Household Collateral Fund & HELOCs: Pros & Drawbacks

House security loans and you will household security credit lines (HELOCs) are ways in which residents utilize new equity they have in their house. Regardless if such money are reasonable and you may simpler, they may not be right for everyone and each disease.

Listed here are three well-known ways that these types of loans are usedparing the pros and you may disadvantages helps you build an intelligent borrowing choice.

Domestic Renovations

Perhaps one of the most prominent spends of household guarantee loans and you may HELOCs is for doing household restoration programs. Whether you are renovations your home otherwise strengthening an improvement, these finance will let you utilize the collateral of your house and come up with your residence better yet.

The main benefit of having fun with property equity loan getting an excellent family recovery endeavor is you can protected the eye rate when the loan is done. This is certainly a significant consideration whenever cost try ascending. After that you loan places Columbine Valley can pay back the mortgage having fixed monthly payments and not have to worry about people unexpected situations afterwards.

When you take away property security financing, might discover a lump sum with the full quantity of the mortgage. It isn’t really practical for many who anticipate to finish the enterprise within the degree while just need to purchase smaller amounts at once. Repayments in your mortgage will begin immediately after you can get the borrowed money.

An important benefit of using a great HELOC to possess a home restoration investment is you can only acquire the bucks you would like when you need it. Instance, you could obtain some money to acquire timber having a room inclusion and you can, after the shaping is finished, you might obtain more to acquire drywall, floors, and you may decorate.

HELOCs possess variable interest rates. This might result in your spending alot more for money your obtain if the cost increase. Unsure exactly what future cost might possibly be including helps make budgeting hard.

Combining Obligations

For those who have numerous higher-desire expenses-like credit cards and you will store cards-checking up on the repayments will likely be difficult in the event the money is tight. Miss you to definitely, and it can damage your credit score. The large-rates may also move you to feel trapped for the a beneficial cycle away from loans.

Household Equity Mortgage Specialist

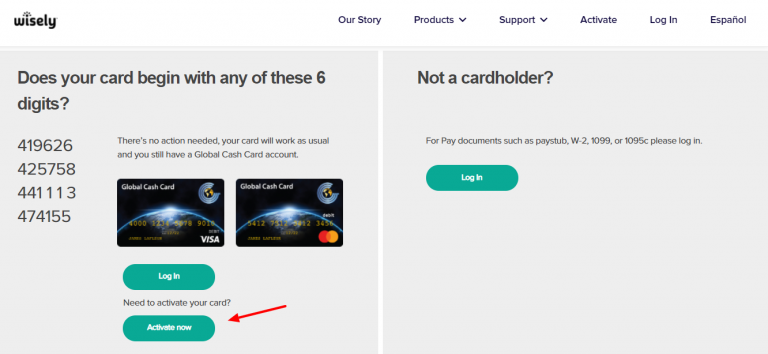

![]()

Family collateral funds usually have all the way down rates of interest than other borrowing from the bank possibilities which can be useful for debt consolidating. This lets it can save you currency, and it may together with help you pay back your financial situation smaller.

Home Collateral Mortgage Fraud

According to lender, a home collateral mortgage could have charges. You may need to pay for the application, origination, household appraisal, and you may closure. These fees you will provide more benefits than the great benefits of combining your financial situation. When your fees is actually tall, some other money option is generally a far greater choice.

HELOC Specialist

You will find a couple of very important HELOCs pros and cons to envision. Having an excellent HELOC, you are able to desire-just money on the currency your use up until your financial situation improves. It is possible to make desire-just repayments provided the fresh new draw several months is actually effective.

HELOC Ripoff

Exactly as slowing down the fresh payment of your dominant that have attract-only money are an advantage whenever money is rigorous, it can be a disadvantage. If you keep putting-off paying off the bucks your debt, the balance will ultimately already been due.

HELOC draw attacks usually do not past permanently. When yours finishes, a balloon commission ount, that may cause monetary distress if you don’t have the money. Depending on the lender, it can be possible in order to re-finance the bill towards the yet another loan and you can pay it off which have fixed monthly installments.

Major Expenses

A lot of people make use of the collateral within belongings to pay for purchase of things needed or wanted. But a few for example:

- Furniture

- Medical expenses

- Automobile solutions

- New products

- House electronic devices

- To cover a wedding

Domestic Security Loan Professional

Family guarantee money enables you to obtain the bucks need with an interest speed that’s lower than just credit cards or store notes. The latest offers might possibly be tall.

Family Equity Mortgage Fraud

Depending on your own financial, it could take two to four months to find a property collateral loan once implementing. It might not end up being recommended if you prefer money punctual.

Home guarantee mortgage charges and settlement costs also can get this borrowing alternative more expensive than many other loans. If you want to fix otherwise alter the transmission on your car, such, a consumer loan will be less that have a lot fewer (if any) fees, when you pays increased interest rate.

HELOC Specialist

The majority of people remove HELOCs to use while the crisis backups in the case one thing goes. You will find a line of credit that one can mark from to fund unforeseen scientific bills, resolve a leaking roof, or have your vehicle’s air conditioning unit fixed. The cash will there be for you when you need it.

HELOC Fraud

Given that guarantee of your house is used as the guarantee, you may be required to pay off one the harmony for individuals who sell your house. Whilst you can use the money you obtain on the marketing in your home to repay their HELOC, it does leave less of your budget on the best way to purchase a separate home.

Tap into Your home Collateral having Atlantic Monetary Borrowing from the bank Relationship

House equity finance and you can HELOCs are ideal for placing brand new equity you really have of your home to use. Whether property collateral mortgage otherwise HELOC excellent to suit your credit needs hinges on the fresh required use. Make sure you think about the positives and negatives cautiously before carefully deciding.

If you are considering both a property guarantee loan otherwise HELOC, Atlantic Monetary Government Borrowing from the bank Relationship even offers each other fund having aggressive attract prices and simple investment conditions. Click the link below for additional info on our home collateral credit selection.

Laisser un commentaire