Family Collateral Financing Charge & Family Security Mortgage Closing costs

You over your homework and discovered a home collateral loan that have an excellent interest rate. Bravo! But beyond acquiring an appealing price, when examining loan choices do you have a handle on the exacltly what the full price of credit could be? Think: closing costs and assessment charges you might have to shell more to obtain the mortgage. The help of signed up appraisers, attorneys, name representatives or any other support team might possibly be requisite in this big date, states Deprive Cook, Direct out of Sale and you may Buyers Feel to possess Select Mortgage brokers, that is the reason specific family collateral funds plus bring costs and you can closing costs. And if you’re not aware of all the areas of your loan, you will probably find your self paying significantly more than your forecast.

The key takeaway listed here is that not all financing is generated equivalent and you can closing costs and you can home security financing costs will vary by the financial. Such as, House collateral finance out-of Discover haven’t any app, origination otherwise assessment charge, and no cash is requisite during the closure, Cook claims. But also for loan providers that do charge charges and you can closing costs, your ount so you don’t need to pay money for these costs initial.

Prior to signing on the dotted line, read the version of charge you could be paying- plus appeal:

Expertise your own upfront settlement costs

Closing costs vary however, they truly are generally between 2 percent and you will 6 percent of your amount borrowed. 2 Certain lenders could possibly get waive the newest fees or pay money for good part of them. Here are a few common closing costs you have to know in the: step 1

step 1. Assessment percentage: A house appraisal identifies the loan-to-value (LTV) proportion to find out just how much you could potentially borrow. This percentage may differ based if you like the full appraisal, a push-because of the appraisal (a less-thorough adaptation), or a desk assessment (where in actuality the bank spends existing research). Such charge are often around $3 hundred to $eight hundred, but could work with higher otherwise lower with regards to the area, assets and type of assessment.

2. Origination percentage: Certain loan providers may charge your a fee to try to get an effective family guarantee financing, also known as an origination fee. Some commonly cost you this fee upfront or roll they into the expense of the mortgage which have increased Apr. These charges usually include $0 in order to $125. Specific cash advance usa in Paoli loan providers can charge a credit card applicatoin percentage in the place of a keen origination percentage.

step 3. Document preparing charges: Your bank could possibly get request you to pay them a payment for getting ready documents associated with the loan. This could encompass solicitors otherwise notaries who will be certain that brand new documentation. Document preparing costs is also run anywhere from $100 to help you $eight hundred. 2

4. Credit file commission: Loan providers check your creditworthiness playing with credit scoring companies. Thinking about your credit score and you can rating will determine for those who be eligible for a home guarantee loan as well as exactly how much. This percentage is sometimes up to $twenty-five.

5. Name Lookup: This lookup confirms into the financial which you actually own your own property. In addition it also offers other information, such as for example if you will find people liens otherwise fees owed. It percentage normally range out of $75 so you’re able to $100.

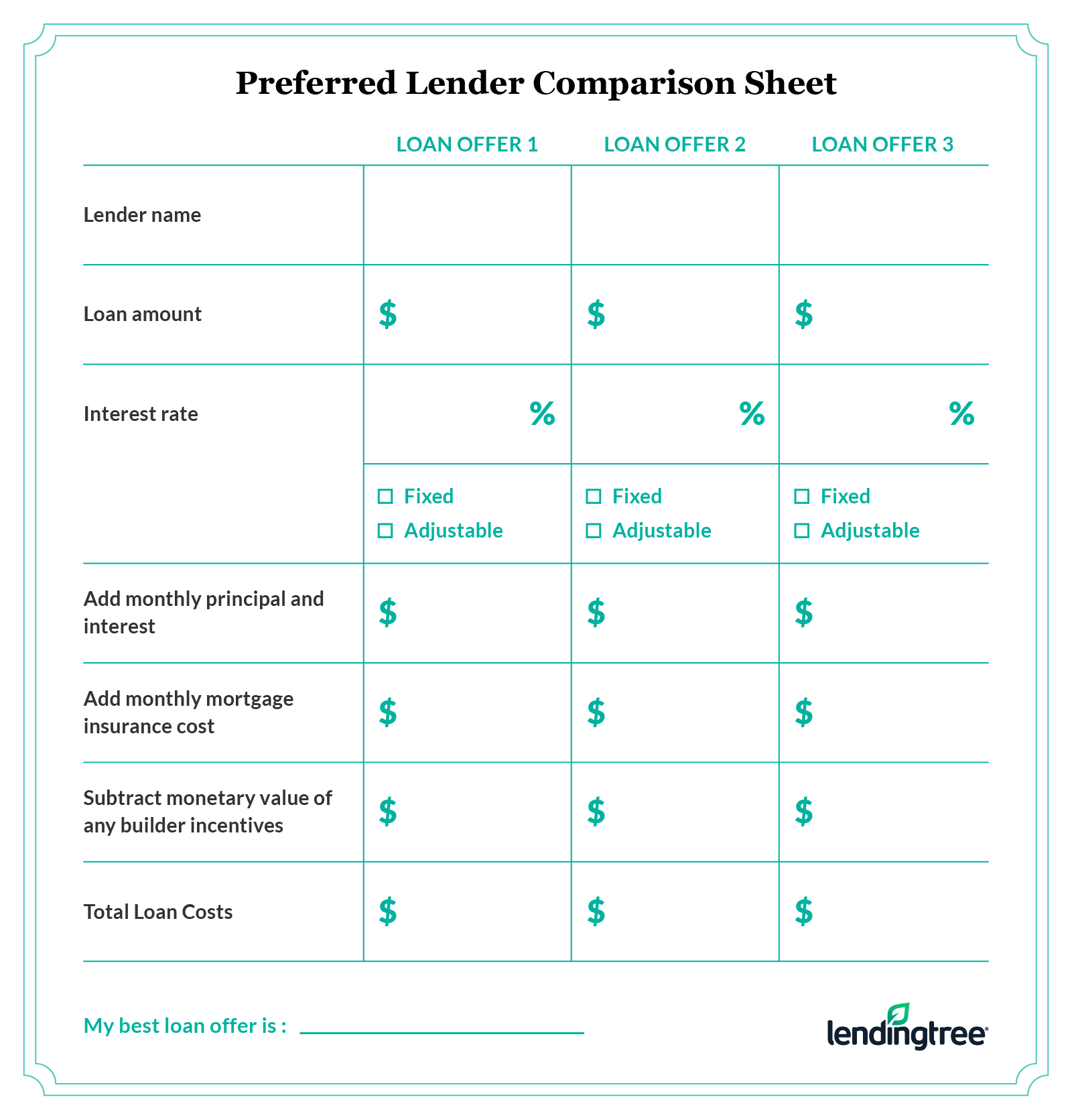

Information comparing lenders

Closure fees normally somewhat add to the overall cost of your own home security mortgage. Even although you come across a loan into reasonable annual commission speed (APR), paying for closing costs you can expect to mean that you have not discovered a beneficial good deal. Researching to get rid of these will set you back is the greatest. Try to find financing and no fees or closing costs, make the most of financial savings and just use what you need. And be sure to accomplish a part-by-top analysis of financing possess toward money considering.

Extremely settlement costs can’t be waived so keep one in your mind when you shop as much as, and stay realistic about your budget and that means you can generate for the-big date payments each month. Performing this you’ll indicate rescuing several otherwise thousands of dollars while in the the life span of your house collateral mortgage.

Laisser un commentaire