loan cash-out refinance loan replaces your existing mortgage with a new one who may have a lower life expectancy rate of interest. Discover’s mortgage refinancing terms try much the same in order to their domestic collateral funds, regardless if their APRs work with some time down.

Look for Domestic Guarantee Loan Pricing

Look for, like all most other lenders, uses your credit rating to determine the Apr it can bring. Definitely use Picks household guarantee loan calculator, that may make it easier to estimate your own price and you may monthly premiums.

Look for Household Collateral Finance Monetary Balance

As of this writing, See Economic Services is ranked Bbb- by Important & Poor’s, BBB+ by Fitch Recommendations, and Baa2 by the Moody’s. The three of these reviews suggest a constant mentality.

Essentially, for you to do business that have mortgage brokers that have strong credit scores since they’re less likely to want to getting insolvent. The 3 rating firms arrived at their ratings because of the comparing Select in certain portion including the strength of its equilibrium piece, its company strategies and the county of large field.

Look for Family Security Loans Access to

You might get a discover household equity mortgage across the phone from anywhere in the country otherwise courtesy Discover’s simpler on line web site.

Availableness

Get a hold of is present in order to You.S. owners excluding the states out of Maryland, Iowa otherwise some of the adopting the All of us territories: Puerto Rico, Us Virgin Islands, Guam, Northern oa.

But not, in order to qualify for a find house guarantee loan, you must meet certain standards. Check to see for individuals who meet up with the after the lowest loan qualification standards.

- Credit history: See requires a credit history of at least 680 to help you be considered to own a property equity mortgage. Increased credit score may lead to down pricing, which is, way more favorable loan terms. When your credit score is not slightly up here yet, listed below are some the report about getting a property security loan with less than perfect credit.

- Credit score: To help you qualify for a property collateral mortgage, Select will guarantee you have got an accountable credit history. It means the business goes throughout your credit history and you will look for a routine regarding uniform, on-date costs. Late costs or account into the selections is a warning sign.

- Loans so you’re able to money (DTI) ratio: Select searches for an excellent DTI out of just about 43%. DTI measures simply how much financial obligation you have got in line with your income. To help you assess your own DTI, separate your monthly debt costs by your month-to-month earnings.

For example, if you mediocre $step 1,five-hundred within the month-to-month debt costs and you also earn $5,000 thirty day period, your own DTI would-be 30%. DTI merely identifies financing eligibility. Oftentimes americash loans Leeds, a reduced DTI, as well as a top credit rating, can help you obtain a good speed.

- Their current work records: Look for requests couple of years off works records files. You might use taxation suggestions, spend stubs, W2 models otherwise 1099 variations (when you’re mind-employed).

Contact info

Find are an online bank, and that means you are unable to head into a region branch work environment so you’re able to make an application for a loan. However, Look for now offers a great amount of simpler indicates having consumers to track down in touch, in addition to an effective 24/eight Select mortgage contact number, a chatbot and you can a good emailing address.

- Phone: Telephone call Discover’s 24/eight toll-100 % free hotline to speak with a support broker during the step 1-800-Select.

- Mailing target: Post general correspondence mail and view Financial, P.O. Field 30418, Salt Lake City, UT 84130.

User experience

Navigating Discover’s webpages and online mode is not difficult and simple. It got you just a few minutes to create a bid. Discover’s streamlined app and you will commission systems produce a traditionally self-confident sense.

Laisser un commentaire