You’ll be able to look at the estimated price towards All of us Financial webpages without inside your borrowing from the bank

United states Lender has the benefit of unsecured signature loans to own do it yourself and you can, like most lenders, does not require promises, appraisals or home inspections. Additionally doesn’t costs an enthusiastic origination commission otherwise a penalty to own paying down the mortgage in advance.

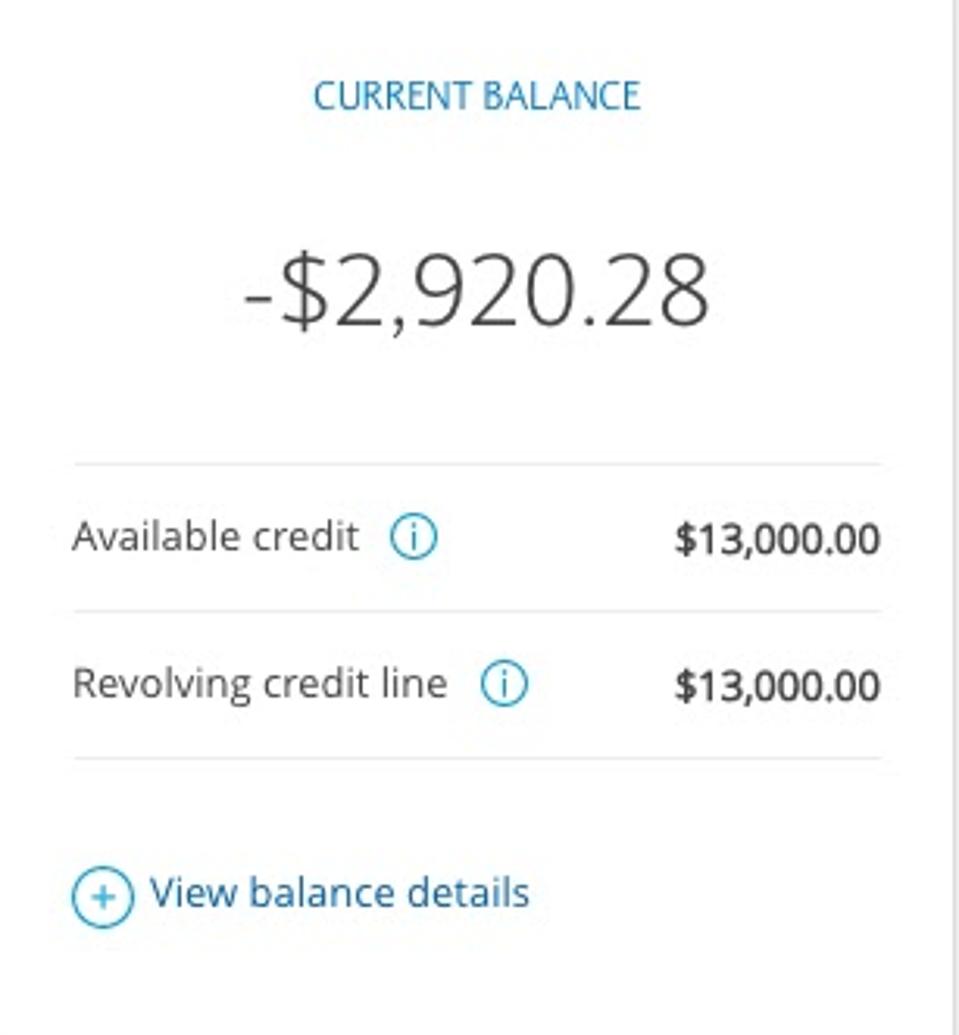

You Financial home improvement finance appear of $step one,100000 in order to $twenty-five,000 having non-consumers or over in order to $fifty,000 to own newest Us Lender people. Repayment terms vary from 12 so you’re able to 84 days for most recent users or more so you’re able to sixty months to own customers who do not have good Us Bank account. Interest rates vary from 7.49% so you’re able to % according to your creditworthiness.

But not, merely current All of us Lender customers can use and you will intimate its mortgage entirely on the internet. If you don’t have a professional All of us lender checking otherwise discounts membership, you may have to intimate the borrowed funds when you go to a neighbor hood branch.

To put on, a credit rating regarding 620 or maybe more is recommended. You ought to supply proof your home address, employment advice and personal records, like your societal cover amount and you may ID.

Digital financing can be open to All of us savings account proprietors contained in this a couple of hours or you to business day regarding approval. However, capital so you’re able to outside profile may take up to four weeks.

Why we picked the firm: Navy Federal Credit Commitment also offers aggressive costs and longer than average costs having military players and their group.

Navy Federal Borrowing Union stands out for delivering aggressive financial products getting armed forces players in addition to their family members. Offered to professionals throughout 50 says, the credit commitment has the benefit of private do it yourself financing as much as $???????25,100 sufficient reason for zero origination charge.

Navy Government provides repaired cost ranging from 7.49% to help you %. Yet not, the minimum interest may vary depending on the loan terminology. Financing having terms of doing 36 months has actually an opening interest regarding 7.49%, People with terms of 37 in order to 60 weeks and you may 61 so you can 180 weeks start on % and you may % correspondingly.

To apply for that loan, your otherwise an immediate loved one need to be a dynamic member, retiree otherwise experienced of Us Army. You will additionally must submit records such as for instance employer suggestions, money, personal defense amount and your email address.

According to Navy Government, exact same go out funding is available. Yet not, in many cases it may take up to 1 day.

Others i believed

The next companies was in fact together with believed, however, didn’t make the last reduce. This might appeal you : 23andMe Slices Off the DNA App Environment It Composed.

Wells Fargo

Wells Fargo was a proper-identified lender which provides pricing undertaking in the 5.74% and mortgage number off $step three,100 to $100,100000. not, its loans cater exclusively to present users. If you’re not a current Wells Fargo the original source consumer which have a good being qualified savings account, you simply cannot sign up for that loan online otherwise discover a speeds write off. Non-people have to connect with among Wells Fargo twigs, being limited within the 37 says.

Most readily useful Eggs

Greatest Egg’s money try restricted to $50,000 that have cost terms of three to five decades. The maximum Apr out of % exceeds precisely what the top lenders within number offer. In addition, it fees an enthusiastic origination fee as high as 8.99%.

TD Bank

TD Bank offers financing quantity out-of $2,000 to help you $fifty,100000 with rates out of six.99% to %. Also, it does not charges origination costs or prepayment punishment. The main disadvantage is actually their minimal availability, already within the sixteen states: Connecticut, Nj-new jersey, Delaware, New york, Arizona, North carolina, Sc, Fl, Pennsylvania, Maine, Rhode Area, Massachusetts, North carolina, The latest Hampshire and you can Virginia. Regardless of this, TD Financial remains a competitive lender. If you’re in one of this type of says, it could be a solution to imagine.

Laisser un commentaire